Time To Dump Gold Silver 3 Reasons Why 3 Reasons Why Not Focus on Funds

Post on: 31 Март, 2015 No Comment

By Murray Coleman

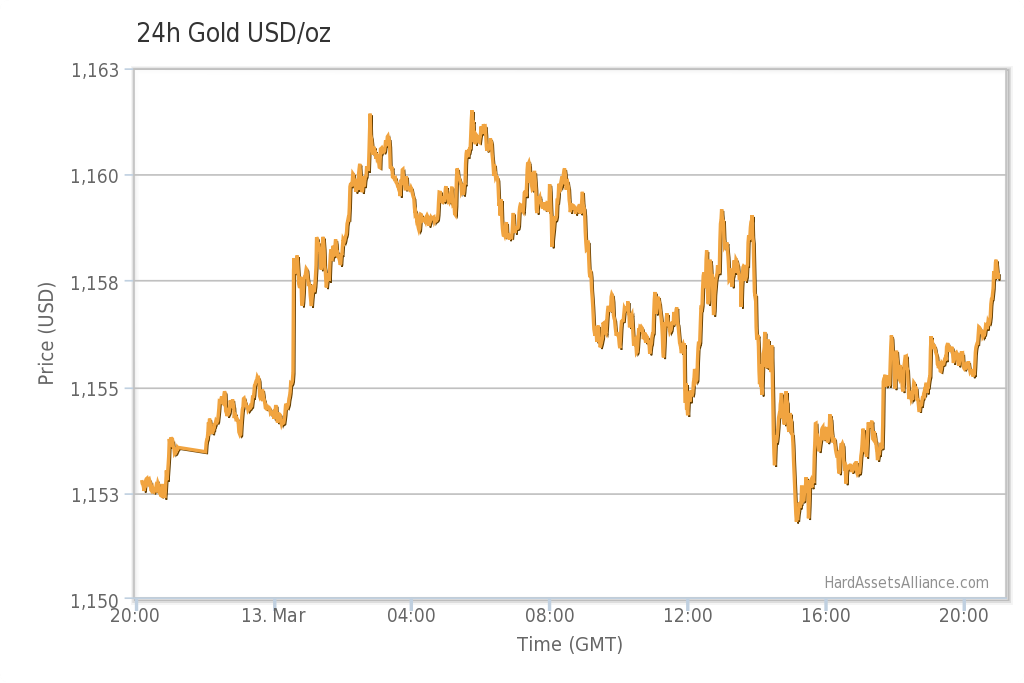

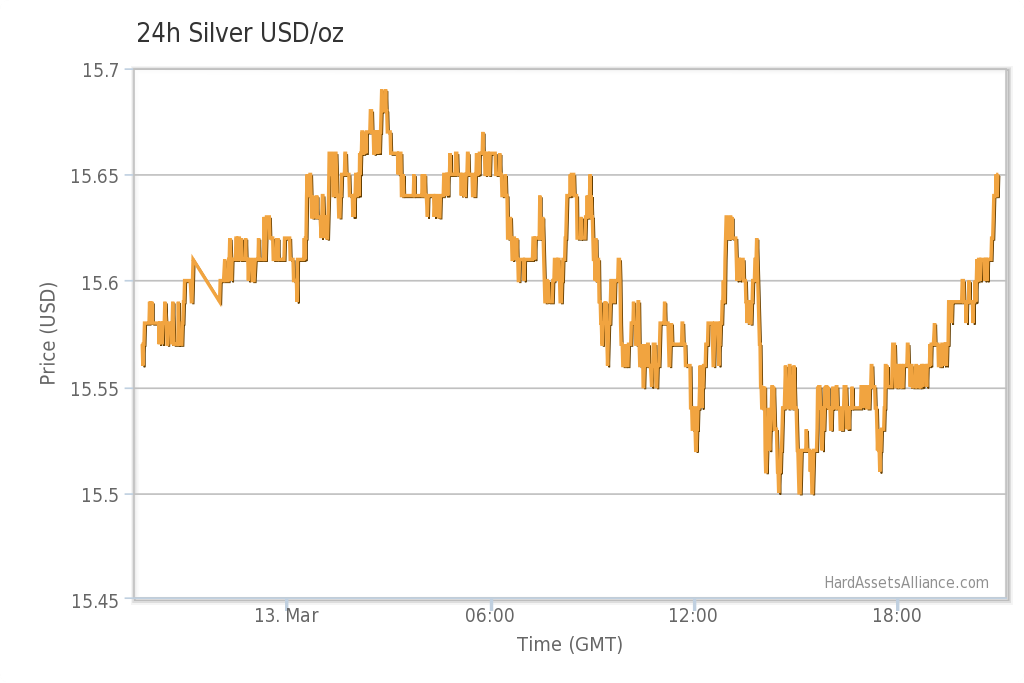

Gold and silver prices continue to fall as investors flee on heightened concerns about Europes sovereign debt crisis and political wrangling in Congress over U.S. federal deficit cuts. Also, the PowerShares U.S. Dollar Index (UUP ) is showing some strength, up slightly on the day.

The SPDR Gold Trust (GLD ) was most recently off by 2.6% and the iShares Silver Trust (SLV ) was down 7.1%. Still, since early October, GLD’s shares have improved by more than 8% while SLV’s jumped 11% through yesterdays close.

One well-heeled money manager I talked to earlier today said he has been taking advantage of dips to move back into GLD. His Los Angeles-area investment firm sold out of the ETF in early September and re-established positions on Oct. 25.

The portfolio manager, who works for a regional advisory shop and asked not to be named due to his work with big institutional investors, sees holiday and other seasonal factors supporting continued strength in gold. Its also the best hedge out there against whats happening in Europe right now and concern ahead of the Super Committees deadline to cut the U.S. federal deficit, he added.

The congressional committee, created under the debt ceiling deal earlier this year, has until Nov. 23 to reach an agreement on $1.2 trillion in deficit reduction moves .

Meanwhile, analysts at Ned Davis Research were telling clients that its too early to sell their precious metals positions. In a new research piece, they explored three bearish arguments pulling at gold investors:

- The risk-on trade has returned and thats bearish for gold.

Gold is still a commodity, and as such, figures to be a prime winner in any coming reflation trade, writes the firms commodities strategist John LaForge. Confusion likely comes from the fact that gold has been a good performer in both risk-on and risk-off environments since 2008, he added.

- Gold has already had a big year, so its due for a breather.

The piece states: We find this reasoning weak. In fact, November and December are classically two of the best months of the year (for precious metals). This has often been the case even if performance in the first 10 months has been good.

- Demand is drying up.

Such a case built steam this week as filings by hedgies indicated that John Paulson cut his holdings by a third in GLD. But as we noted at the time, a lot of his futures and related moves werent disclosed. And sources told Dow Jones Newswires that the famed hedgie has been shifting to more liquid tools to tap into gold and wasnt really cutting back. Ned Davis also pointed out that Paulson likely had to unload some of his most successful positions namely, the ETF to meet redemptions.

Regardless, the research piece also notes that plenty of other investors are picking up the slack. Flows have continued to show strength into both GLD and the mining industry at relatively healthy rates, according to the firms analysis of recent data.

China is also breeding new gold investors, the report says. Since the government liberalized gold prices in 2001, the environment has become so accommodative that it is not uncommon to see government infomercials promoting ownership, LaForge noted.

As a result, investment demand has increased from a relatively tiny 6.4 tons in 2003 to a 254 ton run-rate in the second-quarter of 2011, he noted. This is an astonishing 58% annualized growth rate, the strategist wrote. As long as real returns remain low, which is the case in China and globally, gold buyers should remain plenty.

On Thursday, gold miners were also falling. The Market Vectors Gold Miners ETF (GDX ) was off by 2.9% while the Global X Silver Miners ETF (SIL ) was falling by 3.6% on the day.

Gartman: Oil Prices Trending Down, Not Up! MMR, AREX, CLR Climb Next

Jefferies: Can It Withstand The Storm? Stock Keeps Plunging