Three Basic Candlestick Formations to Improve Your Timing

Post on: 8 Июнь, 2015 No Comment

by Michael C. Thomsett

The study of candlestick charts is mysterious to many. You might recognize the basic significance of the chart patterns, but not know how to spot strong and reliable reversal signals.

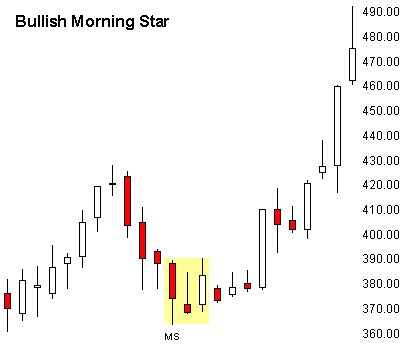

This article demonstrates and explains three of the strongest candlestick reversal patterns. These are the bullish or bearish abandoned baby, the bullish white soldiers and the bearish black crows, and the bullish and bearish engulfing pattern.

These simple but powerful indicators are formed as chart patterns, giving you a lot of information just with a glance. The more time you spend studying candlestick patterns, the more comfortable you are going to be. The origin of candlesticks traces back several hundred years. Candlesticks originally were developed in Japan to track rice futures. Many of the early candlestick experts were able to demonstrate an ability to anticipate market trends and reversals.

In the U.S. candlesticks were first introduced by Steve Nison, who has written several books on the topic. However, the candlestick has become popular only after the Internet made charting fast and easy. Before they were available on the Internet, charting services had to be purchased, often consisting of open/high/low/close charts (those vertical sticks for the trading range with smaller horizontal limbs for opening and closing prices). These services could be quite expensive, especially if you also paid for advice and interpretation.

With automated and free online charting services (such as StockCharts.com), you can now get candlestick charts instantly by just punching in a trading symbol. Some sites also allow you to tailor your charts by choosing the date range and adding the volume; many offer technical indicators and volume or momentum indicators as well. So no matter how much information you want to use to time entry or exit, todays candlestick chart is accessible and easy to use.

Four Steps to Using Candlesticks

Among the dozens of candlestick indicators consisting of a single session or multiple sessions, you can rely on a few very strong ones. A study of hundreds of charts by Thomas Bulkowski (Encyclopedia of Candlestick Charts, John Wiley & Sons, 2008) has concluded that some candlestick patterns lead to reversal more often than not. If you focus only on a short list of highly reliable reversal candlesticks, you may be able to improve the timing of your buys and sells.

The smart use of candlestick indicators requires four steps:

- Pick high-quality companies. Identify companies whose fundamentals justify investment, and then track them regularly through chart analysis. The use of fundamentals to narrow down your search is a method for limiting your risk to the highest-quality companies. Among the best fundamentals are revenue and earnings (why invest in a company with falling revenues or net losses?); dividend yield (and a record of increasing dividends over many years), moderate price-earnings ratio (meaning between 10 and 25, and tracked as a long-term trend); and finally, the trend of the debt ratio (the portion of total capitalization in debt compared to the overall debt and equity, remembering that a high and growing debt ratio is a danger signal).

- Look for strong reversal signals. Find exceptionally strong reversal signals at the top of an uptrend and time your exit, or at the bottom of a downtrend and time your entry. Reversal signals come in many shapes and sizes, in candlesticks as well as other forms. To give you an idea of the range of reversals, there are approximately 100 different candlestick indicators. You cannot possibly expect to look for all of these, and some are more easily spotted than others. For this reason, it makes sense to identify the more reliable reversal signals and focus on looking for those. Some indicators work as price reversal signals about half the time and as price continuation signals the other half of the time. Given this fact, they are not very useful for timing buys and sells. You can do as well by guessing, and you might be right half the time.

- Make sure there is a trend to reverse. Remember, reversal only works if there is a trend to reverse. You cannot expect to find a bullish reversal unless a downtrend is in effect, and you cannot find a bearish reversal unless the current trend is moving upward. When you find those signals in the wrong places, they usually are continuation patternsa sign that the price trend will continue in its current direction. The fact that the same indicator can be either a reversal or a continuation signal should not be confusing. It is just a matter of where it appears within the existing trend. But what if the price is moving sideways and no clear trend has been set? In this case, the prudent course is to wait patiently for some kind of movement to appear. If you act too quickly, you will be right half the time and wrong the other half.

- Always look for confirmation before you act. Before acting, find independent confirmation of the predicted reversal. Only when you have confirmation should you take action. Confirmation is one of the basic techniques used by technicians to time entry and exit. Because no signal is reliable all by itself all of the time, finding confirmation in one form or another just makes sense. And many are surprised to discover that confirmation among the components of trends (price, volume, and momentum) is going to occur most of the time. In addition to confirming reversal, some confirming indicators contradict what the candlestick foreshadows. In this case, dont act until you get additional confirmation or contradiction, or pick the indicator you believe to be the most reliable.

Following these four basic rules vastly improves your timing and adds to overall profits. Many of the candlestick formations that appear frequently were described as being highly reliable in the Bulkowski study. These are among the indicators worth adding to your charting strategy.

Candlestick Indicators to Watch

A candlestick formation reveals a great amount of information in a mere glance: the range between open and close, the extension of trading range, and the direction of movement. Many additional signals have meaning, such as unusually long or short trading ranges, and extended moves above or below the open/close range. All of this shows up in the basic candlestick, as Figure 1 shows.