Trading Volatility Secrets of VXX The Value of the Roll Yield

Post on: 19 Июль, 2015 No Comment

Secrets of VXX: The Value of the Roll Yield

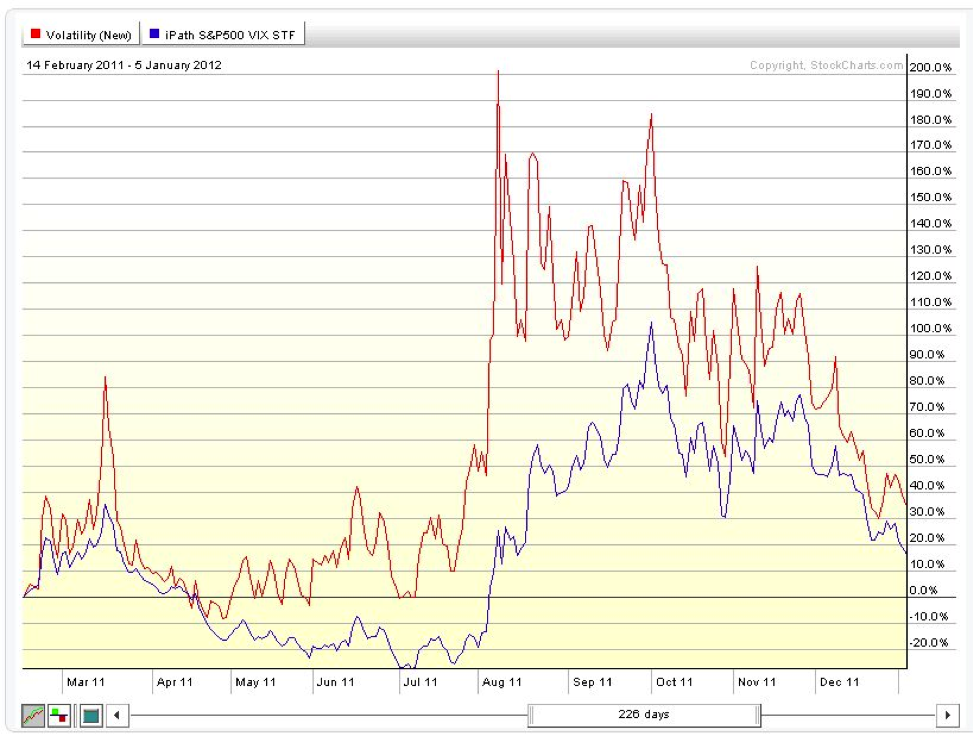

Most people who trade VXX realize that it faces constant headwinds caused by a term structure that is in contango roughly 90% of the time. However, something you may not know is just how big that headwind is at any given time. To help with this I have posted the weekly roll yields for short-term and med-term VIX futures securities on the VIX Futures Data page.

For more on where these numbers come from, continue reading below.

VXX tracks the performance of the first and second month VIX futures. However the actual dollar weight of each month held by VXX changes each day as iPath continuously rolls their portfolio in order to target a constant maturity weighted average futures maturity of 1 month. You can view the current status of these weights on the iPath site .

Summarizing the roll process as defined in iPath’s 200+ page VXX prospectus :

1) At the beginning of the roll period all the weight is allocated to the first month contract.

2) On each subsequent business day a fraction of the first month VIX futures holding is sold and an equal notional amount of the second month VIX futures is bought. The quantity bought/sold depends on the number of business days in the roll period (the number of days varies but averages out to about 21).

3) The following roll period starts after all weight from the front month has been sold and the old second month VIX futures contract becomes the new first month VIX futures contract.

This process has a measurable effect on the price of VXX depending on the term structure.

When the term structure is in contango:

- At the end of each day VXX must sell a quantity of first month shares and replace them with a quantity of second month shares at a higher value. The buy high, sell low scenario results is a negative roll yield for the fund.

When the term structure is in backwardation:

- At the end of each day VXX must sell a quantity of first month shares and replace them with a quantity of second month shares at a lower value. The buy low, sell high scenario results is a positive roll yield for the fund.

The actual value of the roll yield depends on the difference between and 1st and 2nd months (bigger difference = bigger roll yield) and the number of days in the roll period (more days, smaller roll yield). You can calculate the exact value of the daily roll yield but a reasonable approximation is obtained by using 21 days for the number of business days in the roll period.

The same process applies to inverse VIX futures products. In order to obtain the value of the roll yield for the inverse products (XIV/SVXY), just change a negative sign above to a positive, or vice versa.

In my trading, I like to be able to take advantage of this roll yield by holding securities that have a large positive roll yield, so my planned timeframe for trades is on the order of weeks. Therefore, instead of looking at a daily roll yield I prefer to look at the weekly roll yield, obtained from multiplying the daily roll yield by 5 (another approximation).

You can take a similar approach to approximate the roll yield for ZIV (inverse med-term VIX futures) using 4th and 7th month futures. The results of these calculations is what I have listed on the VIX Futures Data page.

To give the roll yield values some context, below I’ve listed the average, min, max, and standard deviation of the weekly roll yields for XIV (past 9 years) and ZIV (past 5 years):

XIV:

avg: +1.2%

low: -11.7%

high: +7.1%

stdev: +1.7%

ZIV:

avg: +0.3%

high: +5.2%

stdev: +0.5%

FAQs

Q: When does the roll period start?

A: The roll period starts on the Tuesday prior to the monthly CBOE VIX Futures Settlement Date (the Wednesday falling 30 calendar days before the S&P 500 option expiration for the following month.)