Volatility Index (VIX) plunges to lowest levels since 2007

Post on: 23 Апрель, 2015 No Comment

“The VIX is collapsing,” Alec Levine, an equity derivatives strategist at Newedge Group SA in New York, said in an interview. “Absent another debt ceiling fiasco, the implied volatility as seen in the VIX is falling to better reflect the actual realized volatility environment.”

The S&P 500 (SPX) ’s five-day historical volatility. a measure of price swings, tumbled 95 percent from Jan. 3 to 1.37 on Jan. 16, its lowest level since 2005. The measure was at 3.92 today.

Speculation President Barack Obama and Congress would fail to reach a budget compromise sent the VIX up 27 percent in the last week of December. It reversed the gain in the first week of the year, sinking 35 percent between Dec. 31 and Jan. 2 for the biggest two-day drop ever, as politicians struck a deal.

While the VIX has lost 31 percent in 2013, the S&P 500 climbed 4.2 percent as earnings at companies from Goldman Sachs Group Inc. to Monsanto Co. (MON) exceeded estimates while housing starts and initial jobless claims showed the U.S. economy is recovering.

Stocks Advance

The benchmark gauge for American equity rose 0.3 percent to 1,485.98 today. Stocks rebounded from their lowest levels of the day as Majority Leader Eric Cantor of Virginia said in a statement that members of Congress won’t be paid if the House or Senate doesn’t pass a budget by the end of the proposed three- month debt-limit increase.

The Treasury Department has said the U.S. will exceed its $16.4 trillion borrowing authority sometime from mid-February to early March. Stocks fell earlier as consumer confidence in the U.S. unexpectedly dropped in January.

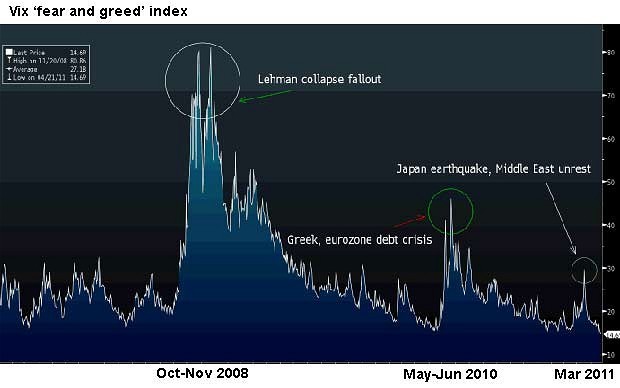

The VIX is 85 percent below its all-time high of 80.86 reached after Lehman Brothers Holdings Inc. declared bankruptcy in 2008. It is trading 39 percent below its lifetime average of 20.43, according to data compiled by Bloomberg.

Ownership of futures on the volatility index rose to a record last week. Open interest climbed to almost 450,000, eclipsing the previous high set in September, according to the CBOE Futures Exchange.

Surprising Decline

“The drop in the VIX has caught a lot of people off guard,” Ben Schwartz, the Chicago-based chief market strategist at broker Lightspeed Financial Inc. said by phone. “There’s still uncertainty surrounding the federal government and corporate earnings. The expectation was that we were going to see some volatility over the next 30 to 40 days.”

The S&P 500 should climb to 1,541 by the end of the year, according to the average forecast of 15 Wall Street strategists surveyed by Bloomberg. That’s up from 1,534 when the year began. More than half of the strategists predict the S&P 500 will exceed its all-time high of 1,565.15 reached in October 2007 by the end of this year, data show.

Corporate earnings for 2013 should climb to a record $110.10 a share, up 8 percent from 2012, according to more than 11,000 analyst estimates compiled by Bloomberg. Of the 67 companies that have posted results for the last three months, 48 have reported better-than-estimated profits, data compiled by Bloomberg show.

VIX Skew

Options traders have pushed the relative cost of protecting against S&P 500 losses near a two-year low. Puts with an exercise price 10 percent below the index level cost 8.19 points more than calls betting on a 10 percent rally, three-month implied volatility data compiled by Bloomberg show. That’s close to the 7.52 level reached on Dec. 12, which was the lowest since November 2010, according to the data.

“We find volatility for sale despite what will remain a contentious debt ceiling debate, a deepening recession in Europe. and what so far has been a mixed earnings picture,” Peter Cecchini, global head of institutional equity derivatives at New York-based Cantor Fitzgerald LP, said in an interview. “The beatdown in volatility, given the upcoming debt ceiling, is an opportunity to buy it.”