The Main Option Strategies in Protrader

Post on: 4 Апрель, 2015 No Comment

normal

Hey there, Protraders!

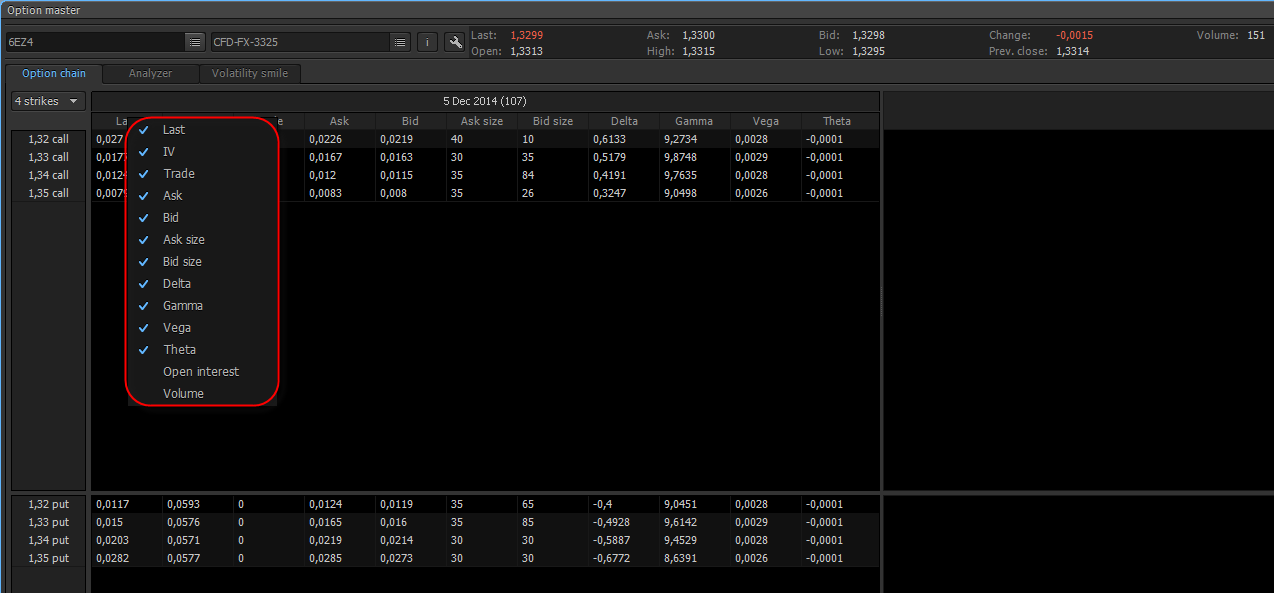

Continuing the topic of options, in the today’s article we will consider the main types of option strategies and plot their profiles using “Option master”.

One of the main option features is their flexibility; a fairly wide range of different strategies can be created with the help of combining the options which will have the specific properties demanded in different market situations. Under option strategies we will call the option position, which consists of several options. Option strategies can be of several types, namely: the simplest, combined and spreads.

The simplest option strategies

Purchase of the Put option

The strategy realizes the trading idea on making a profit when the cost of the underlier falls. The profit when buying a Put option is not limited, and the loss is fixed.

Purchase of the Call option

The strategy realizes the trading idea on making a profit when the cost of the underlier grows. The profit when buying a Call option is not limited, and the loss is fixed.

Sale of the Put option

The strategy realizes the trading idea on making a profit when the cost of the underlier or the lateral motion grows. The risk when selling a Put option is not limited and the profit is fixed.

Sale of the Call option

The strategy realizes the trading idea on making a profit when the cost of the underlier or the lateral motion falls. The risk when selling a Call option is not limited and the profit is fixed.

Combined option strategies

The combined option strategy can be created as a simultaneous purchase and sale of the Put options and Call options on the same underlier.

Long Straddle

If the trader believes in the fast growth of volatility, but does not put on a certain movement direction, he may be interested in option strategy which consists of the purchase of Call and Put options with the same strike price on one option series. The profit potential of the long straddle is not limited, and the loss is fixed.

Short Straddle

In the situation when a trader expects a long low-volatility non-directional movement of the underlier, he may be interested in the sale of Straddle. The strategy is realized using sale of the options both types (Call and Put) with the same strike price on one option series. The profit of short straddle is fixed. The risk is not limited and is realized during the volatile unidirectional asset movement.

Long Strangle

Using Long strangle we can also realize the trading idea on making profit when the volatility of the underlier grows. To provide this, the trader should buy options both types (Call and Put) on one option series. The option strike prices should differ. Risk of the strategy is limited, unlike profit. This strategy is cheaper than Straddle, but profit can be received only when the underlier exceeds the bounds of wider price range.

Short Strangle

The idea of making a profit in conditions of long uncertainty in the direction of underlier movement can be realized using sale of the Strangle. In this case, the trader should sell Call and Put options of one option series. But strike prices of the options should differ. The risk of the strategy is not limited, unlike profit.

Synthetic long futures

The analog of the underlier purchase can be created using options. To provide this, trader should open long position in the Call options and sell Put options with one strike price and one option series. The potential risk and profit of the strategy is unlimited.

Synthetic short futures

By analogy with the underlier synthetic purchase, the analog of the underlier sale can be created from the options. To provide this, trader should open long position in the Put options and sell Call options with one strike price and one option series. The potential risk and profit of the strategy is unlimited.

Spreads – option strategies for creation of which is used the sale and purchase of the options same type (Call/Put) on one underlier.

Vertical spread

For the formation of vertical spread the options of one type and one option series are bought and sold. Depending on the structure there are several types of vertical spreads:

For the formation of bull spread the Call options with different strike prices of one option series are bought and sold. The strike price of long Call options is lower than the strike price of short Call options. The profit and loss of the bull spread is fixed. The bull spread realizes the trading idea on making a profit when the underlier cost grows.

For the formation of bear spread the Put options with different strike prices of one option series are bought and sold. The strike price of short Put options is lower than the strike price of long Put options. The profit and loss of the bear spread is fixed. The bear spread realizes the trading idea on making a profit when the underlier cost declines.

Bull backspread

For the formation of bull backspread the Call options are bought and Put options are sold of one option series. The strike price of Call option is higher than the strike price of Put options. The potential profit and loss are unlimited.

Bear backspread

For the formation of bear backspread the Call options are sold and Put options are bought of one option series. The strike price of Call option is higher than the strike price of Put options. This spread is characterized by potentially unlimited loss and profit.

Backspread is formed by creation of long and short position in the options of one type on the one option series. For spread which consists of Call options, the strike price of bought options should be above the strike price of sold options. For spread which consists of Put options, the strike price of bought options should be under the strike price of sold options. The amount of long options is higher than the amount of sold options. The strategy is oriented on making a profit either at a volatile asset movement by the strike price of bought options or at a low-volatility asset movement.

Ratio spread is formed by creation of long and short position in the options of one type on the one option series. For spread which consists of Call options, the strike price of bought options is under the strike price of sold options. For spread which consists of Put options, the strike price of bought options is above the strike price of sold options. The amount of sold options is higher than the amount of bought options. The strategy realizes the trading idea on making a profit either during a low-volatility asset movement or very strong unidirectional underlier movement.

Butterfly spread

The strategy consists of bull and bear spreads. The strategy can be short or long. In the case of short strategy, the options “in the money” are bought and the “wings” are sold, in the case of long strategy is vice versa. When using short strategy the profit will be obtained during the volatile unidirectional movement of the underlier. Butterfly spread is characterized by limited profit and losses.

Condor spread

In fact this spread is a modified butterfly; the only difference is in the distance between the sold/bought options. Like the butterfly, condor is characterized by limited profit and loss, but has a wider profitable zone.

Calendar spread

The strategy is formed of the options on the different option series. It can be long or short, bearish or bullish. The strategy realizes the trading idea on making a profit on the difference between option prices of different strike series.

We’ve considered the main option strategies, but of course, this is not a complete list of possible option combinations. A trader can create even more complex option combinations, adjusting to the current market situation. Each strategy individually reacts on 3 main parameters of option price formation: underlier price, time till expiration and implied volatility. A trader can use “Option master” and its function “Analyzer” to analyze the characteristics of the chosen strategy. In this case, it is possible to model and investigate the characteristics of selected option strategy while changing the three above option price formation factors.