VXX Trading Volatility Experimenting With Diagonal Calendar Spreads

Post on: 19 Июль, 2015 No Comment

VXX is pretty interesting product that is supposed to track the volatility index (VIX) futures. not the VIX itself. As such it is related to near month future volatility expectations (VIX futures) not pure volatility (VIX).

This Seeking Alpha article here does a pretty good job of explaining the expected (non)correlations between VXX and VIX. Obviously credit to FinancePM10b for the article we arent smart enough to do something that comprehensive

So this somewhat explains why it does such as bad job of tracking the actual VIX index and coupled with all the ETF fees, makes it a really bad long term investment. However does it make a good option trading strategy. We will try selling the near time ATM option volatility (time value only) and hedging by buying longer term ITM options (with some intrinsic and time value).

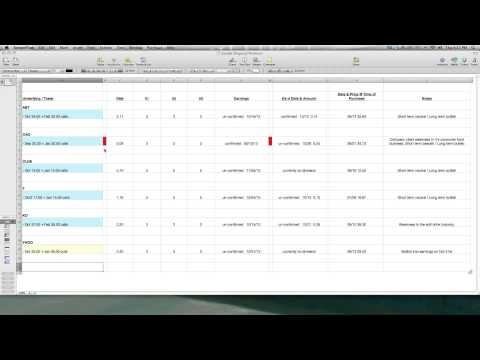

This trade was executed near the close on July 11th after the FED minutes sell off with the VXX trading around $14.03.

Short 5 VXX Aug 2012 Calls strike $14. sold $1.42

Long 5 VXX Dec 2012 Calls strike $12. bought $3.70

Total cost (with commissions). -$1191.42 (debit)

The near term Aug call has time value of $1.42. The Dec call has a time value of $1.67 ($12 strike + $3.70 option premium $14.03 current price). The near term Aug call price premium gives us approximately a 10% upside between now and Aug expiration, before we have to spend money to buy it back (The % upside is calculated by the $1.42 sold option premium divided by $14.03 current price).

What are the potential outcomes by Aug expiration:

VXX goes up more than 20% say $17: Near term Aug $14 call would cost $3 to buy back, but would give us a loss of $3 $1.42 = -$1.58. The far Dec call would be way ITM, with an intrinsic value of $5 with lets assume $0.2 time value, giving a gain of $5.2 $3.70 = $1.50. In this situation we would be about breakeven (or maybe with a small loss with commissions). Obviously any gain/loss is dependent on the far call time value (but the point is that this outcome is not ideal for this strategy). BTW The maths is similar for any VIX prices over $17 too, so not a lot of point in repeating that (try it for $20 if you like).

VXX hangs out at $14: Near term Aug $14 call would expire worthless, pocketing $1.42. Far term Dec $12 call would have reduced in time value, but would still have $2 intrinsic value. We obviously cant know exactly what the realised volatility will be at Aug expiration (hasnt happened yet), but we can take a very conservative guess that time premium for the Dec $12 call price would be the same as the current Sept $12 call price ($2.95 mid price of closing bid/ask). This is conservative because you are comparing the time premium for an option only 2months out against one 5 months out. We will assume a price of $2.95 (even though it should be significantly higher in reality) and assume our loss on the Dec $12 call would be $3.70 $2.95 = -$0.75. The total position return would therefore be $1.42 $0.75 = $0.67 (or $335).

VXX tanks to $10: Near term Aug $14 call would expire worthless, pocketing $1.42. Far term Dec $12 call would have reduced in time value, and would have no intrinsic value. Once again, we obviously cant know exactly what the realised volatility will be at Aug expiration (hasnt happened yet), but we can take a very conservative guess that time premium for the Dec $12 call price, would be the same as a current $2 OTM Sept call. That option is the current price $14.03 + $2, so that would be the Sept $16 call ($1.35 mid price of closing bid/ask). This is conservative because you are comparing the time premium for an option only 2months out against one 5 months out. We will assume a price of $1.35 (even though it should be higher in reality) and assume our loss on the Dec $12 call would be $3.70 $1.35 = -$2.35. The total position return would therefore be $1.42 $2.35 = -$0.93 (or -$465). It would be a judgment at this stage if it was worth rolling for next month (noting that if you could capture $3.70 $1.42 = $2.28 worth of sold premium, say over the next 2 months it maybe worth staying in the trade to breakeven. Alternatively you could just take the hit and try the trade again at a lower price.)

Note. If this did finish slightly OTM, slightly ITM or ATM, you could repeat sell for Sept expiration, then Oct, then Nov, all the way to Dec (and probably want to roll the Dec call after a couple months so time decay doesnt slowly kill the price).

This strategy ends up being a neutral, possibly (very slightly) bullish play on volatility, but the real idea is to capture returns based on selling near month ATM call premium. Its more about using the decaying near month ATM option on a index that tends to go down, so on balance the probability of ATM expiring is higher, but where the premium received (10% per month) makes it worthwhile. Using the long 5 months call (instead of being the underlying VXX ETN) helps because the call will not lose value as fast in a VXX sell off (indeed it will lose value at a decreasing rate (inverse gamma)). This is almost replicating a covered call style investment, but the volatility characteristics of the VXX options give more premium and should significantly lower the overall risk of the position if enough ATM calls are sold over a number of months.

Amusingly this trade is selling volatility (ATM option) on an volatility index constructed from the future expectation expectations of volatility (VIX). Derivative, on a derivative, on a derivative anyone?

Well see how it plays out by August expiration.