The Indian Stock Market An Introduction

Post on: 8 Апрель, 2015 No Comment

We aim to fulfill our promise to you helping make your money work for you!

The Indian Stock Market An Introduction

The Indian Stock Market scene mainly comprises of the Mumbai (Bombay) Stock Exchange (BSE) and the National Stock Exchange of India (NSE)

The Bombay Stock Exchange (BSE ) (Bombay Śhare Bāzaār ) (formerly, The Stock Exchange, Bombay ) is a stock exchange located on Dalal Street, Mumbai and is the oldest stock exchange in Asia. The equity market capitalization of the companies listed on the BSE was US$1 trillion as of December 2011, making it the 6th largest stock exchange in Asia and the 14th largest in the world. The BSE has the largest number of listed companies in the world.

As of March 2012, there are over 5,133 listed Indian companies and over 8,196 scrips on the stock exchange, the Bombay Stock Exchange has a significant trading volume.

Historically an open outcry floor trading exchange, the Bombay Stock Exchange switched to an electronic trading system in 1995. It took the exchange only fifty days to make this transition. This automated, screen-based trading platform called BSE On-line trading (BOLT) currently has a capacity of 8 million orders per day. The BSE has also introduced the worlds first centralized exchange-based internet trading system, BSEWEBx.co.in to enable investors anywhere in the world to trade on the BSE platform. The BSE is currently housed in Phiroze Jeejeebhoy Towers at Dalal Street, Fort area.

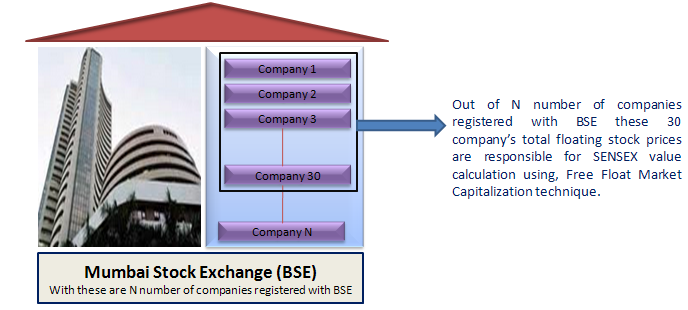

The BSE SENSEX. also called the BSE 30 or simply the SENSEX. is a free-float market capitalization-weighted stock market index of 30 well-established and financially sound companies listed on Bombay Stock Exchange. The 30 component companies which are some of the largest and most actively traded stocks, are representative of various industrial sectors of the Indian economy. Published since January 1, 1986, the SENSEX is regarded as the pulse of the domestic stock markets in India. The base value of the SENSEX is taken as 100 on April 1, 1979, and its base year as 1978-79. As of 21 April 2011, the market capitalisation of SENSEX was about 29,733 billion (US$593 billion) (42.34% of market capitalization of BSE), while its free-float market capitalization was 15,690 billion (US$313 billion).

The National Stock Exchange (NSE ) (Rashtriya Śhare Bāzaār ) is a stock exchange located at Mumbai, India. It is the 16th largest stock exchange in the world by market capitalization and largest in India by daily turnover and number of trades, for both equities and derivative trading. NSE has a market capitalization of around US$ 985 billion and over 1,646 listings as of December 2011. Though a number of other exchanges exist, NSE and the Bombay Stock Exchange are the two most significant stock exchanges in India, and between them are responsible for the vast majority of share transactions. The NSEs key index is the S&P CNX Nifty, known as the NSE NIFTY (National Stock Exchange Fifty), an index of fifty major stocks weighted by market capitalisation.

NSE is mutually owned by a set of leading financial institutions, banks, insurance companies and other financial intermediaries in India but its ownership and management operate as separate entities. There are at least 2 foreign investors NYSE Euronext and Goldman Sachs who have taken a stake in the NSE. NSE is the third largest Stock Exchange in the world in terms of the number of trades in equities. [7] It is the second fastest growing stock exchange in the world with a recorded growth of 16.6%.

The S&P CNX Nifty. also called the Nifty 50 or simply the Nifty. is a stock market index, and one of several leading indices for large companies which are listed on National Stock Exchange of India. Nifty is owned and managed by India Index Services and Products Ltd. (IISL), which is a joint venture between NSE and CRISIL(Credit Rating and Information Services of India Ltd). (IISL) is Indias first specialized company focused upon the index as a core product. IISL has a marketing and licensing agreement with Standard & Poors for co-branding equity indices. CNX in its name stands for CRISIL NSE Index.

S&P CNX Nifty has shaped up as the largest single financial product in India, with an ecosystem comprising: exchange traded funds (onshore and offshore), exchange-traded futures and options (at NSE inIndia and at SGX and CME abroad), other index funds and OTC derivatives (mostly offshore).

26P_CNX_Nifty.svg/400px-S%26P_CNX_Nifty.svg.png /%