Trading Education Trading for Beginners Futures Trading Forex Trading Stock Trading

Post on: 6 Май, 2015 No Comment

Recent Articles

Dont Get Ruined by These 10 Popular Investment Myths (Part X)

By Elliott Wave International

You may remember that after the 2008-2009 crash, many called into question traditional economic models. Why did they fail?

And more importantly, will they warn us of a new approaching doomsday, should there be one?

This series gives you a well-researched answer. Here is the conclusion of this 10-part series.

Myth #10: Central banks and government policies control the markets.

By Robert Prechter (excerpted from the monthly Elliott Wave Theorist ; published since 1979)

Virtually everyone believes this statement; certainly most economists do. Keynesians and monetarists believe that authorities can control the money supply and interest rates, and most neo-Austrians believe that the Fed is all-powerful when it comes to inflating: Whatever inflation rate it wants, it simply manufactures.

Not long ago [in late 2008 Ed.] the U.S. government announced that it will fully back the debt of the mortgage companies it created (Fannie Mae, Freddie Mac); it pledged to use taxpayers money and borrow unlimited amounts to fund banks that it deems too big to fail, while pledging that the FDIC will fund shortfalls at all other banks. At the same time, the worlds top central banks offered unlimited credit at near-zero interest rates, in other words, free money.

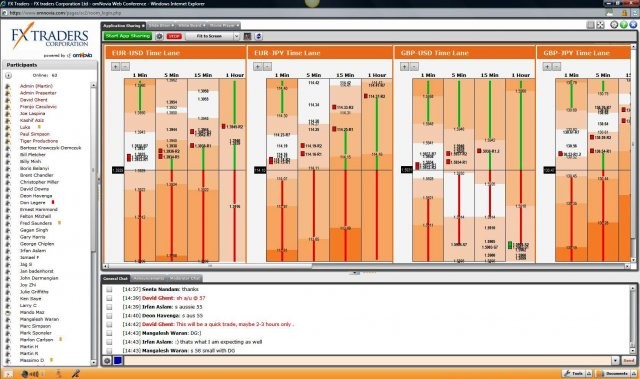

According to the exogenous-cause model, these historic pledges and bailouts should have had immediate results. Take a look at Figure 20. Can you tell where on this graph of stock prices authorities took these actions?

20ewt%20f20.JPG /%

Why the biggest monetary stimulus effort in the world did NOT stop deflation in its tracks by Futures Portal

Abenomics: From Faith to Failure

Why the biggest monetary stimulus effort in the world did NOT stop deflation in its tracks

By Elliott Wave International

When Shinzo Abe became the Prime Minister of Japan in December 2012, he was regarded with the kind of reverence that politicians dream about. He was featured in a hit pop song (Abeno Mix), hailed as a samurai warrior, and featured on the May 2013 The Economist cover as none other than Superman.