Trade Forex With A Directional Strategy_1

Post on: 19 Июль, 2015 No Comment

Forex was once a marketplace available only to governments, central banks, commercial and investment banks and other institutional investors like hedge funds. Today, however, there are many venues where just about anyone can trade currencies. These include currency futures, options on futures, PHLX -listed foreign currency options and the largely unregulated over-the-counter (OTC) forex market. Once the forex trader has decided which venue(s) and instrument(s) he or she will trade, it’s time to develop a well-conceived trading strategy before putting any trading capital at risk. Successful traders must also predetermine their exit strategies and other risk-management tactics to be used should a trade go against them. Here we look at how to develop a trading strategy for the currency markets based on directional trading.(To review some of the concepts in this piece, check out Basic Concepts For The Forex Market and Common Questions About Currency Trading .)

Trend-Following Strategies

Trend-following systems create signals for traders to initiate positions once a specific price move has occurred. These systems are based on the technical premise that once a trend has been established, it is more likely to continue rather than reverse. (Read more about trends in the forex market in Trading Trend Or Range? )

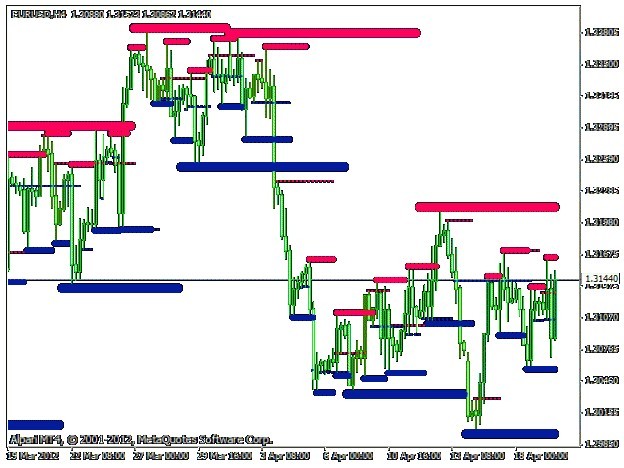

Moving-Average (MA) Crossover

This crossover system posted a buy signal when the five-day crossed over the 20-day to the upside in March 2008, on the left side of the chart. The position is closed once either a downside crossover occurs (as posted in May, right side of chart), or the trade reaches a predetermined price objective.

Breakout Systems

Breakout systems are extremely easy to develop. They are basically a set of predefined trading rules based on the simple premise that a price move to a new high or low is an indication of a continuing trend. Therefore, the system triggers an action to open a position in the direction of the new high/low.

For example, a breakout system may state that the trader should close all shorts and open a long position if the day’s closing price exceeds the high price for the past X days. Part two of the same breakout system will state that the trader must close longs and open a short position if the day’s close is below the X day’s low print. The secret is to determine how long of a period you’d like to trade. Shorter time periods (faster systems) will detect trending markets faster than slower systems. The drawback is that more whipsaws will occur with faster systems.

Pattern-Recognition Strategies

A thorough discussion of every pattern used by forex traders is obviously beyond the scope of this article. As such, we will look at a few popular continuation patterns used by traders. (For more on charts patterns, read Price Patterns — Part 1 .)

Triangles

Traders should open positions once the price action breaks out beyond the converging boundaries of the triangle. In this case, the trader will buy the British pound once the price breaks out above the upper boundary near 1.99.

One way to forecast the extent of the resulting move is to measure the distance of the triangle base and add that distance to the level where the breakout occurred (