The case for the profitability factor in your portfolio

Post on: 16 Март, 2015 No Comment

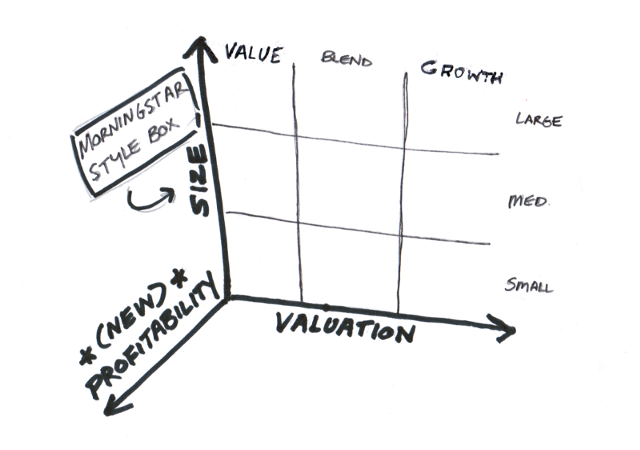

T he profitability (or quality) factor boasts a number of traits that makes it particularly interesting for passive investors :

- Profitability beat the market by 4% per year between 1963 and 2011.

- It’s strong in large cap equities – a rare treat for a return premium.

- It’s particularly powerful when partnered with investments in the value and small cap premiums because it’s negatively correlated with both.

- Profitable equities tend to suffer less in a downturn than the total market.

Profitability works by concentrating on the firms that exhibit traits which are suggestive of rude business health in the future. Its a bit like looking a potential mate up and down and determining their fitness according to the size of particular dangly bits. On an individual basis, youll often be disappointed, but apply the profitability criteria to enough candidates and on aggregate it seems to work.

The real power of profitability though may come from combining it in a portfolio with other financial steroids like value funds .

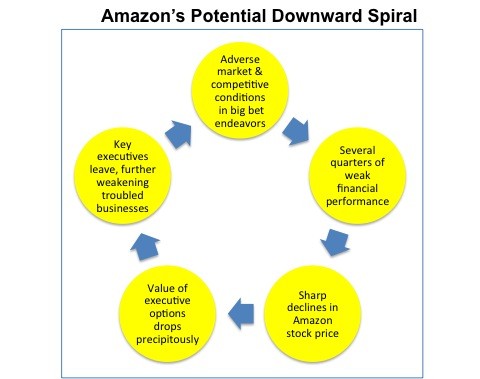

US Professor Robert Novy-Marx revived interest in the profitability factor with his work showing that a dollar invested in the US market in July 1973 grew to over $80 by the end of 2011.

But if you’d invested it in value and profitable equities instead, then that dollar would have grown to $572 (before expenses)

That’s a 615% increase .

Tempting.

The Holy Grail of diversification

The combination works because profitable companies are generally larger and more highly valued by book-to-market ratio than traditional value equities.

The outcome of holding them both is the holy grail of diversification: negatively correlated assets.

When profitable companies are on a roll, value firms tend to flop, and vice versa.

Bring together those complementary behaviours, and you have a portfolio that’s better able to resist a severe dip – because one of the factors should buffer you against the misfortune of the other.

This means you’re taking less overall risk in your portfolio, even though both factors are risky in and of themselves.

Big profits are beautiful

The large cap tilt of profitability also means it’s likely to bear up when small caps are going through a rough patch.

This is important for practical reasons, too. Its hard for UK passive investors to invest in truly small cap equities. Most so-called small cap funds tend to invest more in mid caps, in reality.

Yet premiums like value, momentum and size are usually more powerfully present among smaller equities.

This means that while a return premium may deliver eyebrow-raising returns on paper, the reality of real-life investing is that those theoretical numbers can be leeched away if you have to invest in funds that dont capture the most potent sources of return, such as micro cap equities.

Funds are also undermined by their management and transaction costs and their inability to easily short poorly performing equities, in comparison to the theoretical returns offered by the premiums as touted by academics.

Happily though, the paper Global Return Premiums on Earnings Quality, Value, and Size shows that a long-only portfolio 1 can deliver strong returns by combining value and profitability.

This twin tilt beat the market by 3.9% among large caps, and 5.8% among small caps.

In comparison to a pure value tilt, the addition of profitability added 1.2% to the large cap returns and an extra 1.8% to small caps.

The effect becomes more pronounced still when you throw momentum into the mix, as this factor is negatively correlated with value and has a low correlation with profitability and small cap.

To actually invest in profitability check out our review of UK quality ETFs .

Take it steady,

The Accumulator

Thanks for reading! Monevator is a simply spiffing blog about making, saving, and investing money. Please do check out some of the best articles or follow our posts via Facebook, Twitter, email or RSS.

- That is, one that doesn’t short equities. [↩ ]