What Classes Should You Take To Become a Quantitative Analyst

Post on: 13 Апрель, 2015 No Comment

By Michael Halls-Moore on December 22nd, 2012

I’ve recently been emailed witb this question specifically, so I thought I’d write an article about it.

Due to the differences between education systems in various countries, I will try and generalise as best I can about this topic. In the UK (where I went to university), you apply for a degree in a specific subject, such as mathematics or psychology. In the US, from what I gather, one chooses individual courses. Degree programmes are far more flexible. Thus you end up majoring and minoring in certain subjects. Note: My own undergraduate mathematics course was a lot more like the US-style and I was able to take 25% credits in non-mathematical subjects every year. I ended up taking a lot of physics and scientific computing courses.

I will make a few assumptions here. In particular, I will assume you are taking some form of highly numerate degree such as mathematics, physics, engineering, statistics, economics or computer science. If this is not the case, then I would suggest being a quant may not be the right path for you, as it is a very numerate discipline and requires a good grasp of mathematical concepts.

Here are the courses that are absolutely essential if you wish to be a quantitative analyst, financial engineer, quantitative trader or quantitative developer:

Probability: This is the most important course that a quant can take. All of quantitative finance theory is ultimately based on probability. Having a solid grasp of the basics is essential. If you wish to carry out research into quantitative finance (rather than head into industry), then you will certainly need to take additional courses such as Measure Theory, which provide the rigorous theoretical underpinnings of probability theory.

Stochastic Calculus: This is known as stochastic analysis in the UK. It is the theory of continuous-time random processes and how to define a differential/integral calculus around these processes. Asset price paths (such as stock price movements) are generally modelled by some form of continuous stochastic process (such as a Geometric Brownian Motion ) and thus stochastic analysis is very important for pricing derivatives and Black-Scholes theory. If you want to end up pricing derivatives, you need to learn stochastic calculus.

Statistics/Econometrics: Certain key parts of statistics are the backbone of quantitative trading. In particular, you will need to become extremely adept at regression theory and time-series analysis. These days, more exotic electronic engineering techniques such as fourier analysis and wavelet analysis are utilised. You will also need to become adept at the general concept of data analysis (understanding how to ask the right questions of the data you have to work with!). Unfortunately, this is a skill less widely taught at undergraduate level, but it is heavily carried out at PhD level. This is one of the key reasons why PhDs are in such high demand for quantitative positions.

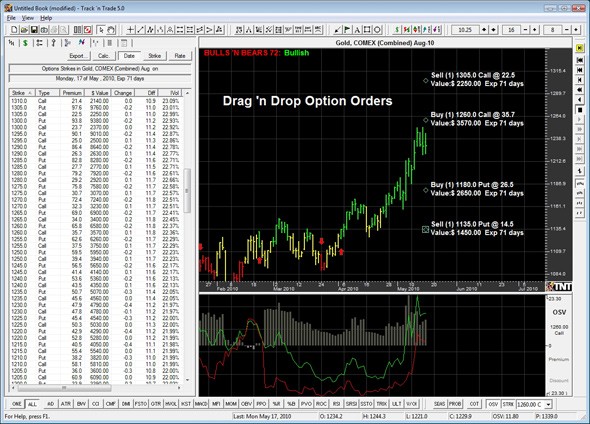

Programming: If possible, in C++, Python or R. Many universities will offer some form of object-oriented programming exposure, usually via Java or C++. Python is rapidly gaining ground in both academia and in finance, since it now possesses strong numerical libraries (such as NumPy and SciPy). Unfortunately, unless you head over to the computer science department, your best chance of doing day-to-day programming is via a PhD position, or as a hobby. Your extra study will pay huge dividends though, as the market for quants with excellent programming skills is extremely buoyant right now.

Other courses which will be beneficial, include: General finance (capital markets, investment banking, private equity etc), derivatives (options, futures, swaps, etc), partial differential equations (if you want to head into quant research) as well as numerical linear algebra (eigenvalue analysis, numerical solutions of PDEs).

Michael Halls-Moore

Mike is the founder of QuantStart and has been involved in the quantitative finance industry for the last five years, primarily as a quant developer and later as a quant trader consulting for hedge funds.