Valuation Multiples

Post on: 16 Март, 2015 No Comment

Enterprise Value Valuation Methods

Valuation multiples are the quickest way to value a company, and are useful in comparing similar companies (comparable company analysis). They attempt to capture many of a firm’s operating and financial characteristics (e.g. expected growth) in a single number that can be mutiplied by some financial metric (e.g. EBITDA ) to yield an enterprise or equity value. Multiples are expressed as a ratio of capital investment to a financial metric attributable to providers of that capital.

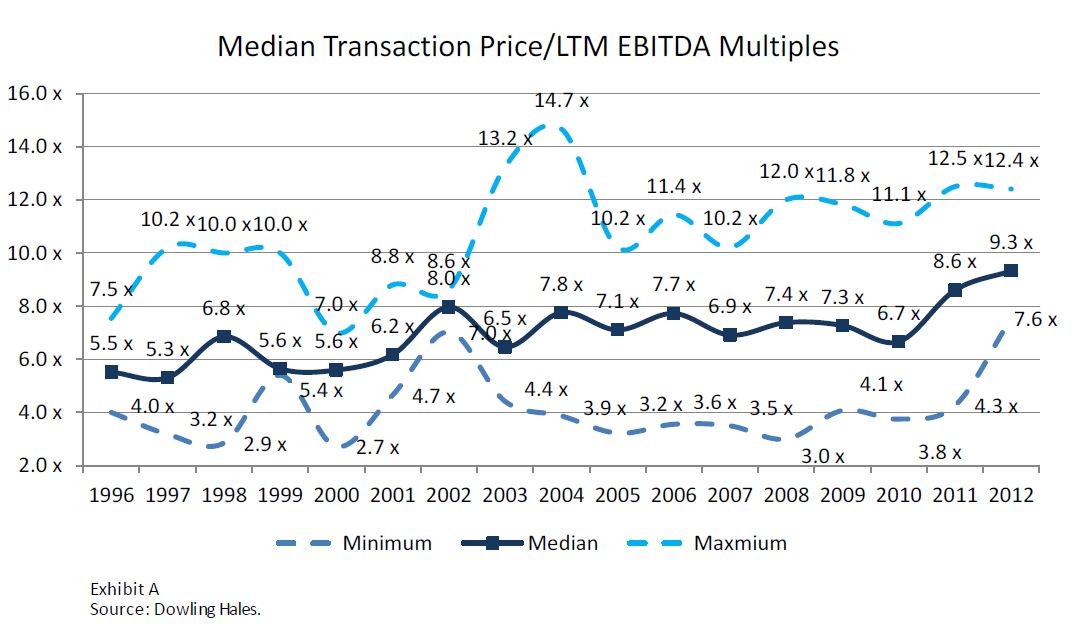

Exhibit A Common Valuation Multiples

One very important point to note about multiples is the connection between the numerator and denominator. Since enterprise value (EV) equals equity value plus net debt, EV multiples are calculated using denominators relevant to all stakeholders (both stock and debt holders). Therefore, the relevant denominator must be computed before interest expense, preferred dividends, and minority interest expense. On the other hand, equity value multiples are calculated using denominators relevant to equity holders, only. Therefore, the relevant denominator must be computed after interest, preferred dividends, and minority interest expense.

For example, an EV/Net Income multiple is meaningless because the numerator applies to shareholders and creditors, but the denominator accrues only to shareholders. Similarly, an Equity Value/EBITDA multiple is meaningless because the numerator applies only to shareholders, while the denominator accrues to all holders of capital. With this understanding of the relationship between numerator and denominator, we can invent virtually any multiple we like to value a business, so long as the multiple is, of course, relevant to that business.

The choice of multiple(s) in valuing and comparing companies depends on the nature of the business or the industry in which the business operates. For example, EV/(EBITDACapEx) multiples are often used to value capital intensive businesses like cable companies, but would be inappropriate for consulting firms. To figure out which multiples apply to a business you are considering, try looking at equity research reports of comparable companies to see what analysts are using.

Enterprise value multiples are better than equity value multiples because the former allow for direct comparison of different firms, regardless of capital structure. Recall, that the value of a firm is theoretically independent of capital structure. Equity value multiples, on the other hand, are influenced by leverage. For example, highly levered firms generally have higher P/E multiples because their expected returns on equity are higher. Additionally, EV multiples are typically less affected by accounting differences, since the denominator is computed higher up on the income statement.

In practice, we generally refer to some multiples using the denominator only, because the numerator is implied. For example, when talking about the EV/EBITDA multiple, we would simply say EBITDA multiple, because the only sensible numerator is EV.