The Effects Of Embedded Options On Bonds Finance Essay

Post on: 9 Май, 2015 No Comment

This is the detail of risks associated with bonds investment. Before investment we have to about the risks. The following are some risks discussed in detail.

1. Credit risk

Whenever a borrower who does not make payments as he promises to the investor to make such payment, this type of risk is called credit risk. The event thus arises is called a default. Credit risk is also called default risk. The losses to an investor includes principal plus interest, reduced cash flow, and augmented collection costs, which usually take place in many situations like

When a customer does not pay outstanding mortgage loan, credit card loan, line of credit, or any other loan

When a business does not pay outstanding mortgage loan, credit card loan, line of credit, or any other loan

When trade invoices are not paid by the business or customer when owing

2. Liquidity Risk

It is a type of risk that a security or asset cannot be converted into ready cash quickly in the market without a loss. Such investments are considered more risky by investors who seek an additional for lack of liquidity. This compensation is called liquidity risk premium.

For example, government saving bond is considered liquid asset as they can be easily sold to a bank without having loss while other investment may not be converted into ready cash easily without a loss.

Certain techniques of asset-liability management can be applied to assessing liquidity risk. A simple test for liquidity risk is to look at future net cash flows on a day-to-day basis. Any day that has a sizeable negative net cash flow is of concern. Such an analysis can be supplemented with stress testing. Look at net cash flows on a day-to-day basis assuming that an important counterparty defaults.

3. Sovereign Risk

It is a type of risk that a government is unwilling or unable to meet its loan obligations, or reneging on loans it guarantees. Whenever there is sovereign risk the creditors should take its decision process in two stages when deciding to lend to a firm in a foreign country. First: creditors should consider the sovereign risk quality of the country, and second: consider the firm’s credit quality.

Following are the five “Macro-economic” variables that affect the probability of sovereign debt rescheduling:

Debt service ratio

Investment ratio

Variance of export revenue

Domestic money supply growth

4. Interest Rate

It is a type of risk borne by an interest-bearing asset, such as a loan or a bond, due to fluctuation of interest rates. Usually an increase in the rate of interest in the market will cause a decrease in the value (price) of a bond and a decrease in interest rate will result in the increase of a bond price. Interest rate risk is generally measured by the duration of bond. Interest rates are usually taken from LIBOR (London Inter Bank Offer Rate).

4.1. Interest Rate Risk Calculation

To measure the impact of fluctuating interest rates on a portfolio having various assets and liabilities there are a number of standard calculations. Some of them are:

Marking to market, the net market value of assets and liabilities is calculated, often called the market value of portfolio equity

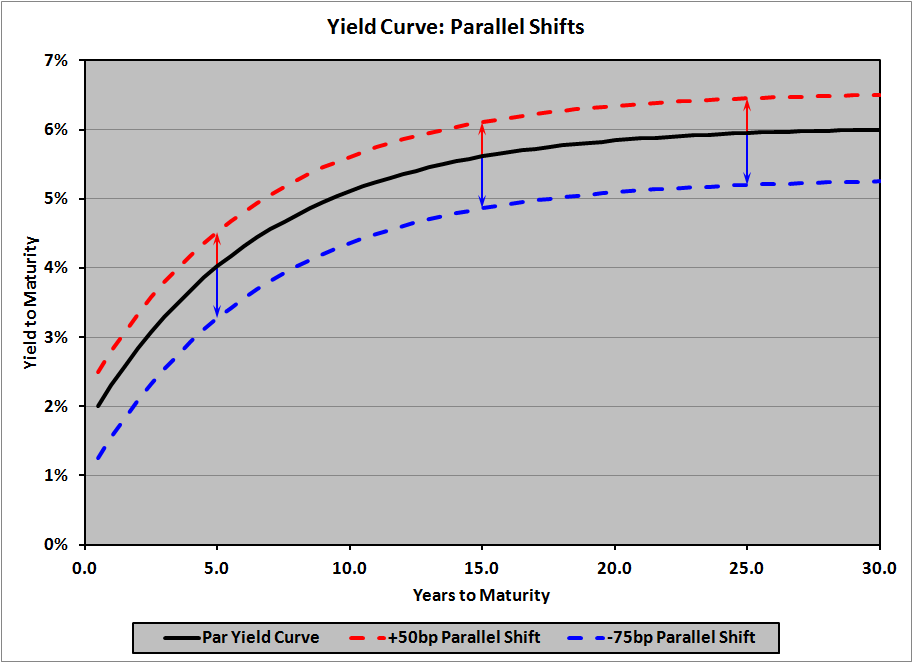

Stress testing this market value by shifting the yield curve in a specific way. Duration is a stress test where the yield curve shift is parallel

Computing the Value on Risk of the portfolio

Computing the multi period cash flow or financial accrual income and expense for periods, say N, forward in a deterministic set of yield curves in future

5. Yield Curve Risk

The risk existing because differences between short-term and long-term interest rates. Short-term interest rates are usually less than long-term interest rates, here the maturity risk concept involves, and banks earn profits by borrowing short-term money (at lower rates) and investing in long-term assets (at higher rates). But the relationship between short-term and long-term rates can shift quickly and considerably, which can cause unpredictable changes in revenues and expenses.

6. Call Risk

A type of risk to the bond-holder when the bond is callable, under such circumstances the issuer of bond will use the callable feature and will redeem the bond before maturity. The bondholder gets payment on the value of the bond and will be reinvesting in a less favorable environment. Normally, the issuers of bond call a bond because they pay high rate on the bond. The interest rate if has been decreased in the market since the first issue of bonds, issuers try to call the bond when it turn out to be callable and they will issue new bonds having lower interest rate (Coupon Rate). The bondholders thus forego the higher rate of their bond and then they will invest in lower rate bonds. This type of risk can be reduced by either deferred call provision in which the issuer cannot call the bond in the first few years from its issue or the bond should be call protected in which the issuer cannot redeem the bond at all. Generally the price at which the bond is called back is higher than the face or stated value of bond. This difference of call price and stated price is termed as Call Premium.

7. Reinvestment risk

The risk that the proceeds might be reinvested at a lower rate than the funds were previously earning to mitigate this risk, investors receives a higher yield on the bond than they would on a similar bond that isn’t callable. Active bond investors can attempt to mitigate reinvestment risk in their portfolios by staggering the potential call dates of their differing bonds. This limits the chance that many bonds will be called at once.

8. Exchange rate risk:

The risk that the investment proceeds are greatly affected by fluctuations in exchange rates. This occurs when investment in foreign currency bonds are made. Any fluctuation in exchange rate will result in change in the value of investment. For example, if a UK based investor invests in U.S bonds, then any fluctuation in Dollar/Pound exchange rate will have an impact on the investor cash flow. This type of risk can be mitigated by entering into future and forward contracts. Currency futures and currency options can be another strategy to minimize the adverse effect of exchange rate fluctuations.

9. Inflation risk:

The risk that the inflation is or might be higher than the return generated by the bond. Since investing in bonds is relatively safe therefore Bonds do not provide a very high rate of return. For example, suppose that an investor earns a rate of return of 4% on a bond. If inflation grows to 5% after the purchase of the Bond, the investor’s true rate of return (because of the decrease in purchasing power) is -1%. One way to reduce inflation

10. Event risk

The risk associated with the changes in the issuer’s ability to make payments due to unusual, noncontiguous and very large unpredictable fluctuations in the market environment such as a usual or any industrial accident or some regulatory change or a takeover, or corporate reformation. For example, a company selling cigarettes carries the event risk that the government may completely ban it. In the same way, implanting a movie theatre has the event risk that it will burn down. Insurance can be used as a mitigation strategy for such kind of risk.

11. Prepayment risks

Prepayment risk is concerned with the holders having their bonds paid off earlier than the maturity date. This is due to decreasing marker rates, which cause the issuer to call the bonds. It can also occur when the borrowers in a MBS or ABS refinance or pay off their debt earlier than the stated maturity date. If the cash flows are unknown, then certainly the yield to maturity of such bonds can also be unknown at the time of purchase. Future interest payments will not be paid on that part of the principal, which is returned earlier. Hedging strategies can be used to mitigate such risk.

12. Volatility risks

Volatility risk involves bonds with embedded options. Expected volatility or vol” affects the option price within a callable or put table bond. Greater expected yield vol yields a greater increase in the value of the option as volatility increases, with all other factors holding the same, the price of the option will increase. This decreases the price of the bond. Such type of risks inherent to be the threat to a given investment, based on the market current condition. This is certainly pointing to some indication that the value of a bond is going to come into a phase of variation that will critically influence performance of the investment. An investor will be usually wishing of being aware of the amount of volatility risk presently linked to the investment, when they are required to decide Whether or not to buy an option. Different kind of hedging techniques can be used to mitigate such risk.