What Is Stop Hunting Forex Trend Dominator Forex Trend Dominator™ Blog

Post on: 27 Июнь, 2015 No Comment

What Is Stop Hunting? Forex Trend Dominator

September 16th, 2012 ForexTrendDominator

You may have heard it mentioned in a few forums or it may have even happened to you. Its enough to drive you crazy and make your head spin. Im referring to Stop Hunting.

Heres an example of a standard situation. Say that you are sure the USD/JPY is on its way up, youve entered a long position at 123.40 and set your stop at 123.05, just slightly below a double bottom. Youve set your initial target at 124.50, that gives you more than a 3.1 ration of reward to risk.

Regrettably, the trade starts to go against you and breaks down through the support. Youve reached your stop and youre out of the trade. You take a sigh of relief that you had that stop in place. Its anyones guess how far it could go now that its support is broken, correct? Not exactly, so take a wild guess what will happen next, after removing your stop, the price makes a u-turn and heads back up, just as you thought it would in the beginning.

As you anxiously watch, the pair moves up past 124.00, it hits 125.00 and continues up from there. It can drive you crazy. You wish youd have set the stop lower. You start to think your luck is bad. But is this really a case of luck?

Let me tell you about one of my own trading experiences. I used a statistical trading tool, I went short the USD/USD at around 0.7530 and placed a stop at 0.7570 which was a local top. I was looking for the price to drop to below 0.7300 over the weeks ahead. About a day or so in, the price hiked up, removed my stop and moved down into the consolidation area at around 0.7540.

Because of that last hike, there were two local highs on the chart near 0.7570. Not to be put off my trade, I re-entered my short position in the 0.7530 area, this time I placed my stop at 0.7580, just a little above the last hike. I figured what were the chances that the price would break through that resistance again.

That is exactly what happened. The price shot up and hit my stop again, kicking me out of the trade for a second time. And to make things worse, a soon as my stop hit, the price turned right back down and went in the direction I had originally thought it would. To quote a Goldfinger character, Once is happenstance, twice is coincidence and three times is enemy action que James Bond music.

I wasnt being paranoid or anything, trying to think that somone was intentionally picking off my stop orders. First, my trades were so small no one would even bother trying to mess with them, second, I was in a demo account. I bet I wasnt the only person putting my stops in that position, right above the recent highs. There were probably alot of buy-stop orders in that price range, but it did appear to me that someone was aiming for those stops. This person may have been a hyporthetical stop hunter.

So whats all this about picking off stop orders and imaginary stop hunters? A stop hunter is a market player that tries to engage the stop orders of other traders for their own gain. They generally will try to move the market by a small degree in a short period. The stop hunter might be a Forex brokers dealing desk which is in competition with its customers or it might simply be a big player in the market like a bank or hedge fund or something like that.

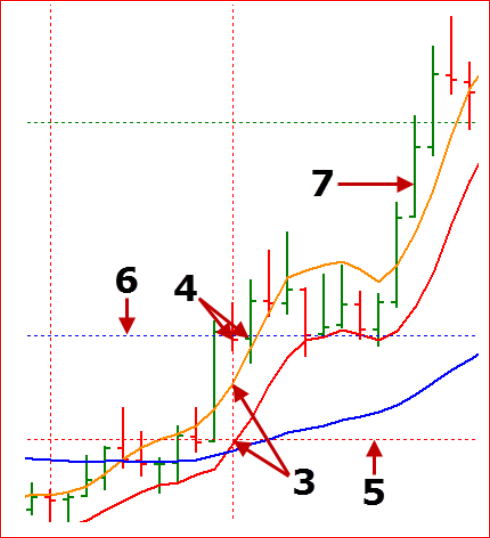

Stop hunters are best in a market when traders believe the market is going to go a certain way. As the traders take their positions, the new traders will put in their stops at pretty obvious places in order to minimize loss if the price goes in another direction. The stop hunters know where the newbies are going to possibly place their stops, so they try to move the market in the direction that it would take to trigger them. This might let a stop hunter enter a trade at a good price before the market starts its move in the direction everyone thinks it will go.

Take for example my short trade explained above, there were a lot of indicators showing the market was heading down. The stop hunters knew that alot of traders had taken short positions and had probably set their stops in the 0.7570 area. So why should these wise stop hunters enter a short position at 0.7530 when so many new traders were open to buying from them at 0.7570? So they go ahead and push the price up to 0.7570, and when my buy stop ordered was activated up there, take a wild guess who I was buying from? Correct! Stop hunters who were selling to me at a good price (for them). Now I was out from the market, and they had taken control of my short position price 40 pips ahead of where I entered it. I had a 40 pip loss, while they entered at a price that ws 40 pips better than they would have had otherwise. Then, when the market started heading down as everyone expected it would do, the stop hunters were laughing all the way to their banks while I was sitting on the outside ready to pull my hair out!

Realize that a situation where everyone expected the market to move up would have turned out quite the opposite. The new traders would set their sell-stops at an obvious point underneath the market, and stop hunters would push the market that way as to trigger the sell-stop orders. Then the new traders would start to sell out their long positions while panicking as the stop hunters were buyings from them at wonderful prices expecting the move to go north.

The type of stop hunting I just told you about occus in situations where most of the market participants expect the price to move in a certain way. This situation has both the savvy stop hunters and the new traders having the same opinion in the market. They are not fighting each other in a battle of bulls vs. bears. The stop hunters main goal is to take over the positions of the new traders at a great price.

There is another situation where stop hunter try to make the market move toward a certain group of stops in hopes of triggering the stops and pushing the market in a directions that will trigger even more stops and cause a snowball like effect. This is how some short term panics and rallies are created. Stop hunters take positions opposite from the new traders and are just trying to trigger stops in order to make the other traders panick and get the ball moving in their direction. I suppose that this tactic is often used most in a less liquid market market, say stocks and futures instead of Forex.