The Structure of a Private Equity Fund

Post on: 16 Март, 2015 No Comment

The Structure of a Private Equity Fund

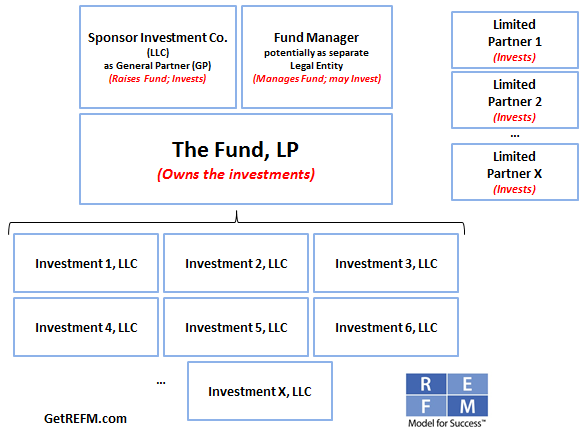

The partners of a private equity firm comprise the General Partner (GP) of a fund. They obtain capital commitments from (typically) institutional investors known as Limited Partners (LPs). These institutional investors include pension and endowment funds, retirement funds, insurance companies, and high net worth individuals.

A single PE firm (if successful) will manage several funds (i.e. a family of funds) and generally try to raise a new fund every few years. They then use this capital to invest in or buy companies, which become portfolio companies .

The LPs generally just provide capital. They dont have a hand in deciding on which companies to invest in. The GPs decide that. However, if the LPs are unimpressed with the returns generated by the GP, they may choose not to invest with the PE fund again.

Funds are structured as partnerships with one GP making the investments and several LPs investing capital. All institutional partners of the fund will agree on set terms laid out in a Limited Partnership Agreement (LPA). Some LPs may also ask for special terms outlined in a side letter. LPs have limited liability up to the amount of their commitment in the fund, but GPs have unlimited liability .

The key terms generally found in an LPA include the duration of the fund (usually 10 years with 2 optional one-year extensions), the percentage of the management fee (typically 2% annually), how profits will be divided and paid out, rights and obligations of the institutional partners, and restrictions imposed on the GP (including industry, size, or geography of investments and any diversification requirements).

Be sure to check out our e-book How to Nail Your Private Equity Interview (whether you have finance training or not) for in-depth tips and strategies on how to successfully interview for investment jobs at top PE firms!

Also be sure to check out our step-by-step PE modeling training videos for walk-through tutorials on how to build an LBO model, navigate Excel with ruthless efficiency, and rapidly create an LBO PowerPoint deck to present to your PE interviewers.

3A%2F%2F0.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D75&r=G /%