The Fundamentals of Oil Gas Hedging

Post on: 21 Май, 2015 No Comment

The Fundamentals of Oil & Gas Hedging — Futures

This post is the first in a series where we will be exploring the most common strategies used by oil and gas producers to hedge their exposure to crude oil, natural gas and NGL prices.

In the energy markets there are six primary energy futures contracts, four of which are traded on the New York Mercantile Exchange (NYMEX): WTI crude oil, Henry Hub natural gas, NY Harbor ultra-low sulfur diesel (formerly heating oil) and RBOB gasoline and two of which are traded on the IntercontinentalExchange (ICE): Brent crude oil and gasoil.

A futures contract gives the buyer of the contract, the right and obligation, to buy the underlying commodity at the price at which he buys the futures contract. On the other hand, a futures contract gives the seller of the contract, the right and obligation, to sell the underlying commodity at the price at which he sells the futures contract. However, in practice, very few commodity futures contracts actually result in delivery, most are utilized for hedging and are sold or bought back prior to expiration.

So how can an oil and gas producer utilize futures contracts to hedge their price risk?

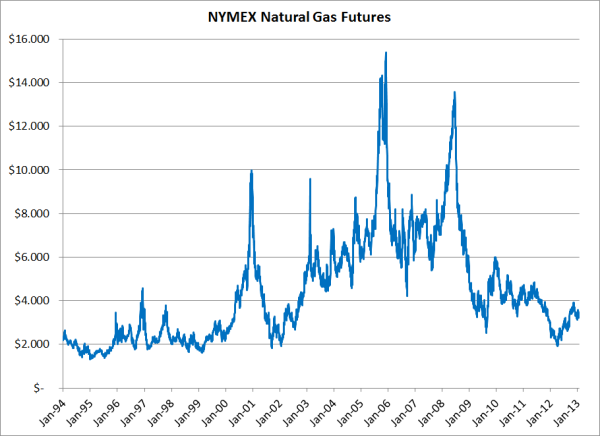

As an example, let’s assume that you are a natural gas producer who wants to hedge the price of your future natural gas production. For sake of simplicity, let’s assume that you are looking to hedge (by fixing or locking in the price) 10,000 MMBtu of your June 2015 production. To hedge this production with futures, you would sell one June 2015 natural gas futures contract. If you had sold this contract based on the closing price on Friday, you would have hedged 10,000 MMBtu of your June 2015 production at $2.839/MMBtu.

Let’s now assume that it is May 27, 2015, the expiration date of the June 2015 natural gas futures contract. Because you do not want to make delivery of the futures contract, you buy back one June natural gas futures contract at the prevailing market price.

To compare how your strategy will work if June natural gas futures settle at prices both above and below your price of $2.839, let’s examine the following two scenarios.

In the first scenario, let’s assume that the prevailing market price, at which you buy back the June natural gas futures contract, is $3.089/MMBtu, which is $0.25 higher than the price at which you sold the futures contract. In this scenario, you would receive approximately $3.089/MMBtu for your June 2015 natural gas production. However, your net price would be $2.839/MMBtu, the price at which you originally sold the futures contract, excluding the basis differential, gathering and transportation fees. This is because you would incur a loss of $0.25/MMBtu ($2.839 — $3.089 = $0.25) on the futures contract.

In the second scenario, let’s assume that the prevailing market price, at which you buy back the June natural gas futures contract, is $2.589/MMBtu, which is $0.25 lower than the price at which you sold the futures contract. In this scenario, you would receive $2.589/MMBtu for your June 2015 natural gas production. Like the first scenario, your net price would be $2.839/MMBtu, again excluding the basis differential, gathering and transportation fees. This is because you would incur a gain of $0.25/MMBtu ($2.839 — $2.589 = $0.25) on the futures contract.

While there are numerous details that need to be considered before you hedge your natural gas production with futures, the basic methodology is rather simple: if you are a natural gas producer and need or want to hedge your exposure to natural gas prices, you can do so by selling a natural gas futures contract.

Last but not least, while this example addressed how a natural gas producer can hedge with futures, similar methodologies apply to hedging production with futures contracts on other energy commodities as well.

This post is the first in a series on hedging oil and gas production. The subsequent posts can be viewed via the following links:

Editor’s Note: The post was originally published in February 2013 and has been updated to better reflect current market conditions.