Turtle Trading A Market Legend

Post on: 23 Июль, 2015 No Comment

Few people associate Eddie Murphy, Dan Ackroyd and the 1983 movie Trading Places with one of the greatest trading stories of all time. However, in the same year the movie was released, a real-life experiment along similar lines was carried out by legendary commodity traders Richard Dennis and William Eckhardt. In the end, life imitated art and the experiment proved that anyone can be taught to trade well. (For related reading, see Financial Careers According To Hollywood .)

The Turtle Experiment

By the early 1980s, Dennis was widely recognized in the trading world as an overwhelming success. He had turned an initial stake of less than $5,000 into more than $100 million. He and his partner, Eckhardt, had frequent discussions about their success. Dennis believed anyone could be taught to trade the futures markets. while Eckhardt countered that Dennis had a special gift that allowed him to profit from trading.

The experiment was set up by Dennis to finally settle this debate. Dennis would find a group of people to teach his rules to, and then have them trade with real money. Dennis believed so strongly in his ideas that he would actually give the traders his own money to trade. The training would last for two weeks and could be repeated over and over. He called his students turtles after recalling turtle farms he had visited in Singapore and deciding that he could grow traders as quickly and efficiently as farm-grown turtles.

Finding the Turtles

- The big money in trading is made when one can get long at lows after a big downtrend.

- It is not helpful to watch every quote in the markets one trades.

- Others’ opinions of the market are good to follow.

- If one has $10,000 to risk, one ought to risk $2,500 on every trade.

- On initiation one should know precisely where to liquidate if a loss occurs.

For the record, according to the Turtle method, 1 and 3 are false; 2, 4, and 5 are true. (For more on turtle trading, see Trading Systems: Run With The Herd Or Be The Lone Wolf? )

The Rules

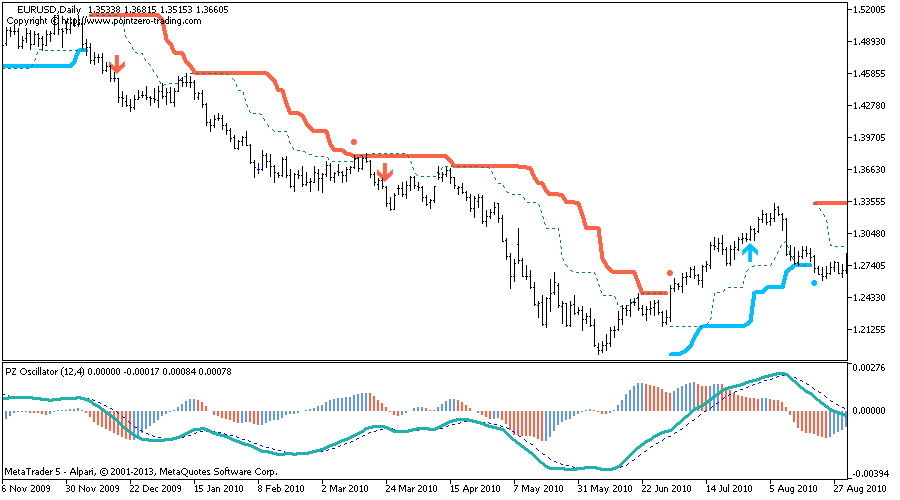

Turtles were taught very specifically how to implement a trend-following strategy. The idea is that the trend is your friend, so you should buy futures breaking out to the upside of trading ranges and sell short downside breakouts. In practice, this means, for example, buying new four-week highs as an entry signal. Figure 1 shows a typical turtle trading strategy. (For more, see Defining Active Trading .)