Volatility Index Options

Post on: 27 Апрель, 2015 No Comment

A volatility index is a compilation of implied volatilities of a series of call and put options. Typically a volatility index will take the implied volatilities from a stock index, however, more sophisticated volatility indices will take the implied vols from the component stocks that make up the index.

The most recognized volatility index is the VIX, which is traded on the Chicago Board of Options Exchange (CBOE).

The CBOE’s VIX

The VIX is a listed derivative that is traded on the CBOE. It is the most popular volatility index in the world as its value represents the markets view on expected 30 day volatility for the S&P 500 index.

The S&P 500 version of the VIX that you see today has been trading since 2004. Prior to this the VIX was based off the S&P 100 index. The S&P 100 version is still available, called the VXO, and is also traded on the CBOE.

What’s so good about the VIX?

The VIX is referred to by many as the Fear Indicator as it tells traders how scared the market is. As you may know, options are a form of insurance, so when the prices are high due to the increase in volatility there is a lot of uncertainty in the market.

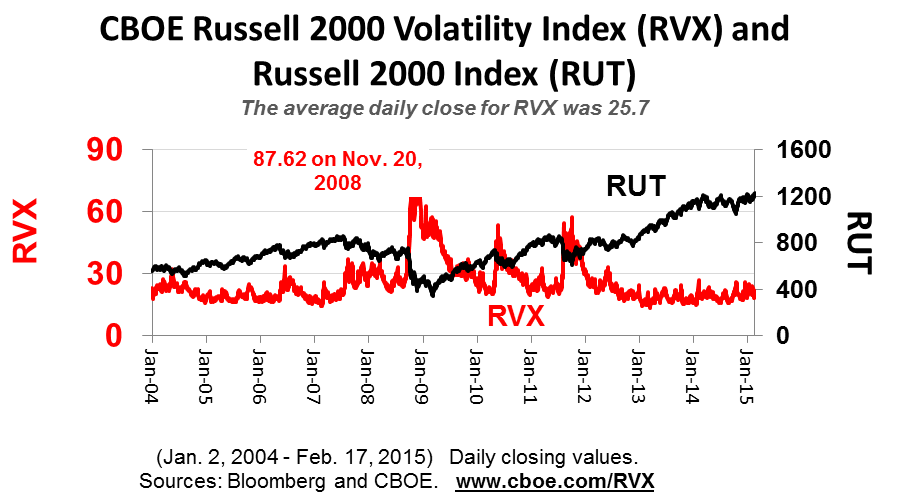

Take a look at the below graph and accompanying spreadsheet.

VIX vs S&P 500

As you can see, generally the VIX is negatively correlated to the S&P 500 stock market index that it is based off. When volatility is high, typically market prices will decline and vice versa.

This is not to say that the VIX is a precise indicator of market direction, but as you can see from the chart, extreme situations when the market experiences large price movements are also accompanied by extremes in volatility, especially on the downside. I think this is consistent with the idea that there’s more uncertainty towards the downside than the upside. In other words, investors expect stock prices to rise, so when they do sentiment is good and volatility is low.

As the market sells off, investors become nervous and this panic can be reflected in the prices as the market heads south.

Calculation of VIX

If you want the exact calculation of the formula used for the VIX, then you can download this white paper from the CBOE:

Calculation of the VIX

It is some kind of kernel-smoothed estimator where the inputs are all of the out-of-the-money call and put options for the front month and second month expiries.

These values are weighted according to the algorithm to arrive at the final volatility figure.

What does the VIX Volatility figure mean?

The price of the VIX represents the expected annualized volatility (determined by the market) of the S&P 500 index. This is the amount of price fluctuations that you can expect the index to move between over the next 30 days (represented as an annualized figure) and which will happen approximately 68% (one standard deviation) of the time.

So, say the VIX is trading at 25. This means that the market expects the price of the S&P 500 index to fluctuate at an annualized rate of 25% over the next 30 days. The key here is annualized. This doesn’t mean that you can actually expect 25% swings in the next 30 days, but rather you should expect swings of 7.17% over the next 30 days.

7.17% is the 30 day equivalent of a 25% annualized volatility figure. I arrive at this number by multiplying the annualized volatility by the square root of time ratio.

Given that the VIX represents the expected annualized volatility over the next 30 days, I multiplied 25% by SQRT (30/365).

Don’t forget that this observation is based on the Normal Distribution and represents one standard deviation (68% of observations):

68% of observations = One Standard Deviation

95% of observations = Two Standard Deviations

99.7% of observations = Three Standard Deviations

Given the above, with the VIX trading at 25%, you could expect with 99.7% confidence that the S&P 500 will trade within a 21.50% range in the next 30 days (25% * 3 * SQRT(30/365).

If you have any comments on my calculations here, please leave a comment below for discussion.

When first introduced by the CBOE, the VIX was based off the S&P 100 index (aka the OEX). The indicator averaged out eight at-the-money call and put options for the S&P 100 and used the Black and Scholes pricing model.

However, in 2003 the CBOE changed the VIX to be based off the S&P 500 index and also changed the calculation method used (see above under calculation).

The S&P 100 volatility index has now become the VXO and the S&P 500 volatility index is the VIX.

The VXO is still widely used, primarily as it provides longer price history for charting and analysis.

Options and Futures

The CBOE listed futures on the VIX in 2004 and are one of (if not THE most) actively traded contract on the exchange. Options were listed for trade 2 years later in 2006. The options chain code for VIX options is VRO.

Expiration

The last trading day for VIX options is the Tuesday after the third Friday of the month.

Settlement

VIX options are European style and settle by cash. The price used to settle the VIX options is called the Special Opening Quotation (SOQ) and is calculated from a series of opening prices on the options that make up the underlying index on the settlement day (the day following the expiration day).