The Crisis of Globalization

Post on: 16 Март, 2015 No Comment

When David M. Smick produces one of his Washington Post op-ed pieces. it pays to take note. Smick, the international economics consultant and author of the best-selling The World Is Curved: Hidden Dangers to the Global Economy . always offers fresh insight and unvarnished analysis on the state of world economics. But today’s article packs a particularly potent punch.

Entitled in print Bye-bye, globalization, the piece argues that the world has reached the end of a marvelously heady time. The era of globalization, says Smick, is now cracking up. He adds ominously: And there appears to be no new model to replace it.

Here at The National Interest. we remain always attuned to arguments that major changes are coming to the national political order and the prevailing global order. Some months back, we produced a special magazine issue under the rubric Crisis of the Old Order. We argued that the Old Order, a remarkably stable and bounteous time fashioned through the crucibles of the Great Depression and World War II, was crumbling. The status quo, we said, could not hold, and a new order would have to emerge to replace the old.

The only question, we suggested, was how much disruption, economic travail and bloodshed would attend the transition from the old order to the new. On the question of economic travail, Smick seems to be saying it will be substantial.

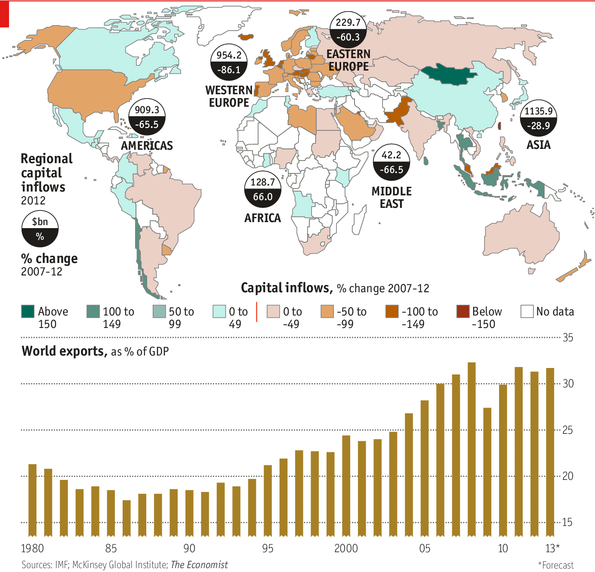

Consider just some of the developments cited by Smick. The growth rate of total global exports, normally an engine for economic expansion, has collapsed. Even China and India, until recently considered outlier nations that could drive global growth, have fallen victim to the seizing up of global trade. The world seems headed toward a currency war, with at least twelve countries beyond China manipulating their currencies against the dollar for trade advantage. The free flow of capital also is being curtailed as banks become more and more nationalistic and nations erect regulatory barriers. In Europe, once a source of investment funding in the developing world, undercapitalized banks are bringing capital home, and it isn’t clear any other nation can fill the gap in foreign investment. Capital scarcity is ratcheting the deglobalization trend into high gear, says Smick, adding this will retard growth prospects in the United States and throughout the industrial world.

The result is likely to be rising geopolitical tensions, which could increase U.S. investor nervousness, contributing to a debilitating risk-averse environment.

The era of globalization was wild. It began in the late-1970s, picked up steam throughout the 1980s, then soared through the 1990s and beyond. As Smick points out, it generated forty million new jobs under both Republican and Democratic presidents. And, as the Peterson Institute’s Gary Hufbauer has noted, it contributed to the country getting a trillion dollars richer each year through globalized trade. The Dow Jones Industrial Average exploded through this period, from about eight hundred in 1979 to more than thirteen thousand by December 2007.

But something else happened during this time, alluded to by Smick. The economy was taken over by Big Finance, which replaced the country’s industrial machine, the driver of growth from the end of the Civil War through the travail of the Great Depression and throughout the grand postwar period of American economic hegemony. As Smick points out, in 2003, the peak of the era of financial globalization, financial services accounted for an absurdly high percentage of the U.S. stock market’s earnings—30 percent. What’s more, financial services companies accounted for fully 40 percent of corporate U.S. profits.

This wasn’t sustainable, and the bubble inevitably burst. But what can replace this artificial financial froth as a true, sustainable engine of growth? The country’s industrial machine has been largely dismantled and shipped overseas. Some people think, as Smick notes, that new energy-extraction techniques will come to the rescue of the American economy as the country becomes an energy exporter, but political crosscurrents could retard that development as a growth engine.

Meanwhile, governments have dumped some $15 trillion into efforts to prop up the globalization system, while central banks have swelled their balance sheets—irresponsibly, some people believe—to the tune of $5 trillion toward the same end. But it hasn’t worked. Globalization is crumbling in the face of all these efforts.