TraderFeed The Psychology of Market Volatility

Post on: 6 Май, 2015 No Comment

Saturday, May 17, 2008

The Psychology of Market Volatility

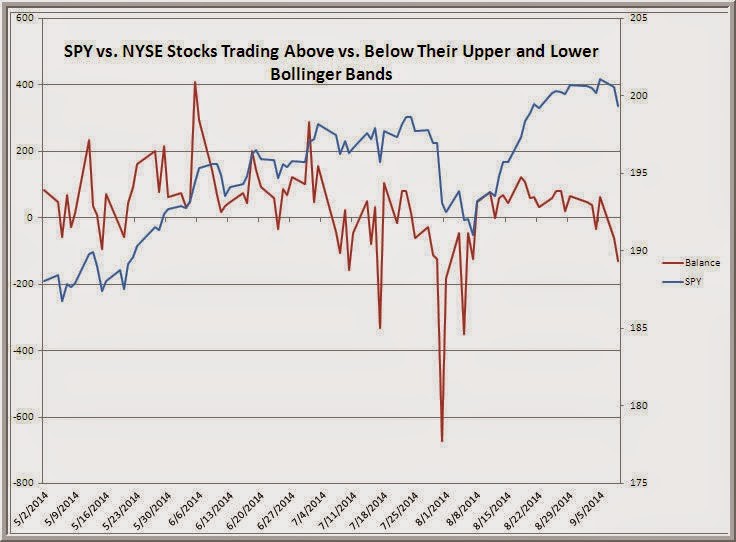

The chart above displays the relentless decline in option-related volatility ($VIX) from the March stock market lows to the present. But how does this decline in volatility affect traders and their psychology?

I ask the question because three observations have struck me in the past week:

1) An increasing number of traders have contacted me, indicating frustration with their (day) trading, including greater losses during the afternoon trade;

2) An increasing number of traders have contacted me, indicating that they have been too aggressive in trading the current market;

3) My own trading performance, which had been quite consistent through 2007, turned flat for several months before resuming consistency in April and now becoming quite positive in May.

I don’t think these observations are unrelated. The day traders I talk with benefit greatly from volatility. When markets become less volatile, they find themselves going after large moves that never materialize. This leads to frustration and over-aggressive trading.

I, on the other hand, tend to be quite risk averse in my trading: a peak-to-trough P/L decline of 3% would be a major deal for me. When I detect large volatility in markets, I immediately cut my size to standardize my returns and I trade less. Where the traders I talk with experience volatility as opportunity (and indeed take advantage of it), I experience it as risk (and benefit far less from it).

Conversely, as volatility drops in the market, I am comfortable with the market conditions, take small profits frequently, and build my account. Where the traders I talk with see the low volatility environment as low opportunity, I experience it as low risk. As soon as the VIX moved back into the low 20s, I was in my glory. The traders, on the other hand, were finding it more difficult to participate in large moves, frustrating their ambitions.

The point here is that volatility affects the psychological environment of trading. Depending on our risk appetites, we will respond differently to volatility regimes—and that will likely affect our trading performance.

A few statistics will highlight the psychological importance of volatility. I went back to January, 2008 (a higher volatility environment) and found that the median 30-minute high-low range for the ES futures was .60%. I then looked at May, 2008 to date (a lower volatility environment) and found that the median 30-minute high-low range for the ES futures was .29%. In other words, at a 30-minute time frame, markets are moving half as much now as they were in January. Is it any wonder that traders looking for big moves are becoming frustrated?

Traders don’t realize that volatility scales at every time period. If we have lower daily volatility (as the chart above depicts), we will have lower volatility for every intraday time period. Whatever our average holding period might be, the market will move less in a low VIX environment than a high VIX one. That greatly affects trading behavior:

* It means that any standard method of placing stops and targets will perform poorly as volatility changes dramatically. When volatility rises, we will tend to have our stops too close and get whipsawed frequently. When volatility falls, our targets will tend to be too far away, leaving us in a situation in which we make money on trades, only to see the trades reverse before we are ready to exit.

* It means that any standard method of sizing trades will lead us to go through periods of high performance volatility as markets become more volatile. These large P/L swings can create considerable distress for risk-averse traders (like myself). On the other hand, the standard method of sizing trades will lead to lower performance volatility as markets become less volatile, leading more aggressive traders to become frustrated with the truncated range of their returns.

Markets change how they trade periodically. What we’ve been seeing since March, 2008 is a noteworthy change in market direction, themes, and volatility. The ideal is to recognize these shifts as they are occurring and make mid-course corrections as promptly as possible. This is especially difficult for newer traders, who lack the database of personal experience to know how to adjust to radically different trading environments.

I’m not going to name names, but if a Market Wizards book were to be written now, surprisingly few of the people featured in those earlier volumes would qualify for chapters today. It’s difficult to succeed at trading, but—given rapidly changing market conditions—even more difficult to sustain success. It’s not good enough to find winning trading techniques; one has to continually adapt these techniques to an ever-changing environment.