Trading Options on Inverse and Ultra ETFs

Post on: 27 Апрель, 2015 No Comment

Posted by greg s | February 15, 2011

by DanKeegan

Originally Published in Futures Magazine

Question: How can traders take advantage of leveraged ETFs without a huge capital commitment?

Answer: Cut out the middleman and do as the indexers do, trade options on the ETFs.

Inverse and ultra exchange traded funds (ETFs) can be handy arrows to be found in a traders quiver. The ultra funds return two or three times the daily return than a normal ETF. Inverse ETFs can achieve the same goals as a straight out short position without consuming nearly as much margin.

What is an ultra ETF? It is an ETF that uses leverage. The 2X ultra aims to double the days return; the 3X ultra aims to triple the days return. A fund manager who is limited to having only 10% of his fund allocated to tech stocks could in effect double that exposure with a 2x fund. The ultras also save capital because double or triple the movement can be achieved with the same initial outlays. Leverage is a double-edged sword, however. If the ETF moves against the trader, more capital needs to be placed into the account. It is similar to a futures trade, but the ETF is trading the spot market and it does not have the same leverage as your typical futures contract.

Lehman Brothers ProShares offered the first ultra ETFs in 2006, with the introduction of its Ultra ProShares. For instance, ProShares Ultra QQQQ is an ETF that aims to double the performance of the NASDAQ 100 on a daily basis. So, if the QQQQ increases 1% on a particular day, QLD should be up around 2%. Smaller returns in a sideways market have a harder time achieving that same target. The ProShares have outlasted Lehman Brothers and have been sponsored by Barclays since Lehmans demise.

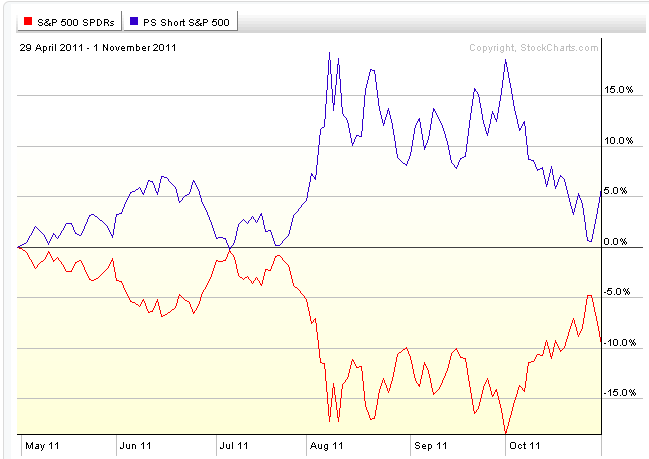

The inverse ETF exists for the goal of profiting from a decline in the value of an index. Trading in an inverse ETF is the same as an outright short of the ETF. For instance, a trader could buy PSQ instead of shorting QQQQ. By purchasing shares in QID, a trader can get double the exposure to the downside.

Are these ETFs the best way to leverage your returns in either an up or down market? The creators of ultra and inverse ETFs use options to achieve their desired results. Traders can cut out the middleman by trading options on QQQQ themselves, rather than trading QLD, PSQ and QID.

Lets say a trader has $56,000 to work with. The trader can buy 1,000 shares of QQQQ at $56. If QQQQ rises 1% in a day the trader will have $56,560 in his account at the end of the day. The trader could also by 651 shares of QLD, trading at $86, with the same amount of money. If QLD rises 2% the trader will have $57,120 at the end of the day (see More bang for the $).