Volatility Trading Intensifies as the VIX Becomes a Trading Tool

Post on: 14 Июль, 2015 No Comment

Related Content

Volatility divides. Too much and it can be catastrophic. Too little and returns shrivel. Investors have felt the sharp decline in equity volatility during the past few years. Average volatility levels, as measured by the Chicago Board Options Exchange’s (CBOE) volatility index (VIX), dropped from 24.2 in 2011 to 17.1 in 2012 and to 14.3 last year. Returns on equity swings have become much more elusive for traders. So what’s the next-best tactic? Trading volatility itself.

Specialized hedge fund firms such as Arcanum Capital Management and BlueMountain Capital Management and proprietary trading desks have pursued volatility trading for years, using equity options and futures. But since 2008, it has become more mainstream. Presently, many investors’ go-to tool to accomplish this is the VIX itself. “The volatility landscape is fundamentally changed,” says Paul Stephens, head of institutional and international marketing at the CBOE. “In the 1990s if you wanted to trade volatility, the main way was through options and straddles. But then you had to delta-manage your positions to isolate volatility. Today liquidity is so deep in the VIX that it has become the main way to trade volatility. It has taken time for the investor base to learn.” He adds, “Liquidity is begetting liquidity.”

Average daily volumes for VIX options hit 567,000 contracts in 2013, a fivefold rise from the average 102,000 contracts traded daily in 2008. Meanwhile, average daily volumes in VIX futures rose 67 percent between 2012 and 2013, to 159,000 contracts, much bigger than the 4,300 figure in 2008. The dampened volatility in the underlying equity markets certainly isn’t reflected in the VIX. VIX levels move faster and further than the underlying equity benchmark, and the index has spiked above 80 at some point during all but one of the past six years.

Says Stephens, “An attribute of the VIX is that it moves — which is to say, the volatility of volatility is high.”

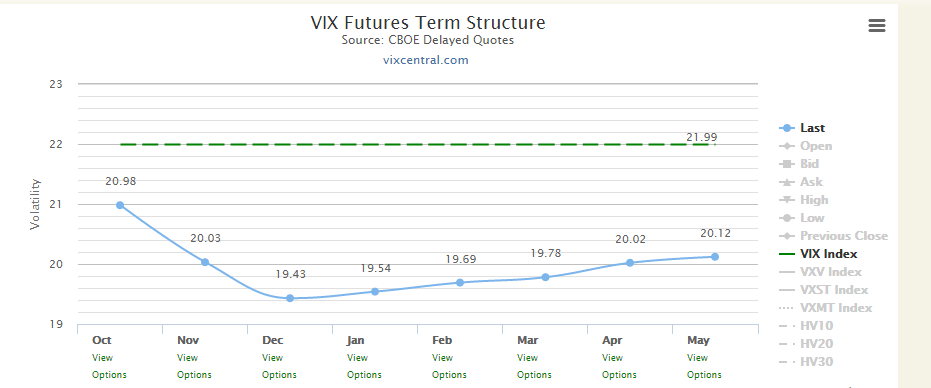

Spikes in VIX volatility — such as that which occurred in early February in connection with political upheaval in Ukraine — have presented opportunities to short volatility. Similarly, curve rolldown trades, which benefit from the fact that VIX futures typically go down in price as their expiration approaches, are a solid source of volume.

The roots of VIX options and futures trace back to the credit crunch. The attention paid to the VIX as an indicator of fear during the market dislocation of 2008–’09 helped VIX products take off. After the crisis, investors began to clamor for tail hedges to protect against extreme volatility and turned to the broad range of VIX options and futures, which provided a way to hedge risk that was more pure than options and futures.

“With vanilla options, your put is struck at a certain level. If there is a correction, you know what it will pay out,” says Davide Silvestrini. executive director in equity derivatives strategy at J.P. Morgan in London. “VIX options are linked to the settlement level of the VIX. So it’s a pure volatility play and will allow you to hedge no matter where the market has gone in the previous time period.”

Tail hedgers probably lost money buying VIX options in 2012 and 2013, with nothing resembling a tail event at that time. That outcome should not worry investors, however, since option costs on fat-tailed events tend to be very low. VIX tail hedging is likely to become more profitable this year. Francesco Filia, chief investment officer of Fasanara Capital, a London-based hedge fund that specializes in tail hedging, expects more violent swings in 2014 with “corrections of more than 10 percent” returning to the norm and with the risk of a larger correction of 20 percent or 30 percent being more plausible than ever before.

Aside from hedging, trading VIX volatility as an offensive play has also helped investors make money in the past two years.

“You are seeing more people looking at the VIX as a profit center as opposed to hedging,” says Daniel Deming, options specialist at Stutland Volatility Group in Chicago. “These are the more offensive-type plays with strategies looking at variations in the implied volatilities of the VIX and the S&P.”

In tough traditional markets, selling volatility is one of the major areas in which investors have found a rich source of returns, says Eric Boess, global head of derivatives at Allianz Global Investors in Frankfurt, which currently manages approximately €1.3 billion ($1.81 billion) of assets in pure volatility-driven funds. Allianz Global Investors uses VIX options and futures in some of its products. Boess praises their deep liquidity. “Given that they represent forward-starting volatility while index or equity options are spot volatility, they complete the tool set a portfolio manager has at his disposal,” he says.

Allianz Global Investors has also been selling volatility. The profitability of this strategy is dependent not so much on the absolute level of volatility but rather on the difference between realized and implied volatility. Nonetheless, this trade can be costly when volatility spikes. “Return patterns from short volatility positions are different from fixed-income returns,” says Boess. “When you sold volatility and it spikes, negative convexity can become very expensive very quickly. If you expect more of a fixed-income-like return stream, you could be in for a surprise.”

Shorting the VIX has meant that options and futures exhibit far greater volatility when the underlying equity index spikes, which has thrown investors off guard in the past. Or, as one trader puts it, “That trade works most of the time, though now and again you get spanked.”