Understanding the topdown and bottom up approach in investing

Post on: 2 Октябрь, 2015 No Comment

Understanding the ‘top-down’ and ‘bottom up’ approach in investing

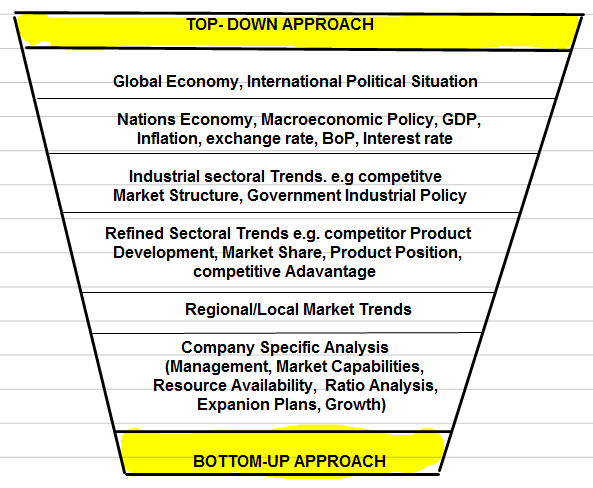

Customarily, there are two approaches employed for investment, one is “Top-Down “and the other, “Bottom-Up”. Although the parameters of selection criteria and evaluation differ, they both are engaged for the same end goal of getting the best returns possible.

What is Top –Down approach?

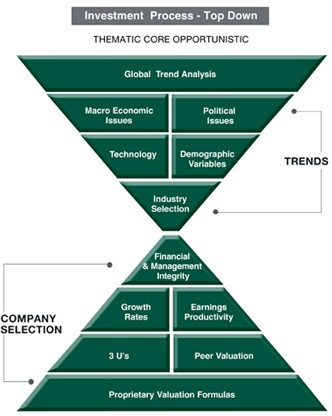

Top down approach takes into consideration macroeconomic variables like inflation, GDP, exchange rates, exports-imports, monetary and fiscal policy etc to arrive at a decision. The investor monitors these factors and based on his/her analysis, invests in the portfolio which will appreciate as the result of the changes in these variables. For example, post analysis, it is identified that the interest rates might be reduced by the RBI which will automatically encourage borrowings both on retail and corporate front. This money will be used for growth and expansion, especially in the corporate sector, thus showing positive effects on equity market.

If an investment is intended for stock market using this approach: first, the sector/industry showing the most potential is identified and then investment is made in the promising company or companies within that sector.

An investor interested in maintaining a portfolio of investments outside the domestic market should take into consideration the effects of globalization and international fiscal market trends. For example, post the European crisis, the credit rating of the investments in the concerned nations have drastically fallen while due to rise in economic powers like China and India, Asian subcontinent is showing a great potential for foreign investments.

Top-down approach is dynamic as the financial market trends are volatile and thus, it cannot be used as a standalone approach for long term stable investments.

What is Bottom-Up approach?

This approach does not give emphasis to market or economic trends but merely focuses on the targeted investment vehicle or entity. The investor analyses the financial health of the investment vehicles/business enterprises and chooses the most promising one among them. For equity based investment, the factors that are considered in this approach are financial reports, market share information, M& A strategies and share prices of different companies. This approach looks at long term effects (about 5-10 years) but requires immense research since the study would be at the bottom most level in the economic hierarchy.

For example, an individual wants to invest in stock market. A recent piece of media information shows that company ABC has initiated the process for acquiring an exponentially growing startup XYZ (think Facebook’s acquisition of Whatsapp or Yahoo’s acquisition of Summly or even Flipkart’s recent acquisition of Myntra). This in turn will translate into an increase in the share price of the former company. The investor using this approach will immediately invest looking at this future potential.

Top-Down Vs Bottom-Up approach.

The former approach typically requires in-depth knowledge of the economy in general and the variables that influence it while the latter approach demands in-depth knowledge of the investment vehicles/entities at the ground level.

Now the question arises as to which one is better. It is always advised to have a mix of both strategies since looking at the larger picture (Top-Down), the ground level realities (Bottom-up) cannot be ignored and vice –versa.