Trading Around Limit Moves in the Futures Markets

Post on: 18 Апрель, 2015 No Comment

Subscribe to the Weekly Newsletter published by Online Trading Academy. Receive the full newsletter with charts!

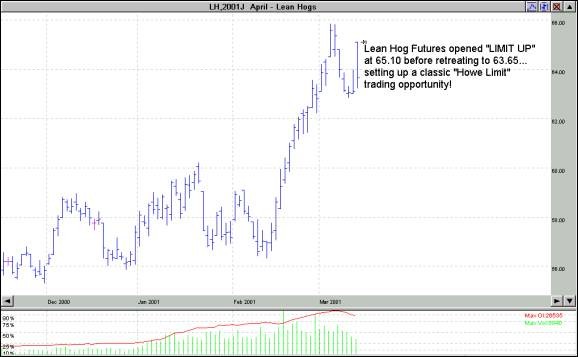

Most of us have seen the movie Trading Places. It is the story of a few guys that are trying to corner the Orange Juice market and two traders come in to break up the scheme. During this time they witness the Orange Juice market go Limit up on the monthly Supply and Demand report that was released for the orange crop. Then, almost as fast as the market went Limit up the selling came in and drove the prices to Limit down all in a short order of time. This may have been a scene in the movies, but this has happened in real life markets many times. Note: under no circumstances would I advise trading the Orange Juice contract. This market is dominated by the commercials and has very little liquidity.

A Limit Move is the maximum amount the price of a Commodity Futures contract can change during any particular trading day up or down from the previous day’s closing price. Many years ago the majority of Futures contracts had these daily limit moves. Over the years the Exchanges have removed limit move restrictions on most of the Futures markets and allowed the markets own supply/demand to determine how far the market can trade each session.

The market can trade to these Limits and actually turn and go the other way during the trading day. The limit just restricts the market participants to no buying above the limit high or no selling below the limit low.

For example, Corn has a 25 cent initial limit move per day. If yesterday’s settlement price of Corn was 4.10, then for today’s trading Corn could only trade as high as 4.35 (4.10 + .25) or low as 3.85 (4.10 – .25).

I mentioned initial Limit in a previous paragraph because if the market trades to a limit up and closes there, Locked Limit (above example closes at 4.35), then the Exchange will expand the limit move for the following day to 40 cents. The next day’s limits for Corn would then be a high of 4.75 and a low of 3.95, always adding and subtracting the limits from the previous day’s settlement price. Once the market does not close at a limit high or low then the initial limit (25 cents) goes back into affect.

Not all Commodity Futures have limits. Several years ago more markets had these limits, but some have since been removed. The reasons for these limits are to allow calmer heads to prevail. Usually when a market goes limit up or limit down there is an event that triggered it. Sometimes it is weather related, supply/demand Report or just excessive fear or greed in the markets. The Exchanges feel that if they stop the trading then people will have time to analyze the situation and perhaps see that there was simply an overreaction to the event that started the move. There are mixed opinions about how effective these Limits are. Some say that it restricts the process of price discovery and puts artificial barriers in the market place. Others say that it helps to protect traders/investors from being wiped out by excessive price moves.

Here are a few of the markets that currently do have daily price limits:

Soybean Complex (Soybeans, Soybean Meal, Soybean Oil)