Treasuries Rise on Refuge Demand as Fed Taper Matches Forecast Bloomberg Business

Post on: 9 Июль, 2015 No Comment

Jan. 29 (Bloomberg) — Treasury 10-year note yields fell to the lowest level in two months as investors sought a haven from emerging-market turmoil even as the Federal Reserve announced plans for a second reduction in its bond-buying program.

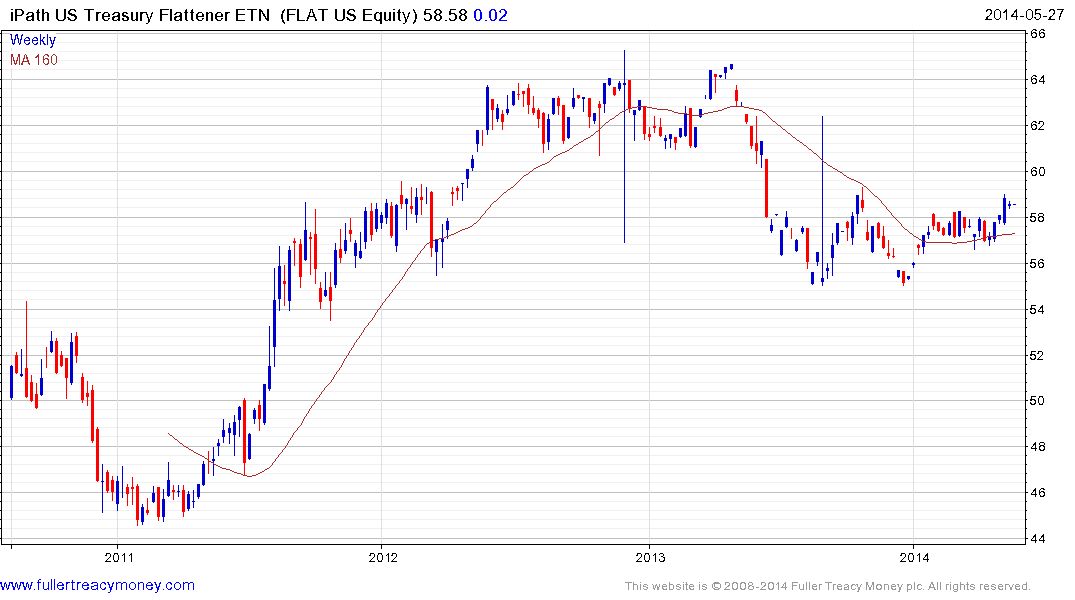

U.S. debt rallied as the Federal Open Market Committee cut monthly purchases to $65 billion from $75 billion and left unchanged a statement that it will probably hold its target interest rate at almost zero “well past the time” that unemployment falls below 6.5 percent, “especially if projected inflation” remains below the committee’s 2 percent goal. Treasuries gained earlier as South Africa’s central bank joined Turkey in raising its benchmark interest-rate in moves that failed to reassure investors, while Russia’s ruble extended its slump to 13 days and Hungary’s forint weakened.

“There is no way that anybody should be surprised,” said Mitchell Stapley, chief investment officer for Cincinnati-based ClearArc Capital, which oversees about $7 billion. “Bonds can continue to run up on the flight-to-quality. At the end of the day, the band-aid has to come off.”

The 10-year note yield fell seven basis points, or 0.07 percentage point, to 2.68 percent at 5 p.m. in New York, according to Bloomberg Bond Trader prices. The price of the 2.75 percent note due in November 2023 added 20/32, or $6.25 per $1,000 face amount, to 100 20/32. The yield reached the least since Nov. 19.

Thirty-year bond yields fell five basis points to 3.62 percent, touching the lowest level since Oct. 30.

Priced In

“The entire content of the statement was priced in,” said Christopher Sullivan, who oversees $2.25 billion as chief investment officer at United Nations Federal Credit Union in New York. “Treasuries are still reacting in terms of equity market declines around the world. Flight-to-quality flows are coming out of emerging markets into Treasuries.”

The benchmark note yields rose six basis points to 2.89 percent on Dec. 18 after Fed policy makers announced the first cut to monthly purchases.

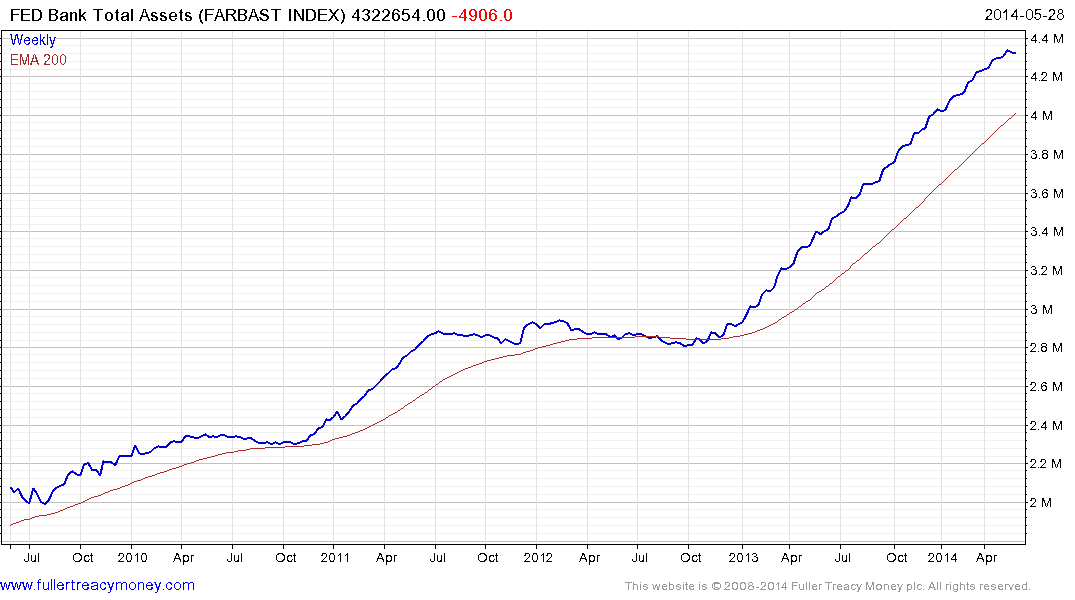

The Fed has undertaken three rounds of bond-buying since 2008 under the quantitative-easing stimulus strategy. The purchases have swelled its balance sheet to a record $4.1 trillion.

The Treasuries-purchase schedule for February will be announced at 3 p.m. on Jan. 31, the New York Fed said on its website.

Policy makers have held the benchmark interest rate, the target for overnight loans between banks, at zero to 0.25 percent since 2008 to support the economy. The odds that it will stay unchanged through 2014 are about 85 percent, based on data compiled by Bloomberg from futures contracts.

Price Levels

Slowing inflation has cut any urgency for the Fed to raise the rate. The consumer price index increased 1.5 percent in December from the year before, the fastest pace since August, a government report showed on Jan. 16. It is still less than the average for the past decade of 2.4 percent.

The Bloomberg U.S. Treasury Bond Index has risen 1.3 percent in the past month through yesterday. The Standard & Poor’s 500 Index of U.S. shares have lost 2.9 percent including reinvested dividends.

Fed policy makers also extended for a year tests of an overnight fixed-rate reverse repurchase program that could serve as an additional tool for the Fed when it eventually seeks to raise interest rates.

“This work is a matter of prudent advance planning,” the Federal Reserve Bank of New York, the branch of the central bank that implements monetary policy, said today in a statement on its website. The tests will be extended through Jan. 30, 2015.

Market Test

Starting tomorrow, “the maximum allotment cap will be increased to $5 billion per counterparty per day from its current level of $3 billion,” and may be increased further, the New York Fed said.

The Treasury’s initial sale of $15 billion of floating-rate notes had a high discount margin of 0.045 percent. The sale drew a bid-to-cover ratio, which gauges demand by comparing the number of bids with the amount of securities sold, of 5.67.

“The sale came extraordinarily well,” said Jim Vogel, head of agency-debt research at FTN Financial in Memphis, Tennessee. “The floaters are money market yields without the headaches. From the beginning the floaters have had ‘winner’ stamped all over it. And the securities came at the perfect time.”

The debt offers investors a short-term security that’s a hedge against a potential rise in interest rates. The securities are considered short term because they are benchmarked to a short-term index — the high rate from a 13-week bill. The rate at which interest will accrue on the notes will be re-set daily.

Note Sales

The Treasury plans to sell more floating-rate notes in April, July and October, with two re-openings in the subsequent months of each quarter.

Investors will bid for $35 billion of five-year securities and $29 billion of seven-year debt tomorrow.

Turkish central-bank Governor Erdem Basci is fighting to arrest a currency run after a corruption scandal that broke last month ensnared several cabinet members. The political fallout coincided with an outflow of money from emerging economies including Brazil as the U.S. reduces monetary stimulus.

The exodus prompted the South Africa Reserve Bank to unexpectedly increase its benchmark interest rate. The Monetary Policy Committee lifted the repurchase rate to 5.5 percent from 5 percent, Governor Gill Marcus told reporters in Pretoria today. All 25 economists surveyed by Bloomberg last week said the rate would stay unchanged as the central bank focuses on supporting an economy buffeted by slower global demand and mining strikes.

“All these bubbles are getting pricked all over the world and it’s raining back to the Treasury market,” said Charles Comiskey, head of Treasury trading at Bank of Nova Scotia in New York, one of 21 primary dealers that trade with the Fed. “They’re rallying the Treasury market on a cutback in purchases.”

To contact the reporter on this story: Daniel Kruger in New York at dkruger1@bloomberg.net

To contact the editor responsible for this story: Dave Liedtka at dliedtka@bloomberg.net