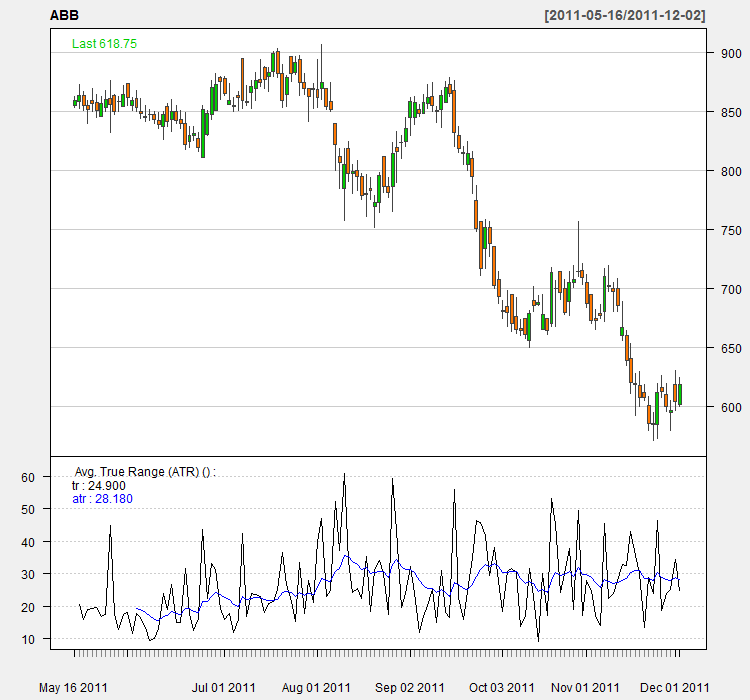

Volatility Range True Range and ATR

Post on: 10 Июнь, 2015 No Comment

Using Range for Measuring Volatility

The easiest way to quickly measure markets volatility during a particular trading day or week is by calculating the Range. Price Range is simply the absolute difference between the highest and the lowest price reached during a particular time period (e.g. a trading day).

- Range = High – Low

S&P500 Futures Daily Range Example

For example, the daily high of S&P500 index futures was 1,151.75 and the daily low was 1,139.50. The Range of that particular trading day was 1,151.75 less 1,139.50, which equals 12.25 points.

When you follow the trading range of a market on a regular basis (you know that the average daily range of S&P500 futures has been lets say 18 points), you can tell whether this particular days volatility was high or low. You can observe the development in trading range over multiple days and use it as one of the tools for describing market conditions and making trading decisions.

The Problem with Gaps and Limit Moves

Range as a measure of volatility over a series of trading days has one significant weakness. It only looks at every single trading day in isolation and without any regard to overnight price changes. You only look at the high and the low, but you dont care where the market is trading relative to the previous day.

While markets usually open near the level where they closed the previous day, sometimes there are gaps (for example when important news come out during the night). This has been characteristic for some commodity futures markets, where spikes in supply or demand sometimes push prices to their daily price limits, which may result in gaps and limit moves over multiple days in a row.

In case of gaps and limit moves, range as a measure of volatility is misleading. as it understates the volatility. It only measures intraday volatility. but it ignores overnight volatility .

Range vs. True Range

In the 1970s, when commodity futures markets were showing limit moves and gaps often, J. Welles Wilder Jr. invented the concept of True Range. which addressed this problem. Compared to the traditional Range, True Range takes into consideration both intraday and overnight component of price volatility .

How to Determine True Range

True Range is defined as the greatest of the following three:

- Current bars High less current bars Low (the traditional Range – it is the greatest of the three when the previous bars close is within the current bars range)

- Current bars High less previous bars Close (this one is the greatest when current bars low is higher than previous bars close)

- Previous bars Close less current bars Low (this one is the greatest when current bars high is lower than previous bars close)