Understanding the Leveraged Investment Showdown Technique Trading Tutorials

Post on: 5 Июнь, 2015 No Comment

Understanding the Leveraged Investment Showdown Technique

Understanding the Leveraged Investment Showdown Technique 5.00 / 5 (100.00%) 1 vote

Traders interested in diversifying their investment opportunities should always keep up with the latest in investing techniques and practices. Learning about different strategies will ensure that they never have to rely too heavily on one, which can allow them to work better with active market conditions to make the most profit. One of the most versatile types of investment strategies is known as the leveraged investment showdown. This technique focuses on seeking higher investment profits through the use of borrowed money. When the trader makes a profit, they return the borrowed capital and can enjoy a significant percentage of the profits themselves. While it can be a great way to look into higher profit opportunities, it ends up exposing the investor to a much higher degree of risk. Consider some of the following ways to borrow the capital from reliable sources.

One of the most common ways to borrow the money is from margin loans. Margin loans will typically set the equity in the investors account as the collateral for the transaction. They are usually provided by brokers and are very heavily regulated by a variety of different agencies, including the Federal Reserve. The reason for this regulation is because the availability of investment credit was easily one of the biggest contributing factors to the stock market crash in 1929. One of the largest advantages that comes from working with these loans is that they are very easy to use. The capital received from margin loans can be used in a variety of different investments, depending on where the investor feels the most comfortable.

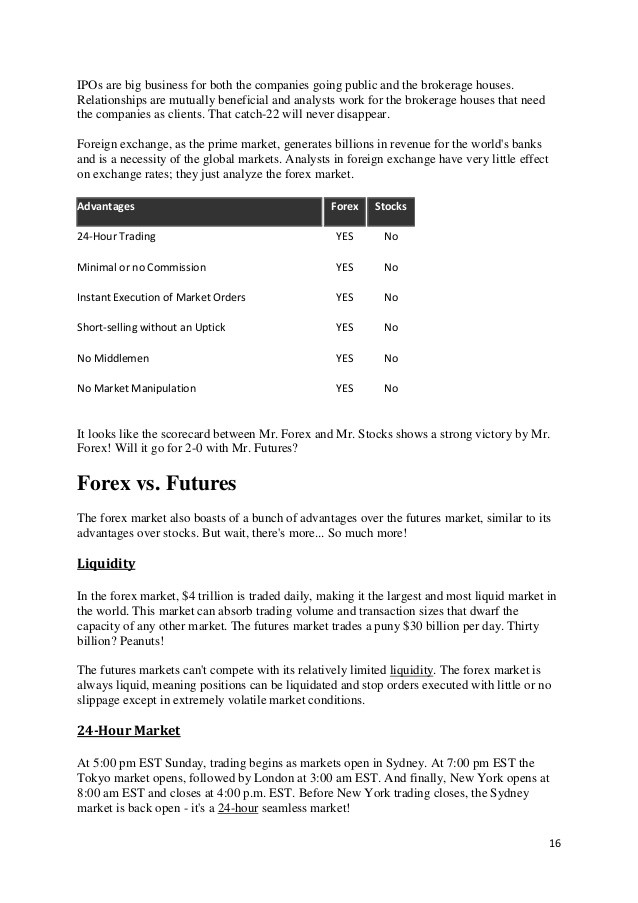

Index futures can be another good way to borrow funds for your planned investments. The futures contract is a type of financial instrument that you can use to purchase the investments that you need for certain prices at later dates. The financing costs are already included in the futures price, which makes them work on the same level as a short term loan. Most futures are associated with commodities, currencies, and interest rates instead of equities, but their versatility has slowly been expanding in the past few years. These contracts can be a great way to get started for most traders because of their low bid spreads.

ETF options are the final way to work with the leveraged investment showdown strategy. These options provide their buyers with the right to trade shares of securities for specific prices. All of the options have different strike prices and expiry dates. These can be a difficult type of fund to work with, however, as option pricing is usually driven by the risk of the seller, relating to how volatile the underlying investment is. Options can play a very important role in most markets as powerful hedging tools. Using options can help limit the risk involved with most types of trades and transactions at the cost of a little appreciation.