US payrolls surge jobless rate hits 5 5year low The Malaysian Insider

Post on: 3 Июнь, 2015 No Comment

Published: 2 May 2014 9:35 PM

US job growth increased at its fastest pace in more than two years in April, suggesting a sharp rebound in economic activity early in the second quarter.

Nonfarm payrolls surged 288,000 last month, the Labor Department said today. That was the largest gain since January 2012 and beat Wall Street’s expectations for only a 210,000 increase.

March and February’s data was revised to show 36,000 more jobs than previously reported.

While the unemployment rate dived 0.4 percentage point to a five-and-a-half-year low of 6.3%, the Labor Department said that was because of a drop in the number of unemployed people reentering the labour market as well as a fall in new entrants into the labour force.

The unemployment rate was last at this level in September 2008.

The economy really has strong underlying fundamentals supporting its growth. Temporary headwinds such as the bad weather can be certainly managed, said Russell Price, senior economist at Ameriprise Financial in Troy, Michigan.

US Treasury debt yields soared after the report, while the dollar jumped to session highs against the euro and the yen. US stock index futures turned higher.

The economy stalled in the first quarter, weighed down by an unusually cold and disruptive winter. A slow pace of stock accumulation by businesses, while they work through a glut of goods amassed in the second half of 2013, also undercut growth.

The employment report joins other upbeat data such as consumer spending and industrial production in suggesting the first quarter’s 0.1% annual growth pace was an aberration and is not a reflection of the economy’s otherwise sound fundamentals.

The Federal Reserve on Wednesday shrugged off the dismal performance in the first quarter.

The US central bank, which announced further reductions to the amount of money it is pumping into the economy through monthly bond purchases, said indications were that growth in economic activity has picked up recently.

Economists expect second-quarter growth to top a 3% pace.

While details of the bigger survey of employers were robust, the smaller and volatile household survey from which the unemployment rate is calculated was mixed.

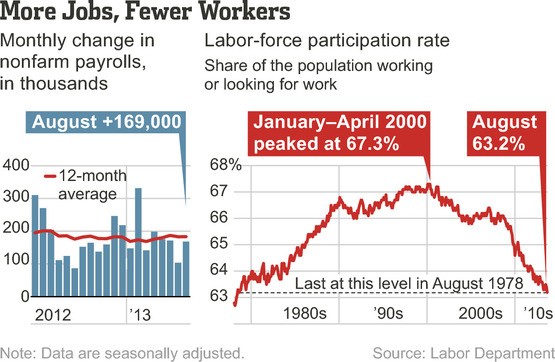

Household employment fell slightly after increasing strongly in the first quarter. The labour force, which also grew during the same period as improving job prospects encouraged some job seekers who had given up the hunt to resume looking for work, declined sharply in April.

The labour force participation rate, or the share of working-age Americans who are employed and unemployed but looking for a job, fell 0.4 percentage point to 62.8%. That was the lowest level since last December.

Some of the 1.35 million people who lost their longer-term unemployment benefits at the end of last December could have dropped out the labour force last month.

But a broad measure of unemployment, which includes people who want to work but have stopped looking and those working only part time but who want more work, fell to a 20-year low of 12.3% in April. It was at 12.7% in March.

The participation rate and the persistently high number of Americans out of work for long spells could keep the Fed from lifting interest rates for some time to come.

Employment gains in April were broad based, with the private sector adding 273,000 jobs and government payrolls rising 15,000. Manufacturing employment increased 12,000 after rising by 7,000 in March.

Construction payrolls gained 32,000. That followed an increase of 17,000 jobs in March. The hiring trend could slow in the months ahead as residential construction loses some steam.

Average hourly earnings were flat in April. The length of the workweek held steady at 34.5 hours in April after bouncing back in March from its winter-depressed levels. – Reuters, May 2, 2014.