Valuation & Hedge Accounting Services for Commdities

Post on: 19 Апрель, 2015 No Comment

DerivActiv provides valuation and hedge accounting services to entities that use the commodities markets to hedge risks. DerivActiv has developed proprietary pricing models to structure and value all types of complex commodity hedges. We provide fair value measurements for commodity futures, forwards, options, and swaps. Our clients use our fair values in financial reports to comply with ASC 820. DerivActiv also performs hedge accounting for commodities contracts to assure compliance under either ASC 815 or GASB 53.

To learn more about DerivActiv’s valuation and hedge accounting services for commodities valuation, please contact us at 1-866-200-9012.

Many entities that use commodity hedges are required to produce financial reports that meet FASB accounting standards such as ASC 820 and ASC 815 or GASB accounting standards such as GASB 53.

DerivActiv Calculates the Fair Value of Commodity Contracts for ASC 820

DerivActiv calculates the fair value, as defined under ASC 820, of all types of commodity contracts including futures, forwards, options, and swaps. This involves determining adjustments due to non-performance risk. DerivActiv analyzes the underlying instrument for each commodity contract to determine its classification in the fair value hierarchy, and then decides which methodology is most appropriate for calculating an accurate exit price. We use a combination of observable market data and proprietary pricing models to produce a non-performance risk-adjusted fair value that complies with ASC 820. The methodologies that DerivActiv uses to measure fair value have been tested and accepted by auditors.

DerivActiv Provides ASC 815 Compliant Hedge Accounting for Clients Using Commodity Hedges

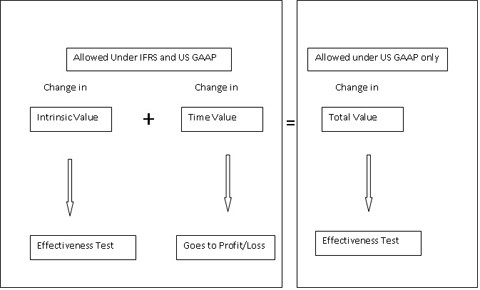

DerivActivs in-house hedge accounting experts make sure that clients are using appropriate hedge accounting to comply with ASC 815. ASC 815 requires that entities assess the effectiveness of hedges using standardized testing methods and report them correctly on financial statements. DerivActiv provides hedge accounting analytics to measure hedge effectiveness and prepares the supporting documentation that is required by auditors. We also provide ongoing analysis and journal entries necessary for ASC 815 compliance.

Governmental Entities that Practice Commodity Hedging Use DerivActivs Services to Comply with GASB 53

DerivActiv provides a full range of services related to GASB 53, which promotes transparency in financial statements by requiring governmental entities to measure derivative instruments at fair value and provide hedge effectiveness testing and disclosures. DerivActiv’s GASB 53 services include: testing hedge effectiveness, preparing a compliance report that includes a summary of the testing methodology and assumptions used, and calculating an independent fair value of each derivative in a client’s portfolio. Clients use our GASB 53 compliance report to help them prepare their financial statements.