Volatility Made Simple

Post on: 19 Июль, 2015 No Comment

Weve tested 22 simple strategies for trading VIX ETPs on this blog (separate and unrelated to our own strategy ). And while I can’t speak for all traders, based on all of my readings both academic and in the blogosphere. the strategies weve tested are broadly representative of how the vast majority of traders are timing these products.

Some of these strategies returned in excess of +30% for the month on the back of a strong performance for inverse VIX ETPs like XIV and ZIV. Below Ive shown the February results of the 22 strategies weve blogged about previously, trading short-term VIX ETPs. Read about test assumptions or get help following these strategies .

XIV and VXX are of course not the only show in town. Below I’ve rerun the same tests, this time applying each strategy to the less popular (or is it “underutilized”?) mid-term VIX ETPs ZIV and VXZ (click to zoom).

Note that when any of these strategies signal new trades, we include an alert on the daily report sent to subscribers. This is completely unrelated to our own strategy ; it just serves to add a little color to our daily report and allows subscribers to see what other quantitative strategies are saying about the market.

Good Trading,

Volatility Made Simple

Weve tested 22 simple strategies for trading VIX ETPs on this blog (separate and unrelated to our own strategy ). And while I can’t speak for all traders, based on all of my readings both academic and in the blogosphere. the strategies weve tested are broadly representative of how the vast majority of traders are timing these products.

All but but a handful of these strategies fell in January following losses in inverse VIX ETPs like XIV and ZIV. Below Ive shown the January results of the 22 strategies weve blogged about previously, trading short-term VIX ETPs. Click for for 2014 results, read about test assumptions. or get help following these strategies .

DDNs Momentum Rotation was the top performer of the month after a tough 2014 .

The real standout in terms of consistency though continues to be the Revised TM RSI(2) strategy, a short-term mean-reversion model that has been able to capitalize on the series of brief VIX spikes that have plagued the VIX complex as of late.

XIV and VXX are of course not the only show in town. Below I’ve rerun the same tests, this time applying each strategy to the less popular (or is it “underutilized”?) mid-term VIX ETPs ZIV and VXZ (click to zoom).

Note that when any of these strategies signal new trades, we include an alert on the daily report sent to subscribers. This is completely unrelated to our own strategy ; it just serves to add a little color to our daily report and allows subscribers to see what other quantitative strategies are saying about the market.

Good Trading,

Volatility Made Simple

This is a test of a strategy from Ilya Kipnis of QuantStrat TradeR for trading VIX ETPs like XIV and VXX. Ilya provides a framework for testing the robustness of a given set of trading parameters. I encourage you to read Ilya’s piece, but that isn’t the subject of this post. Here I test the strategy that resulted from Ilya’s analysis (with a twist).

Strategy results from 08/2008 trading XIV (inverse VIX) and VXX (long VIX) follow in blue, versus buying and holding XIV in grey. Read about test assumptions. or get help following this strategy .

Ilya’s post found 3 different parameter values that looked promising. Here I’ve combined them into one single strategy. Strategy rules follow (read about test assumptions ):

- After the close, calculate the ratio: VXV (3-month VIX) divided by VXMT (mid-term VIX).

- Calculate the 60-day, 125-day, and 150-day average of that ratio. These are for the three separate strategies that we will combine into one.

- For each strategy, when both the current VXV/VXMT ratio is below the average and the average is below 1, that strategy is short vol (XIV). When both the ratio is above the average and the average is above 1, that strategy is long vol (VXX).

- Average the signal from all three strategies. For example, 2 short vol and 1 cash signal would average out to a 2/3 position short vol.

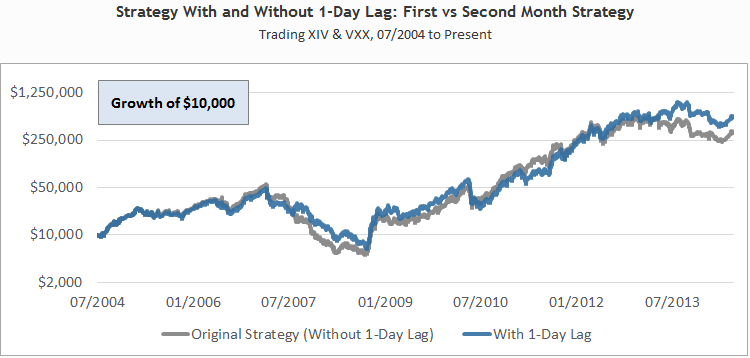

- Execute that signal at the following day’s close using a market-on-close order. In other words, this strategy has a 1-day lag. Weve touched briefly on 1-day lags previously. Hold until a change in position.

Because VXMT data is only available from 2008, we cant test this strategy back to mid-2004 as readers are accustomed to. The strategy looks promising though despite the limited data, at the very least because some thought went into parameter selection.

Note from the equity curve above (and drawdown curve below) that the strength of the strategy has been in managing losses, and the strategy has tended to lag buy & hold when XIV has been particularly strong.

The strategy spends about 65% of all days with some position on. I should note that of those days, the vast majority (92%) are short the VIX, meaning an important mechanism for the success of this strategy is moving to cash when the ratio is above or below the average (as opposed to switching between long and short VIX).

I look forward to seeing how this strategy performs out-of-sample. Like most of the strategies we test on our blog, we’ll continue tracking this one for the benefit of subscribers .

When the strategies that we cover on our blog (including this one) signal new trades, we include an alert on the daily report sent to subscribers. This is completely unrelated to our own strategy’s signal; it just serves to add a little color to the daily report and allows subscribers to see what other quantitative strategies are saying about the market.

Click to see Volatility Made Simple’s own elegant solution to the VIX ETP puzzle.

Good Trading,

Volatility Made Simple

This is a follow up to the posts here and here from the always excellent Trading the Odds. We’ve covered TTO’s work previously when we looked at their variation of a “VRP” strategy. comparing implied vs historical volatility to trade VIX ETPs like XIV and VXX.

In these new posts, TTO looked at other measures of implied volatility beyond just the VIX index. We put these other measures to the test here. Strategy results from 07/2004 trading XIV (inverse VIX) and VXX (long VIX) follow. Read about test assumptions. or get help following this strategy .

There are four equity curves in blue in the graph above, versus buying and holding XIV in grey. I’ve intentionally painted them all the same color (more on why in a moment). But first, the strategy rules as tested:

- At the close, calculate the following: the 5-day average of [implied volatility – (2-day historical volatility of SPY * 100)].

- Each of the equity curves above uses a different measure for “implied volatility”: the VIX index, the 30-day constant maturity price of VIX futures. or VXMT (mid-term VIX) (1). I’ve also added the VXV index for good measure.

- Go long XIV at the close when the result of the above formula is greater than zero (i.e. a premium exists between implied and historical volatility), otherwise go long VXX. Hold until a change in position.

Note that our results differ significantly from TTO’s. See footnote for a discussion of why.

I painted all four equity curves blue to drive home the point that, regardless of any perceived difference, these strategies have performed so similarly that any advantage of one over the others is likely the result of random chance. I would be about equally confident in any of these strategies moving forward.

All four variations were in agreement on about 96% of days. That’s because there’s very little information contained in any one of these measures that’s not also contained in the others.

30-day futures will tend to price higher than the VIX index, VXV higher than futures, and VXMT higher than VXV, simply because they’re measuring implied volatility further out (which adds to uncertainty, which tends to increase required risk premium).

Contrary to my first thought though, that doesn’t mean that longer-dated implied volatility spends significantly more time short the VIX (ex. long XIV). I’m assuming that’s because these type of strategies tend to only take a long vol position when volatility spikes, which is also when the premium between longer and shorter-dated implied vol is compressing, meaning that when it actually counts, using shorter-dated implied vol (like the VIX) doesn’t result in significantly different results than longer-dated vol (like VXMT).

In short, one of these four variations will outperform in the future just by happenstance, but I don’t think history offers a useful enough guide as to which variation that will be. I’d be about equally confident in any of these variations in the future.

A big thank you to Trading the Odds for the thoughts and allowing us to add our two cents here.

* * *

When the strategies that we cover on our blog (including this one) signal new trades, we include an alert on the daily report sent to subscribers. This is completely unrelated to our own strategy’s signal; it just serves to add a little color to the daily report and allows subscribers to see what other quantitative strategies are saying about the market.

Click to see Volatility Made Simple’s own elegant solution to the VIX ETP puzzle.

Good Trading,

Volatility Made Simple

Simply looking at a graph of a VIX ETP like VXX or XIV doesn’t tell us much about the underlying forces at play in the VIX complex. ETP prices are merely the end result of the relationship between these underlying forces (which is why traders shouldnt rely too heavily on price to guide trades, the way one might with say a stock index).

In the next four graphs, I show how four of these key relationships played out in 2014. These relationships are numbered 1-4 in the image to the right, which shows how volatility, the VIX, and VIX futures are most commonly aligned.

Long-time readers will note that these are the same four I covered in Four Graphs to Rule Them All as far back as 1986. Note that Ive also included YTD data for 2015 to capture our most recent VIX spike.

Historical volatility (shown here in grey as the S&P 500s 10-day annualized standard deviation) is running hot at the moment, currently in the top third of readings since the VIXs inception. The most recent uptick in HV is the result of two big up days for the equity market, hence the reason you see the VIX falling in response.

VIX futures behaved mostly as youd expect in 2014 relative to the spot VIX. There was a fairly constant premium over the spot during periods of market calm (i.e. contango), and futures trailed the spot during significant spikes (i.e. backwardation, betting on mean-reversion to pull the spot VIX down).

As I noted in Four Graphs to Rule Them All. as you move from graph #1 to graph #4, the relationships illustrated become more and more important, but less and less consistent and/or predictable.

The fourth graph, VIX futures vs the future realized VIX, is really the key to the VIX trading game. Short-term VIX ETPs like XIV and VXX (for example) are perpetually shifting towards the second month contract to maintain a 30-day constant maturity. As long as futures are consistently overestimating the subsequent realized VIX, there will be money to be had in this trade as VIX futures are forced to converge to the VIX spot as they approach expiration.

The VIX complex did a very bad job in the second half of the year predicting the future as it failed to maintain a consistent premium (or discount for that matter) between futures and the subsequent realized VIX. As this is ostensibly a forward-looking relationship (futures today versus the spot in the future), I chalk that failure up to stuff happens rather than any fundamental shift in the VIX complex.

Where do we stand now? Despite VIX futures coming down from their recent highs, futures are still higher than about 80% of VIX spot readings since the current bull run began in late-2011, and higher than 90% of spot readings in 2014/15. That means that, if this market can continue to remain reasonably calm, theres plenty of room for futures to fall, and XIV/ZIV to rise.

Having said that, in the back of VIX traders minds should always be the fact that at some point the low volatility regime of the last few years will come to an end. VIX futures are very much average at the moment relative to the entire history of the VIX spot.

Click to see Volatility Made Simples own elegant solution to the VIX ETP puzzle.

Good Trading,

Volatility Made Simple