Trading Using Fear and Greed

Post on: 9 Август, 2015 No Comment

Instructor

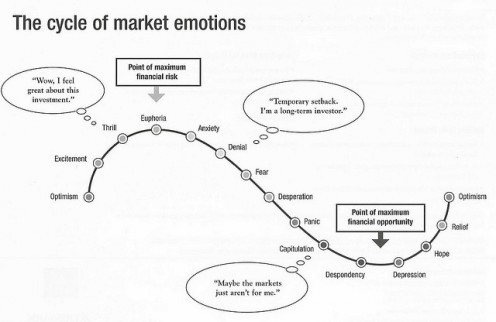

The emotions of fear and greed are clearly identifiable on a price chart if you know what to look for. This is important if we want to spot the traders that are usually selling at the lows of a move, or the ones chasing the market by buying just as the market turns down. In order to do this, we must learn what configuration, or pattern best represents these two emotions.

When looking at a price chart, most traders look at the overall direction of the market, and are conditioned to trade in that same direction. In certain market cycles, these tactics would be fine, however there is a time when a trend reaches a fever pitch and thats when greed shows up on a price chart. The weekly chart of the US Dollar Index below illustrates that when a strong move (the picture of greed) comes into a large institutional sell order, the most probable result is that all the late buyers will simply have to suffer as the market retreats.

Over the last three months the US Dollar Index has been in an extremely strong uptrend and buying in this uptrend (early on) was very profitable, but as I stated earlier, knowing when the trend was likely to change is a function of market psychology. This entails looking for the last greedy buyer to enter the market. In this example this meant that supply was nearby.

As we can see on a lower time frame chart of the DXY, the picture of greed is seen a little clearer.

When looking for the fearful seller to buy from (especially when the market has been dropping for some time), the picture looks like the mirror image of greed,with one exception, the emotion of fear is much stronger. For a trader that understands this, it means opportunity.

On the chart below we can see that the Swiss Franc Futures contract has been a steady spiral downward. In addition, the majority of traders in this currency were probably short and very negative on the prospects for this nations currency to turn around.

Similar to the Dollar moving higher, moving to the short side of this currency early in the trend paid handsomely, but theres a time when the pessimism is too much. This is when all the longs have given up and everyone is short, convinced that the currency is going to be worth very little. This tends to happen just as we approach a strong demand zone.

And just as before, in the smaller time frame we can see the picture that represents the fearful seller, or in this case then it may also be the last short seller thats convinced the Swiss franc is going a lot lower

In the final analysis, trading profitably is a function of buying low and selling high, anticipating when the market will turn, and doing this with high probability. Knowing who is on the other side of the trade, and what that picture looks like is part of this process. I hope this helps to better recognize this so that you can be on the right side when the market turns.

Until next time, I hope everyone gets what they want out of their trading.