The Seven Most Traded Currency Pairs in Forex

Post on: 21 Апрель, 2015 No Comment

In the foreign exchange market exchange rates are always quoted as currency pairs. In a currency pair the base currency is always quoted first. For instance if the pound sterling/dollar (GBP/USD) rate is quoted as 1.5700-10.The left hand side of the rate is the quoter’s bid rate or the rate he buys the base currency. So, at 1.5700 the quoter is saying that he will sell 1.5700 dollars for every one pound he buys. The right hand side of the quote is the quoter’s offer rate; the rate he sells the base currency at. So the quoter will buy 1.5710 dollars for every one pound he sells.

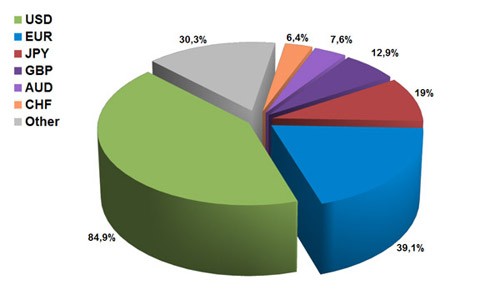

The main purpose of the Forex market is to facilitate the trading of forex currency among market participants in order that multinational companies and merchants that need foreign currencies to pay for goods or services delivered by foreign suppliers can actually sell and buy the goods and services .Nevertheless, there are countries whose currencies are more widely traded than others. There are almost as many currency pairs as there are countries in the world, however, of these only seven are considered ‘the major currency pairs’. These pairs are the most traded and therefore the most liquid. In addition all seven of these pairs have the US dollar as one of the currencies in the pair. The US dollar accounts for over 95% of forex trades in the market. The seven most commonly traded currency pairs can be grouped into four “Majors” and three “Commodity Pairs.”

The four major currency pairs are:

The Euro and US Dollar (EUR/USD)

The US Dollar and Japanese Yen (USD/JPY)

The US Dollar and Swiss Franc (USD/CHF)

The three Commodity Pairs are:

The Australian Dollar and US Dollar

The New Zealand Dollar and US Dollar

The US Dollar and Canadian Dollar

Commodity pairs are currencies that are closely linked with commodities, such as commodities of precious metals and energy. The most active and important commodity currencies are those of Australia, New Zealand, and Canada. These currencies all have the dollar as their countercurrencies and are very much linked to the rise and fall of the prices of oil and precious metals. The Canadian Dollar for example is a huge currency recipient when the value of oil moves upwards.

The Commodity Currency Pairs:

Since Canada is a key exporter of oil and conversely Japan is a key importer of oil there is a solid correlation between the CAD/JPY pair. Similarly as oil is priced in dollars there is a sturdy correlation with oil prices and the USD/CAD and USD/JPY exchange rates. Other currency pairs which have a robust correlation to the price of commodities are the Australian and New Zealand dollar. The AUD/USD and the NZD/USD are closely correlated to gold’s price of gold and the oil price. The reason is that Australia is China’s main gold exporter which places Australia in fourth place in the global world gold exporter league. Because New Zealand is one of Australia’s main trading partners it is very much affected by what the Australian currency does. In addition Australia is also a major oil exporter, particularly to China so the AUD/USD pair correlates positively to the price movement of oil as it does to gold’s price movements. In trading these correlations it is essential that you time your trades correctly as even a closely correlated commodity pair won’t be one hundred percent correlated all of the time. Every now and then a relationship breaks down or most usually the response times of rising commodity prices and rising currency prices can lag quite a bit.

The Dollar Index

In response to the “Nixon Shock” of 1971, when President Nixon uncoupled the price of gold from the US dollar exchange rate, the US Dollar Index (USDX) was established by the New York Board of Trade in 1973. This was done because when the US dollar was coupled to the price of gold, as the gold price was fixed at $35 an ounce, it was easy to measure the performance of the dollar. However, once uncoupled there had to be another mechanism in order to measure the performance of the US Dollar. The New York Board of Trade decided to measure the dollar against a basket of six diverse currencies. This basket includes the following currencies:

Swiss Franc, with a weighting of 3.6%

Swedish Kronar, with a weighting of 4.2%

Canadian dollar, with a weighting of 9.1%

Pound Sterling, with a weighting of 11.9%

Japanese Yen, with a weighting of 13.6%

Of course in 1973 there was no Euro so the basket of currencies included the German Mark and the French Franc. The USDX is a key index, especially as the US Dollar is one of the pairs in the “Majors.” A rising index signals increasing US monetary strength and a falling index decreasing US monetary strength.

The USDX can be traded as:

Exchange Traded Funds (ETFs)

Futures Contracts on the International Commodities Exchange