Tuesday s ETF to Watch PowerShares Bullish Fund (UUP)

Post on: 5 Апрель, 2015 No Comment

By Eric Dutram, ETF Database | More Articles

With triple digit oil seemingly here to stay, investors around the world have begun to worry about the prospect of inflation and if this phenomenon will curtail any hopes the U.S. economy has of avoiding a double dip recession. However, many point to the precious commodity’s rise as a result of geopolitical concerns as a reason for investors to dismiss the surge as a short term blip rather than something that should be impacting U.S. monetary policy. Nevertheless, fears over increased fuel costs trickling into the CPI compounded with the total devastation of the world’s third biggest economy are forcing many economists to go back and forth between predictions of Bernanke flooding the market with more money to stimulate the economy or the prospect of taking cash off of the table in order to prevent a great inflation spike further down the road.

For these reasons, today’s Federal Open Market Committee (FOMC) meeting should help clarify the U.S. position going forward as well as the Fed’s plans to fight inflation in both the near and mid term. Most believe that the Fed will continue its $600 billion Treasury buying program, more popularly known as QE2, as planned — suggesting that the program will tapper out in June as originally called for. Nevertheless, most metrics for the dollar have been relatively bullish as of late ; manufacturing orders were up, unemployment was down, and the CPI, even when stripping out food and energy, has posted solid gains over the previous data release. All of this positive data could lead some Fed members to consider hinting at raising rates or at least voting against continuing the bond buying program in some form. If this happens, it could be dollar positive and signal to the market that a rate hike is closer than some initially thought.

On the other hand, with concerns growing that Japanese investors as well as insurance companies will be forced to sell off Treasury holdings in order to help pay for quake damage, the end of QE2 might not be as close as some are predicting. Japan currently holds about $880 billion in U.S. government debt, and part of that sum may soon be taken out of the market. Furthermore, even if Japanese investors don’t sell off their American debt, it seems unlikely that they will continue to buy up U.S. Treasuries at the rate they have been, suggesting that QE2 might be necessary in order to keep bond yields from spiking in the near term [see Bond ETFs That Steer Clear of Interest Rate Risk ].

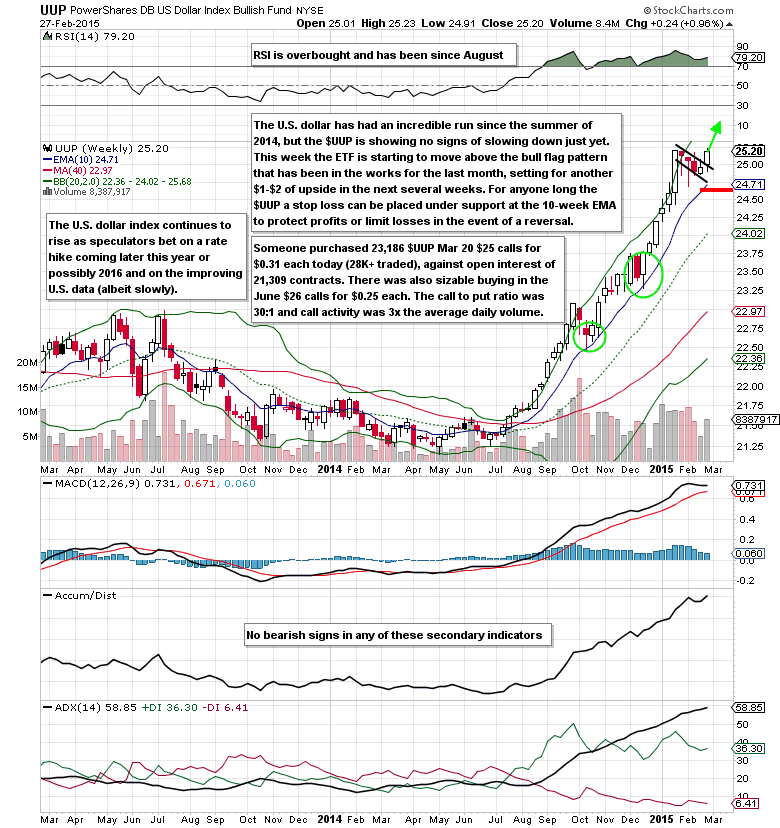

Because of today’s FOMC meeting, as well as continued speculation over Japanese investors pulling money from U.S. Treasury markets to help pay for the rebuilding plan, the PowerShares DB USD Index Bullish Portfolio ( NYSE: UUP ) should be active in Tuesday trading. The fund tracks the Deutsche Bank Long US Dollar Index (USDX) Futures Index. a rules-based index compared solely of long USDX futures contracts. The USDX futures contract is designed to replicate the performance of being long the U.S. Dollar against the following currencies: Euro, Japanese Yen, British Pound, Canadian Dollar, Swedish Krona, and Swiss Franc. The basket is traded-weighted, and as a result, the euro (57.6%), yen (13.6%), and pound (11.9%) dominate the holdings list [see more on UUP’s fact sheet ].

Should the Fed announce an end to QE2, it could help to push the dollar and UUP sharply higher on the day. If, however, Bernanke and Co. announce further liquidity measures or plans for more quantitative easing, look for UUP to slump in Tuesday trading and continue its recent spat of weakness [see How ETFs Have Democratized Investing ].

[For more ETFs to watch sign up for our free ETF newsletter .]

More from ETFdb.com:

Disclosure: No positions at time of writing.

ETF Database is not an investment advisor, and any content published by ETF Database does not constitute individual investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. From time to time, issuers of exchange-traded products mentioned herein may place paid advertisements with ETF Database. All content on ETF Database is produced independently of any advertising relationships. Read the full disclaimer here .