Unconstrained Income Investing

Post on: 28 Июль, 2015 No Comment

2:19 PM ET

Calvert Is Latest To Join Unconstrained Bond Fund Bandwagon

By Michael Aneiro

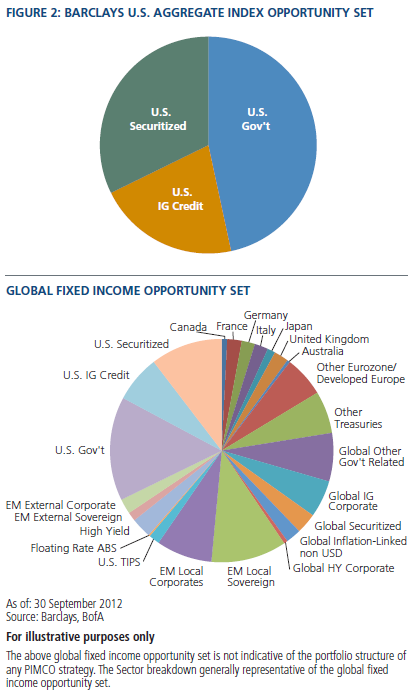

Everybody and his brother (and Bill Gross too) loves an unconstrained bond fund these days, and Calvert Investments is the latest to hop on that bandwagon, announcing today the launch of the Calvert Unconstrained Bond Fund (CUBAX ). In short, unconstrained funds arent benchmarked against traditional bond indexes, like the Barclays Aggregate Index. Instead they offer managers hedge-fund style freedom to trade in and out of sectors and bonds as they please. In the last couple of years theyve been pitched as way to minimize risk at a time when interest rates are supposed to rise and bonds could see losses like they did in the summer of 2013. (For the longer version, see my Barrons cover story on unconstrained funds from last October.)

In addition to the usual language about flexibility and providing returns during any market environment that typically accompanies the launch of these funds, Calvert calls this fund the only mutual fund in the nontraditional bond category to feature the incorporation of environmental, social and governance (ESG) analysis in its investment process. More from Calvert:

A unique aspect of Calvert’s sector and security selection process involves a relative value assessment of both fundamental and ESG risks. The credit team collaborates with in-house sustainability research analysts to find opportunities in industries and companies that exhibit a combination of particularly strong fundamentals and favorable ESG factors. They avoid exposure in areas of the credit market where the reverse may apply.

Separately, Western Asset today put out a report titled A Decade of Unconstrained Investing touting the 10-year anniversary of the firms Total Return Unconstrained strategy. Here are Western Assets Mark Lindbloom and Doug Wade looking to the years ahead:

Looking ahead, we expect US Treasury rates will eventually increase as the Fed continues to normalize monetary policy. The rally in global spread sectors has amplified the importance of fundamental analysis as true value opportunities are scarce. Western Asset’s TRU is a dynamic product that we believe is well equipped to meet these future market challenges. TRU has the duration and curve flexibility to fully express our views on interest rates and help protect the portfolio in a potential rising rate environment.

Aug 18, 2014

4:40 PM ET

BlackRock Touts Unconstrained Strategy For Muni Investing

By Michael Aneiro

With the Fed poised to start hiking short-term rates in the next year or so, BlackRock sees interest rates becoming more volatile and says municipal bond investors should be looking to the same unconstrained-style fund strategies that have been gobbling up market share across the broader bond market. Peter Hayes, head of BlackRocks muni bond group, says investors should be thankful for the big gains posted by munis so far this year, up 6% through July, but that caution is warranted at this point and investors should protect those gains rather than reach for more.

Hayes makes the case for an unconstrained investing approach essentially eschewing traditional benchmarks and giving a fund manager greater leeway to select securities for munis in his latest blog post :

It’s a concept that’s just taking hold in the muni space, and we think it makes a lot of sense. Essentially, an unconstrained municipal strategy, such as our own Strategic Municipal Opportunities Fund (MAMTX ), is a flexible, one-stop solution that invests across the entire municipal spectrum. It’s not limited to bonds of a particular credit quality or maturity date. Importantly, we are able to manage interest rate risk by adjusting our duration as needed in an effort to mitigate the losses that accompany a rise in interest rates. It’s a kind of flexibility not previously available, and we think it can add a lot of diversification to your muni allocation at a time when market uncertainty demands a high level of adaptability.

Fund management firms have been pitching unconstrained strategies as solutions to bond investing at a time when rates are expected to rise, and unconstrained funds have surged in popularity in the wake of the spike in bond yields during May and June 2013. As I wrote in my Barrons cover story last October, these funds can make sense as complementary holdings to traditional bond funds, but investors need to keep an eye on what these funds hold, since they can move in and out of investments quickly and frequently, and one firms unconstrained strategy can bear little resemblance to anothers. BlackRocks flexible muni fund is up 7.56% so far this year.

Jun 23, 2014

11:11 AM ET

Another New Unconstrained Bond Fund, This Time From Schroders

By Michael Aneiro

Firms keep adding unconstrained bond funds to their mutual fund offerings, and the newest addition to the unconstrained bandwagon comes from Schroders. which today announced the launch of the Schroder Global Strategic Bond Fund (SGBNX ). Schroders calls it an actively managed portfolio with the flexibility to invest in the best opportunities throughout the fixed income universe that offers investors the potential for total return in different market environments—including periods of rising rates. Schroders also announced the launch of the Schroder Global Multi-Asset Income Fund (SGMNX ), which Schroders calls a diversified portfolio that seeks to maximize income and manage volatility by investing directly into both equities and fixed income securities around the globe.

As Ive written before (particularly in my Barron’s cover story on unconstrained funds last October), unconstrained funds dont tether themselves to traditional benchmark bond indexes (namely the Barclays Agg ) that govern most core” bond funds and effectively require them to hold certain percentage of Treasuries and mortgage bonds, which are highly susceptible to interest-rate risk. In the past year investors have flocked to alternative fund that claims to protect against rate risk but the tricky part is keeping track of what these funds hold at any time and whether they expose investors to other risks and heightened equity correlation. Hence theyre best used as complements to traditional bond funds rather than replacements.

Schroders offers a thorough explanation of the funds mandate in its prospectus. which serves as a pretty good primer on how broadly flexible unconstrained funds are in general. Heres an excerpt:

The Fund invests primarily in securities of issuers located in a number of countries around the world, including emerging markets and the United States. The Fund may invest in securities rated in any rating category and in unrated securities, and it may invest any portion of its assets in securities rated below investment grade or in unrated securities considered by the Funds advisers to be of comparable quality (so-called junk bonds). In addition, the Fund may invest a majority of its assets in asset-backed and mortgage-backed securities.

Unconstrained by design, the portfolio is not managed with reference to a specific benchmark. The Funds advisers will allocate the Funds assets among issuers, types of securities, industries, interest rates, and geographical regions based on an assessment of the relative values and the risks and rewards these potential investments present. The allocation of the Funds assets to different sectors and issuers will change over time, sometimes rapidly, and the Fund may invest without limit in a single sector or a small number of sectors of the fixed income universe. The average duration of the Fund will vary based on the advisers forecast for interest rates, and there are no limits on the Funds portfolio duration or average maturity….

The advisers may use derivatives actively in managing the Fund, including without limitation, foreign currency exchange transactions (including currency futures, forwards, and option transactions), swap contracts (including interest rate swaps, total return swaps, and credit default swaps), futures contracts and options on futures…. The Fund may implement short positions, including through the use of derivative instruments, such as swaps or futures, or through short sales of instruments that are eligible investments for the Fund.

Apr 8, 2014

5:35 PM ET

Gundlach: New DoubleLine Flexible Fund Aims To Be Transparent

By Michael Aneiro

DoubleLine founder Jeffrey Gundlach hosted a webcast today to discuss the firms two newest funds, the DoubleLine Flexible Income Fund (DFLEX ) and the DoubleLine Low Duration Emerging Markets Fixed Income Fund (DBLLX ), both designed generally to offer healthy yields while minimizing interest-rate risk. He spent most of the time talking about the flexible fund, which marked an about-face for such a previously outspoken critic of so-called unconstrained bond funds. Without ever using the word unconstrained, Gundlach said he hopes to differentiate this fund from similar go-anywhere funds by keeping investors apprised if it makes any big changes in its holdings.

Gundlach parried some skeptical questions at the end of the webcast, such as one asking why this fund seems similar to products offered by competitors years ago, to which Gundlach basically said that you can’t always rush these things, noting that the fund is based on a strategy DoubleLine has already been implementing for institutional clients for the past couple of years. To another listener asking if these new new offerings stretch DoubleLine too thin, he replied Hardly,” even if he “can sympathize” with the idea that investors can sometimes face too much choice. He said there are no plans for other new DoubleLine funds on the drawing board except potentially a non-dollar-denominated international bond fund.