The Ichimoku Kinko Hyo japanese charting technique

Post on: 1 Апрель, 2015 No Comment

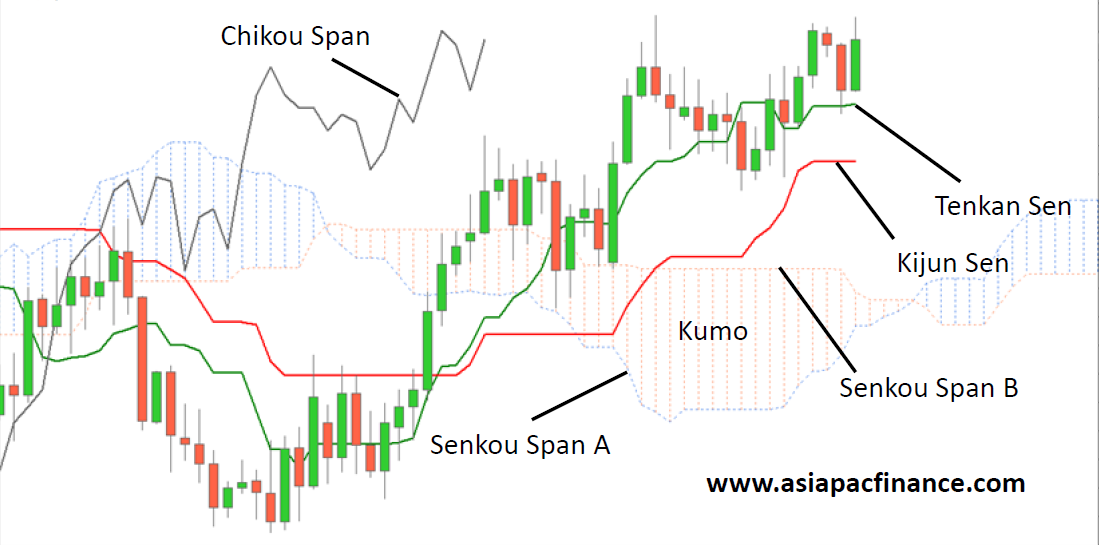

Ichimoku forecast. Ichimoku Kinko Hyo (IKH) is Japanese for one glance cloud chart. It consists of five lines called Tenkan-sen, Kijun-sen (sen is Japanese for line), Senkou Span A, Senkou Span B and Chinkou Span. The calculation uses four different time periods which we call termT, termK, termS and termC. The Ichimoku Kinko Hyo is graphed over the closing price line. The space between the Senkou spans is called the Cloud, and is usually graphed in a hatched pattern.

The Senkou Spans are support and resistance lines. When the price is in the Cloud, the market is non-trending. When the price is above the Cloud, the higher Span is the first support level and the lower Span is the second support level. When the price is below the Cloud, the lower Span is the first resistance level and the higher Span is the second resistance level.

Kijun-sen and Tenkan-sen are trend indicators. When the price is above the Kijun-sen, prices will likely continue to go up, when the price is below the Kijun-sen, prices will likely continue to go down. The direction of the Tenkan-sen indicates the direction of the trend. If the Tenkan-sen is flat, the market is in a non-trending channel.

The Ichimoku Kinko Hyo Japanese charting technique was developed before World War II with the aim of portraying — in a snapshot — where the price was heading and when was the right time to enter or exit the market. This was all performed without the aid of any other technical analysis technique (or study).

The word Ichimoku can be translated to mean a glance or one look. Kinko translates into equilibrium or balance, with respect to price and time, and Hyo is the Japanese word for chart. Thus, Ichimoku Kinko Hyo simply means a glance at an equilibrium chart, providing a panoramic view of where prices are likely to go and the position one should undertake.

Invented by a Japanese journalist with a pen name of Ichimoku Sanjin, meaning a glance of a mountain man, Ichimoku charts have become a popular trading tool in Japan, not only with the equity market, but in the currency, bond, futures, commodity and options markets as well. The technique was published over 30 years ago but has only gained international attention within the last few years.

The Ichimoku chart consists of five lines. The calculation for four of these lines involves taking only the midpoints of previous highs and lows, similar to moving average studies. Yet even with this simplicity, the completed chart is able to present a clear perspective of the price action.

Ichimoku uses three key time periods for its input parameters: 9, 26, and 52. When Ichimoku was created back in the 1930s, a trading week was 6 days long. These parameters, thus, represent one and a half week, one month, and two months, respectively. Now that the trading week is 5 days, one may want to modify the parameters to 7, 22, and 44.

Moreover, there are, in fact, different levels of strengths for the buy and sell signals of an Ichimoku chart. First, if there was a bullish crossover signal and the price, at that time, was trading above the Kumo (or cloud), this would be considered a very strong buy signal. In contrast, if there was a bearish crossover signal and the price, at that time, was trading below the Kumo, this would be considered a very strong sell signal. Secondly, a normal buy or sell signal would be issued if the price was trading within the Kumo when the crossover took place. Thirdly, a weak buy signal would be issued if there was a bullish crossover that occurred while the price was trading below the Kumo. On the other hand, a weak signal would be issued if there was a bearish crossover that occurred when the price was trading above the Kumo.

Another striking feature of the Ichimoku charting technique is the identification of support and resistance levels. These levels can be predicted by the presence of the Kumo. The Kumo can also be used to help identify the prevailing trend of the market. If the price is above the Kumo, the prevailing trend is said to be up. And if the price is below the Kumo, the prevailing trend is said to be down.

A final feature of Ichimoku is the Chikou Span. This line can also be used to determine the strength of the buy or sell signal. If the Chikou Span was below the closing price and a sell signal was issued, then the strength is with the sellers, otherwise it is a weak signal. Conversely, if there was a buy signal and the Chikou Span was above the price, then there is strength to the upside, otherwise it can be considered a weak buy signal. This feature can also be incorporated into the other signals.

Chinkou Span shows the closing price of the current candle shifted backwards by the value of the second time interval. The distance between the Senkou lines is hatched with another color and called ‘cloud’. If the price is between these lines, the market should be considered as non-trend, and then the cloud margins form the support and opposition levels. If the price is above the cloud, its upper line forms the first support level, and the second line forms the second support level. If the price is below cloud, the lower line forms the first opposition level, and the upper one forms the second level. If the Chinkou Span line traverses the price chart in the bottom-up direction it is signal to buy. If the Chinkou Span line traverses the price chart in the top-down direction it is signal to sell. Kijun-sen is used as an indicator of the market movement. If the price is higher than this indicator, the prices will probably continue to increase. When the price traverses this line the further trend changing is possible.

Another kind of using the Kijun-sen is giving signals. Signal to buy is generated when the Tenkan-sen line traverses the Kijun-sen in the bottom-up direction. Top-down direction is the signal to sell. Tenkan-sen is used as an indicator of the market trend. If this line increases or decreases, the trend exists. When it goes horizontally, it means that the market has come into the channel.

Most traditional technical analysis techniques are based on the open, high, low, close or average price. Others may use volatility while fixed scales such as Fibonacci numbers have also been applied. But the results are the same. Support and resistance levels are always depicted as a point or a line.