The Week Ahead Profiting From a Weak Euro

Post on: 20 Июнь, 2015 No Comment

It was a nervous week for the markets as September’s history of weak stock performance kept some on the sidelines. The other main concern for the market (as overseas tensions subsided) was whether the FOMC may change its policy this week.

In last week’s analysis Is the Junk Dump a Warning? . I noted the heavy selling in some of the high yield or junk bond ETFs ahead of the FOMC meeting. If we do see a change in the wording of the FOMC announcement, as some are expecting, it could trigger a sharp-but I believe brief-market decline.

In a way, it would be a positive as it would remove one more concern from the investor’s wall of worry. A decline would also serve to reduce the high level of bullish sentiment as-amongst the Wall Street firms-the bearish strategist camp was reduced further last week .

Click to Enlarge

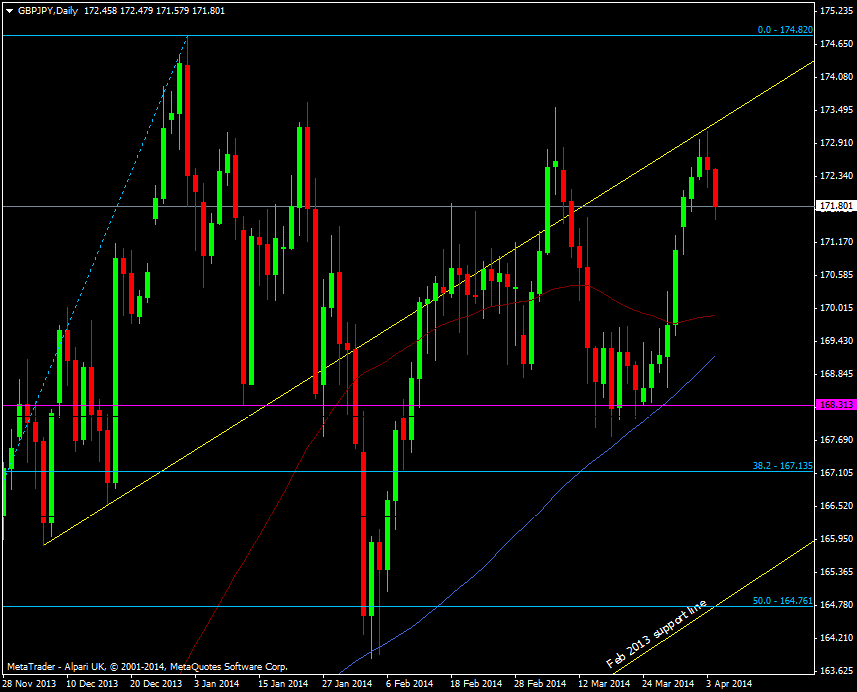

The volatility has returned to the currency markets with a vengeance as forex traders have been suffering with the low volatility. The Japanese yen fell to a six-year low last week as their bond yields dropped into negative territory. Overseas yields are now much more attractive, especially with the potential of higher US rates in the next year.

The chart shows that the yen broke major support, line b, on December 12, 2012. Since then, it has lost 22% of its value. The breakout (line 1) came one week before the NK225 broke through its downtrend, line a. The NK225 is up over 71% since the bottom formation was completed. I continue to think that the yen will get even weaker, which will be good for Japanese stocks.

The comments from Mario Draghi last month that the Eurozone should drop its austerity-based recovery plan was followed-up by an asset repurchase plan. Some countries, like Germany and France, are not in favor of this change in policy. He also suggested that the governments should guarantee some of the riskier assets.

The pressure of the low inflation and low growth needs drastic action, in my opinion, to avert a deflationary spiral. As I pointed out in October of 2012, Austerity Didn’t Work in ’37…What About Now? , the brief switch in 1937 to austerity by FDR almost pushed the country back into a depression.

Click to Enlarge

The action by the ECB has had a big impact on the euro as it has dropped almost 14% from the March highs. The euro has been forming lower highs since the spring (line b) and then violated its uptrend, line c, in the middle of July.

As I noted last week, sentiment on the euro is overly bearish so a rebound is likely before it moves even lower. For those interested in the forex markets, I will be doing a Webinar on September 23 discussing FX trading techniques (If you are interested, sign up here ).

European stocks have been lagging this year, including Vanguard FTSE Europe (VGK ), which is one of my dollar cost averaging picks I discussed last week. In addition to the 66% in developed European stocks, it also has 33% in the United Kingdom. The Scottish vote on independence has hurt the pound recently.

The chart of VGK shows that it has come back to support from the 2011 highs, line a, which is holding so far. I think the weaker euro will have a positive impact on their exports and their economies. I expect more widespread growth in the Eurozone by next spring.

Some of their economies are already recovering nicely as the beaten down Irish economy has staged a dramatic turnaround as they will repay part of their IMF loan early. Their composite purchasing mangers index recently hit the highest level since 2000.

Click to Enlarge

Though the economic calendar was light last week, the falling gasoline prices should translate to stronger consumer spending in the next few months. The chart shows the sharp drop in the gasoline futures since early in the year. A drop much below $2.50 (line a) would signal that prices can move even lower.