What Does Bitcoin s Memorable Year Mean for the Future

Post on: 14 Апрель, 2015 No Comment

Don’t let it get away!

Keep track of the stocks that matter to you.

Help yourself with the Fool’s FREE and easy new watchlist service today.

From the U.S. government’s shutdown to the snowstorm that hit Cairo for the first time in over a century, 2013 was definitely an interesting year. For Bitcoin, the underground digital money system, it was a landmark year.

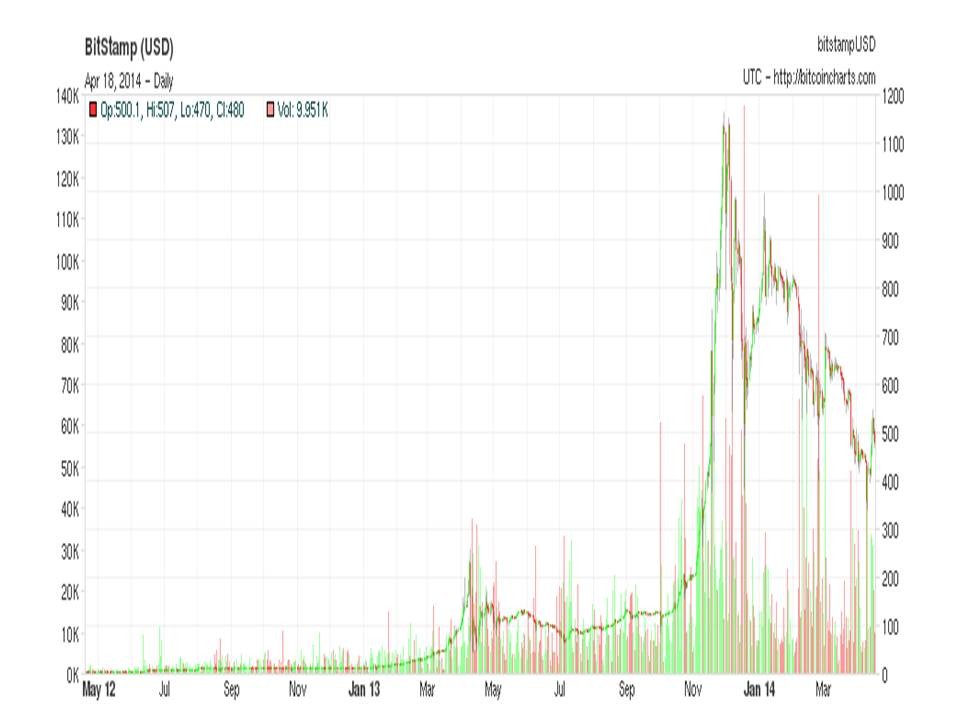

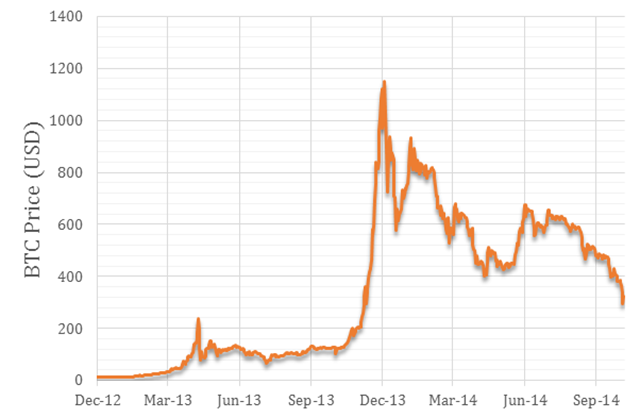

In 2013, Bitcoin was crowned word of the year by the Australian National Dictionary Centre, it crossed the $1,200 threshold but halved in value in just a split second, it raised eyebrows among regulators and world-class economists, while its rebellious nature allured Wall Street and Silicon Valley.

Here are a few of the most memorable Bitcoin moments of 2013:

The open source peer-to-peer currency kicked off a roller-coaster year with the Blockchain.info wallet – the go-to Bitcoin wallet service – surpassing 100,000 users. Throughout 2013 and as the Bitcoin craze begun to gather pace, the number of new users skyrocketed to nearly one million.

On Valentine’s Day, social discovery and discussion site Reddit started accepting Bitcoins for its premium Reddit Gold service. At the time, it was the second most popular website after WordPress to accept Bitcoin as a payment option. Slowly but surely, others like L.A.-based travel agency CheapAir.com and the University of Nicosia in Cyprus followed suit, paving the way for the virtual currency’s push into the mainstream.

On March 11, the math-based money network experienced a major hiccup. A bug in the system caused the blockchain – the publicly maintained Bitcoin ledger – to split into two. Miners and traders hit the panic button after watching Bitcoin take an almost 25% nosedive. But the split lasted only six hours and everything went back to normal again.

During the next month. a flurry of Bitcoin news drove its value to peak at $2 6 6 making Bitcoin traders rub their hands in glee; but not for long. Out of the blue, a Reddit user by the name of Bitcoinbillionaire gave away more than $13,000 worth of Bitcoins, randomly rewarding 13 redditors. And on April 11, Mt Gox, the top Bitcoin exchange, halted trading for nearly a day. Bitcoin tumbled all the way down, losing as much as 70% of its value.

In May, the U.S. government made waves on the Bitcoin world. The Department of Homeland Security ordered mobile payments service Dwolla – one of the easiest ways to get U.S. funds in and out of Bitcoin – to seize all account activities with Mt. Gox. DHS officials claimed that Mt. Gox was operating an unlicensed money transmitting business.

Later in the summer, Bitcoin gained a legal footing in Germany. T he Finance Ministry ruled that Bitcoin is a unit of account and any profit from it is subject to the country’s 25% capital-gains tax, unless it is held for more than a year.

Bitcoin made headlines again in October when the world’s first Bitcoin ATM was installed in a Waves Coffee House in Vancouver, and the FBI shut down Silk Road, the online drug marketplace that used it for payments. Growing c oncerns over the darker side to the use of Bitcoin led to the first-ever congressional hearing on virtual currencies held in November. U. S. officials gave Bitcoin the thumbs up, calling it a legitimate financial service, and its price continue d to zoom.

Boosted by an astronomical surge in Chinese demand, the digital currency topped out above $1,200 in December, making many jaws drop. But as soon as China decided to bar financial institutions from handling Bitcoin transactions forcing the country’s biggest exchange to stop accepting new fiat deposits. the love-it-or-hate-it virtual cash crashed and lost 50% of its value, as well as its mojo.

What’s next for Bitcoin in 2014?

Bitcoin is exciting to watch because it’s unpredictable. Even so, who can resist a bit of crystal — ball gazing into the future of the world’s most controversial currency?

On one side. there are those like Bitcoin entrepreneur Roger Ver, also known as Bitcoin Jesus, who have faith in the crypto-currency’s potential as a commonly used payment method. 2014 will be the year that Bitcoin gains mainstream acceptance, he says. With Bitcoin start-ups popping up like mushrooms after the rain and vendor adoption steadily increasing. this argument makes sense.

On the bearish side, Mark Williams, finance professor at Boston University School of Management, predicts that Bitcoin will trade for under $10 a share by the first half of 2014, s ingle digit pricing reflecting its option value as a pure commodity play.

What’s going to happen? Nobody really knows.

My take on Bitcoin

Most of those who ‘ve joined the Bitcoin fray focus mainly on Bitcoin’s potential as a rival to traditional paper money. That’s one way of looking at it.

F or Bitcoin to emerge as a viable alternative to today’s paper cash. the world as we know it has to change first. As I pointed out in a recent article. its decentralized nature, though relevant to the current trend of open-source economy, disrupts the international monetary status quo. Th is status quo might change in favor of Bitcoin, provided that governments, regulators, and monetary authorities around the globe are a part of that change – something that’s highly unlikely to happen any time soon.

But Bitcoin is more of a system than it is a currency. And as an open-source transactions system, it could revolutionize the incumbent payment mechanisms by adding social value. However. when humans let their selfish craving for wealth wash over them. even if that wealth is only virtual, the best of innovations lose their luster and end up being nothing more than a standing joke.

Today, many people buy Bitcoins hoping to cash in on its extreme volatility, not because they truly believe in it. H ow do you explain then all those alternative digital currencies or alt — coins – cryptocoins created by forking the Bitcoin system and adjusting it – which. with a few rare exception s, tickle speculators pink just like a brand new toy does to a child.

Want to figure out how to profit on business analysis like this? The key is to learn how to turn business insights into portfolio gold by taking your first steps as an investor. Those who wait on the sidelines are missing out on huge gains and putting their financial futures in jeopardy. In our brand-new special report, Your Essential Guide to Start Investing Today , The Motley Fool’s personal-finance experts show you what you need to get started, and even gives you access to some stocks to buy first. Click here to get your copy today — it’s absolutely free.