What Can Investors Learn From Eurodollar Futures Holdings

Post on: 28 Март, 2015 No Comment

I have no idea what you worry about, but I worry that I don’t worry about enough things of fashionable concern — such as the massive imbalance between commercial and noncommercial eurodollar futures positions held at the Chicago Mercantile Exchange (CME). If this hasn’t been furrowing your brow either, don’t worry — this means you have a life worth living.

Let’s Go Price the Swap

A eurodollar future delivers 90-day time deposits of dollars held outside of the US. The price of the contract determines the implied add-on yield paid or received for the three months following the expiration. This makes strips of contracts useful for pricing and hedging interest rate swaps. A short position in one of these strips means the seller is a fixed-rate payor, or borrower in the futures market at the strip’s implied rate; the long position is a fixed-rate receiver, or lender at the strip’s implied rate.

Critically, while these futures positions can be held outright without an offsetting cash market position, they most often are used to price and hedge swaps as opposed to expressing a directional opinion on interest rates. Really, when the high-low range for the three-month LIBOR has been less than 5.5 basis points over the past year, do you think people would be trading an average of more than 2.32 million contracts a day to bet on direction?

Reportable Positions

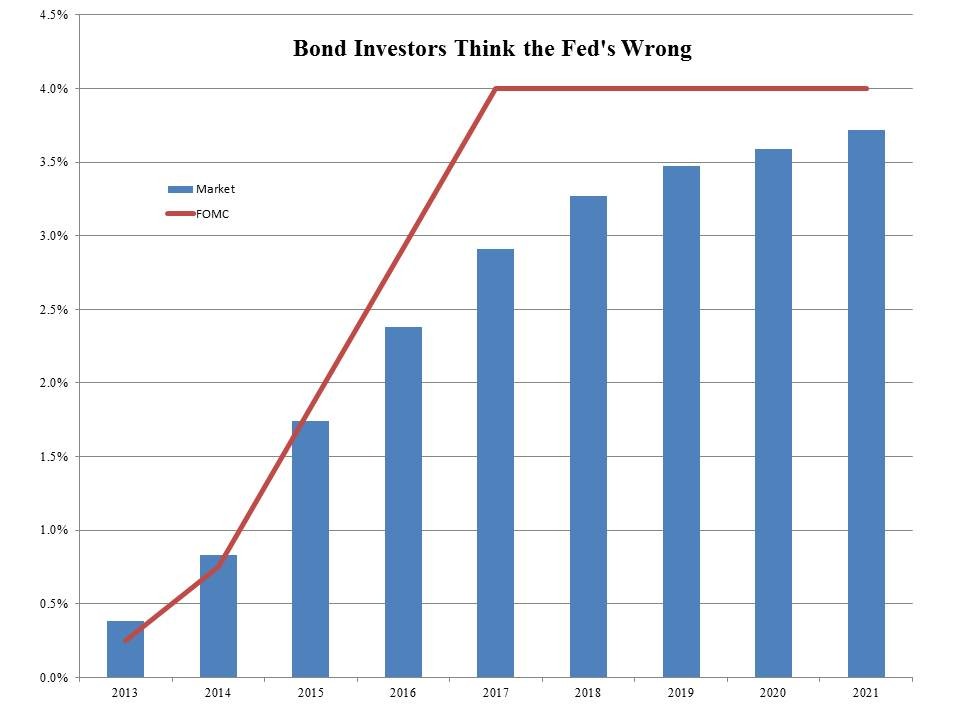

If we map the reportable positions for both commercial and noncommercial traders and their net going back to the Federal Reserve’s first declaration of war on deflation in May 2003, we see the current outsized positions for traders holding more than 1,000 contracts in either direction. The net is rising as the long positions for commercials are exceeding the short positions of noncommercials. The balance is held in smaller positions — those less than 1,000 contracts.

Click to enlarge

As noted above, the commercials are net fixed-rate receivers. These are bullish futures positions most likely being traded against a fixed-rate paying positions in the cash market. The noncommercial traders have bearish futures positions, indicating a willingness to pay today’s low fixed rates.

Is This Predictive?

More than 99% of the eurodollar open interest is in the first five years out of the 10 years available. Let’s ask whether the net reportable position leads the five-year swap rate. The answer, conveniently but implausibly, has the strongest lead time at one year. It’s not particularly strong, with an r-squared or percentage of variance explained of only 0.368.

Click to enlarge

Worse, the relationship is a direct and not an inverse one. The more positive the net is today, the more likely that long position will be wrong and five-year swap rates will be higher one year from now. Restated, the hugely short noncommercial traders are more likely to profit over the next year on their futures positions than the hugely long commercial traders will with their futures positions. However, if these positions are being offset by cash market swaps, the opposite is true; the commercials who are fixed-rate payors in the cash market will gain there, and vice versa for the noncommercials.