What is a Derivative Market (with pictures)

Post on: 17 Апрель, 2015 No Comment

These 10 animal facts will amaze you.

Adorable animal families that will make you aww.

These 10 facts about space will blow your mind.

Derivative markets are investment markets that are geared toward the buying and selling of a certain type of securities, or financial instruments. These securities derive their value, or at least part of their value, from the value of another security, which is called the underlier. The underlier can come in many forms, including commodities, mortgages, stocks, bonds, or currency. The reason investors may invest in a derivative security is to hedge their bet. By investing in something based on a more stable underlier, the investor is assuming less risk than if she invested in an risky security without an underlier.

There are actually two distinct forms of the derivative market. It is possible to purchase and sell derivatives in the form of futures or as over-the-counter offerings. It is not unusual for investors who are interested in derivatives to actively participate in both of these financial markets.

In the case of futures, there are markets around the world that allow trading that involves derivative contracts. In the United States, the Chicago Mercantile Exchange is one example. In this type of financial market environment. the exchange functions as a counterparty to members engaged in buying and selling activity.

The process for investing in the futures market works by establishing a situation where one party sells a futures contract while the counterparty purchases a new futures contract. The result of the two transactions effectively produces a position that is considered to be at zero. This approach essentially transfers the bulk of the risk to the counterparty in the arrangement and makes it possible to earn a return by exchanging a long position for a short one.

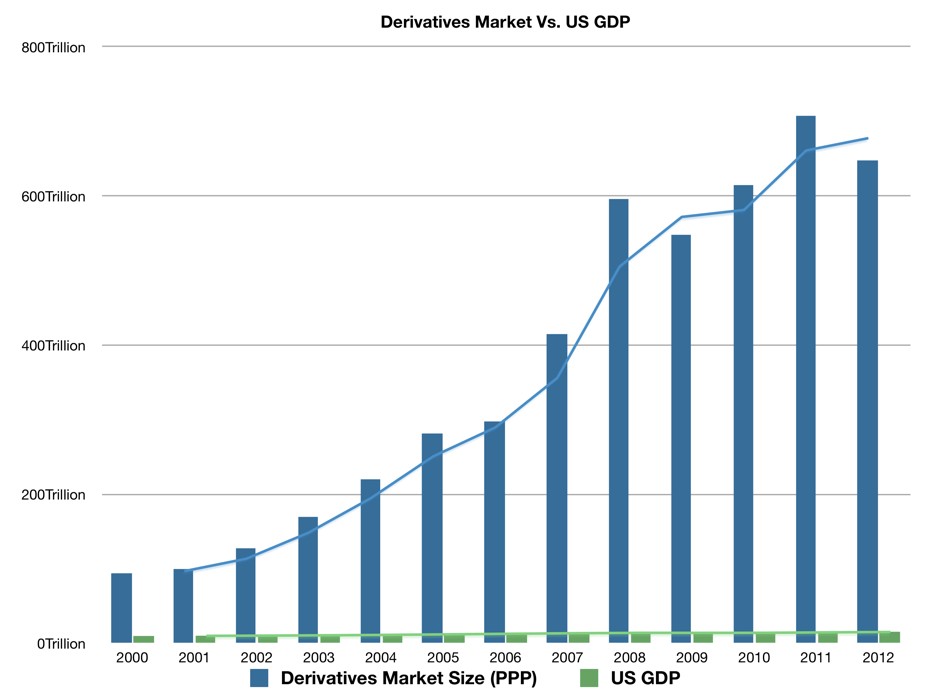

Along with futures, there are over-the-counter or OTC markets. In this scenario, the derivatives focus on larger clients, such as government entities, investment banks, and hedge funds. Trading on these markets can involve several different types of options, including credit derivatives. The volume of the trading activity is substantial, involving significant amounts of resources on the part of the investors involved.

The appeal of a derivative market has to do with the potential for a larger return than is usually the case with other forms of investment. In like manner, the ability to transfer the liability from one party to another is also appealing in some situations. While it is true that derivatives can be somewhat volatile, the fact is that many of the trades carry no more risk than in investment markets. As long as the investor performs due diligence as it relates to understanding past, current, and projected performance, it is possible to do very well in a the market.