The myth behind leveraged ETFs

Post on: 28 Март, 2015 No Comment

ThomasH. Kee Jr.

Thomas’s Latest Posts

Last time I wrote for Marketwatch I said ‘no more new shorts,’ since then the market is up substantially, but before I move on it is time to dispel some popular misconceptions. There is a myth surrounding leveraged ETFs and I will expose that myth in this article.

Because we have all read bold headlines that claim significant deterioration in leveraged ETFs versus the underlying entities they are based on, many investors have become afraid to consider leveraged ETF as part of a portfolio. Most of the time those headlines are not wrong, the ETF that they talk about are faced with serious deterioration risk, but there is a reason why and it does not apply to all leveraged ETFs.

Leveraged ET apps that focus on single or limited entities like natural gas or the financial sector have limited instruments to invest in and those instruments are often ill liquid. For example, an ETF that trades natural gas can only invest in natural gas, market makers know this, they can determine when new money must be invested, and those market makers can manipulate the price of those instruments (natural gas in the example)so as to give the ETF that is forced to buy or sell the worst price possible. That worst price turns out to be the best price for the market makers during this manipulative cycle. Evidence of this can also be seen by comparing the Financial Sector ETF XLF, +2.17% to the 2x Financial ETF UYG, +4.20% over a two-year timeframe. The Financial ETF is up about 9% over the past two years, but UYG is only up 11%. It is easy for market makers to manipulate very focused ETFs like this.

Therefore, ETF that focus on single entities or entities with limited options that have poor liquidity also have serious deterioration risk, but that is not true for ETFs that focus on broader market indexes that are extremely liquid.

For example, the ETF that represents the S&P 500 SPX, +1.26% do not have the same deterioration risk as single element ETF because the S&P 500 has 500 stocks that act as potential investment instruments and market makers are not able to manipulate the investment flows from those ETF as readily as they can single instruments. Compare the S&P 500 to the 2x ETF for the S&P 500 SSO, +2.50% . Over the past two years the 2x ETF for the S&P 500 is exactly where it should be in relation to the S&P 500 over the past two years. The S&P 500 is up about 19% while SSO is up about 38%, exactly what we would expect from a 2x leveraged ETF.

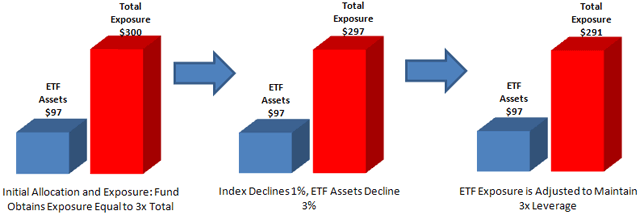

In the example above deterioration risk did not appear like it does in single entity ETF. However, if we press the envelope and move from 2x to 3x ETFs deterioration risk begins to surface again. This time, deterioration is not based on manipulation but instead it has everything to do with rollover risk. Because 3x ETF’s require so much leverage they roll over futures and options contracts on a regular basis, much more often than 2x ETF, and every time they do that it costs money. The 3x ETFs can experience serious deterioration over time based on costs.

Using the same two year example versus the S&P 500 the 3x ETF for the S&P 500 UPRO, +3.82% is not up proportionally to what we would expect given the 19% increase in the S&P 500. If this was directly proportional we would expect a 57% increase, but the 3x ETF is only up less than 50%. The difference can be directly attributed to rollover costs.

My experience also suggests something more interesting. The past two years has seen a few wild gyrations in the market, but when we limit our observations to periods where the market moves straight up, over time spans of six months or more, the 2x ETF actually has the ability and often does outperform the market on a proportional basis. If the market was up 10 we would expect the double ETF to be up 20, but if the market moves straight up the double long ETF might be up 21 or 22 for example. When the market moves in one direction over many months without much volatility the double ETF associated with the market can outperform proportionally, but this applies to both the short and long sides of the market. If the Market falls the short-side ETF can outperform proportionally too.

In conclusion, the deterioration risk that exists in leveraged ETF is real, it is pronounced in single entity ETF and 3x ETF, each for different reasons. Single entity ETF can be easily manipulated, 3x ETF have extremely high rollover costs, but broad market based 2x ETF do not have the same level of deterioration risks and in fact can do exactly what they are supposed to do over long periods of time as well. In our two year example, SSO is up almost exactly twice what the increase in the S&P 500 has been, and that is exactly what the ETF is designed to do, so the bold headlines that tell people to steer clear from leveraged ETFs should be read carefully, completely understood, and with this added information hopefully differentiated from broad market based ETFs that do not have the same degree of deterioration risks.