Warren Buffett Is Right The Fed Will Have A Tough Time Raising Rates In 2015

Post on: 14 Апрель, 2015 No Comment

Summary

- Warren Buffett has stated that the Fed will have a tough time raising interest rates due to strength in the U.S. dollar.

- Market participants seem to expect a Fed Funds Rate of 0.5% by the end of the year.

- If rates stay low for longer, it could catalyze the appreciation of risk assets.

The oracle of Omaha has been making rounds lately saying that it will be very tough for (the Fed) to raise rates. To make the case, Buffett has argued that because economies in Europe and Asia are struggling, a hike in interest rates would further strengthen the dollar versus other world currencies. Furthermore, because central banks around the world are aggressively easing, the Fed raising U.S. interest rates could have: a lot of international repercussions.

Because the United States is very dependent on exports, and nearly half of the S&P 500’s (NYSEARCA:SPY ) revenues come from outside the U.S. a stronger dollar could put significant pressure on many companies. Indeed, the dollar has been appreciating relentlessly and is now up 18% against a basket of foreign currencies since May 2014 (Figure 1).

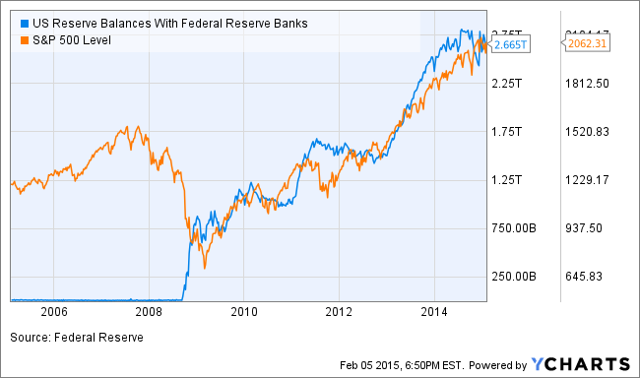

It is interesting to consider the possible reasons for the Fed to wait on raising rates against the market’s expectations for rate increases. Over the past several years the market has generally risen when economic policies have proven more dovish that was generally expected. For example, after the Fed ended QE1 in early 2010 the market had a very rocky period until a second round of easing was announced later that year. When market participants were surprised by the Fed’s dovish actions the market again rallied at the onset of QE3 (Figure 2).

In December, Liberty Street Economics posted an article analyzing the trajectory of expected interest rate increases by market participants. This posting analyzed Fed funds futures, overnight index swaps and Eurodollar futures to gain insight into the expected path for interest rates over the next five years (Figure 3).

Figure 3: The Market-Implied Path of the Effective Federal Funds Rate (click to enlarge)

Source: Liberty Street Economics

The interesting conclusion when contrasting market expectations with Warren Buffett’s intuition is that the market seems to be expecting a trajectory that is a good deal more hawkish than the octogenarian oracle of Omaha. By the end of 2015 the market appears to expect a Fed Funds rate of around 0.5%. Over the twelve months following that another hundred basis points are expected. Then over the next several years rates are expected to stabilize at around 2.5%.

It is clear that the market is expecting rates to stay lower than in previous economic cycles. Before the 2000 recession rates topped at a bit over 6%, while leading up to the financial crisis they were a bit over 5%. However, in the near term the expected trajectory could be overly hawkish. The Fed clearly must expect that the market reaction to an interest rate hike would be a further strengthening of the U.S. dollar. If the Fed is concerned about this (as most market participants appear to be), then they may signal a slower approach.

It must be remembered that the Federal Reserve has a duel mandate in which maximum employment and stable prices are key goals. With the falling price of oil and commodities it could be argued that deflation is a more significant risk than inflation at the present juncture. With respect to the goal of maximizing employment, there are significant risks that result from a strong dollar. For example, U.S. manufacturers have been under significant strain due to the strong dollar. Therefore, it is possible that risks to the economy could outweigh potential rewards for hiking interest rates. The Fed has also expressed concerns about overpriced assets and the potential for asset bubbles. However, it is worth noting that the falling price of oil has caused a significant correction in the price of junk bonds, one asset that could be a particular concern.

Conclusions:

It seems likely at this juncture that Warren Buffett is correct, the Fed may have a very difficult time raising interest rates in the near term. If this were the case and investor expectations are too hawkish the likely result would be a market rally when investors are surprised to find that rates are not increased on schedule. Clearly, other factors are at work, but at the moment it seems very unlikely that the Fed will be more hawkish than expected and fairly likely that they may be more dovish than expected. In this respect the current environment could be described as an asymmetric risk-reward profile. If rates are hiked as expected the downside should be limited, but if they are not an upside surprise is possible.

There are a number of investment decisions that would capitalize on a gap between investor expectations and Fed actions over the next year. Clearly dividend paying stocks could appear more attractive the longer interest rates stay low, with names such as AT&T (NYSE:T ), Kinder Morgan (NYSE:KMI ), Phillip Morris (NYSE:PM ) and Realty Income (NYSE:O ) coming to mind. MLPs in particular are sensitive to interest rates, both because they pay distributions and because they carry debt, as such an index fund (NYSEARCA:MLPI ) could capitalize provided that oil prices have hit bottom. Lastly, junk-rated debt (NYSEARCA:JNK ) could outperform as the search for yield continues.

Disclosure: The author is long KMI, MLPI, O, PM. (More. ) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.