The Best Housing ETFs for 2015 (ITB XHB PKB) (ITB XHB PKB LEN)

Post on: 4 Июль, 2015 No Comment

The housing recovery disappointed in 2014 for sure. Housing starts numbered about one million, up about 7% and far from the 30% growth they saw the previous year. The 5.4% gain the Dow Jones U.S. Select Home Construction Index saw in 2014 badly trailed the market. Will 2015 be any better for homebuilder shares or the exchange-traded funds (ETFs) financial advisors may recommend to give clients exposure to this highly cyclical sector? (For more, see: An Introduction to Sector ETFs ).

Some ETFs to Consider

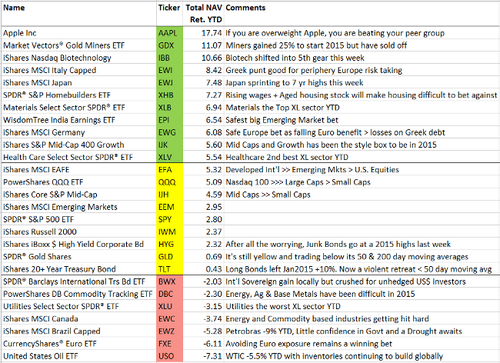

Predictions of a housing surge this year have to live with the disappointment of 2014. But if the housing recovery does accelerate enough to propel new home starts 15% to 20% higher, as many top economists predict, that could bolster the case for funds like the iShares U.S. Home Construction ETF (ITB ) and the SPDR S&P Homebuilders ETF (XHB ). The iShares fund is closer to being a pure play on home builders themselves, while the SPDR ETF gives broader exposure to companies that build the house and everything in it. (For more, see: Trading the SPDR S&P Homebuilders Indexes ).

iShares has been the better performer in 2014. Its top five holdings are D.R Horton Inc. (DHI ), Lennar Corp. (LEN ), PulteGroup Inc. (PHM ), Toll Brothers Inc. (TOL ) and NVR Inc. (NVR ). Only in its second five holdings do you see ancillary names like the home improvement chains Home Depot Inc. (HD ) and Lowe’s Companies Inc. (LOW ) as well as paint maker Sherwin-Williams Co. (SHW ). Tracking the Dow Jones Home Construction Index, it has 38 holdings and its top 10 comprise 64% of its $1.5 billion in assets under management. In 2014 it rose 5.3%. (For more, see: Unwrapping the Home-Improvement Big Boxes ).

The SPDR ETF’s top holding is Whirlpool Corp. (WHR ), making clear that this fund is about a wider range of companies that make money when new homes are built. Along with Lennar, PulteGroup and D.R. Horton, its top 10 include Williams-Sonoma Inc. (WSM ), Bed, Bath & Beyond Inc. (BBBY ) and air-conditioning maker Lennox International Inc. (LII ). The top 10 command only a third of the assets in the 36-holding fund, which is indexed to the S&P Homebuilders Select Industry Index. The $1.4 billion fund rose just 3.1% in 2014, but is up 25% since hitting a 52-week low. Both funds have underperformed the market in the last two years.

Loading the player.

The third ETF nominally in this category is the PowerShares Dynamic Building & Construction Portfolio (PKB ). But that $55 million fund focuses on construction and related industries more broadly and doesn’t have a builder in its top 10 holdings.

Wage Growth

How you feel about builder ETFs depends on how you think housing will go next year and that ultimately depends on wage growth. If you think this fall’s rise in wages is a feint, you might want to keep clients away from these funds. If you suspect that the drop in unemployment is close to soaking up slack in the labor markets, there’s still time to move in despite the recent moves because ultimately, housing demand is going to turn on whether younger buyers think their futures are secure enough to begin forming households at pre-recession rates again. (For more, see: Why Housing Market Bubbles Pop ).

Housing Starts

Most economists forecast that housing starts will grow about 15% to 20% in 2015, resuming the pace of recovery the market held in 2013 before slowing on interest rate fears last year. (For more, see: What’s the Difference between Housing Starts and Building Permits? ).

“The market increasingly depends on fundamentals such as job growth, rising incomes and more household formation,” Trulia.com chief economist Jed Kolko says. “But here’s the hitch: These fundamental drivers of supply and demand haven’t returned to full strength.’’

Bank of America Merrill Lynch economist Michelle Meyer predicts that starts will rise about 20% to around 1.2 million, existing home sales will rise to 5.2 million (from 4.9 million) and home prices will see a rise of about 3.6%. Each of those three measures will fall short of where they were in 2006 if her predictions come true.

Young Buyers

The problem isn’t any shift in attitudes among young, would-be buyers, Kolko and Meyer agree. A Trulia survey found that millennials still want to buy houses: 78% believe home-ownership is a goal (up from 65% in 2011). So the issue around a housing recovery is much more “when” than “if.” (For more, see: Money Habits of the Millennials ).

The barriers are many, including tightened access to credit, a weak jobs market and weak wage growth. Household formation, Meyer notes, usually drives demand, yet it’s still less than half its pre-recession level. And if you want an idea about how tight credit is, the average rejected borrower had a credit score of nearly 700.

It’s All About Timing

The primary question if those indicators will change direction in 2015 or improve gradually before hitting critical mass in 2016, as Moody’s Analytics thinks it will. At IHS Global Insight, economist Stephanie Karol is rather bullish. She points to labor market improvement in 2014 — not just a lower unemployment rate but better wages in the second half and falling unemployment insurance claims — as evidence potential buyers are gaining confidence. At the same time, supply side problems, such as builders’ access to financing and a shortage of buildable lots, are clearing up, she says.

Ellie Mae’s survey of rejected loans shows a marked decline in the credit scores of ill-fated borrowers in recent months, with the average credit score of denied applicants falling 20 points this year. Banks are getting back to funding prime borrowers and rejecting just people who either have too much credit card debt or don’t pay their bills reliably.

The Bottom Line

For stocks and the ETFs that hold them, the timing of the recovery clearly matters. Home building stocks anticipated the 2012 pickup in housing markets by beginning to surge in late 2011. They did the same in the second half of 2014. The last time, there was more room to run when the economic fundamentals began to come in as strong as investors had anticipated with stocks and ETFs rising more in 2012. If that happens again in a 2015 recovery, investors will wish they had gotten in right about now, if not a little sooner. (For related reading, see: 2015’s Most Promising ETFs ).