The Baltic Dry Index Evaluating An Economic Recov Fundamental Analysis Explained Market Dhara

Post on: 16 Март, 2015 No Comment

Home Fundamental Analysis Explained The Baltic Dry Index: Evaluating An Economic Recov

1/9/2012 3:02:12 AM

Administrator

Posts: 562

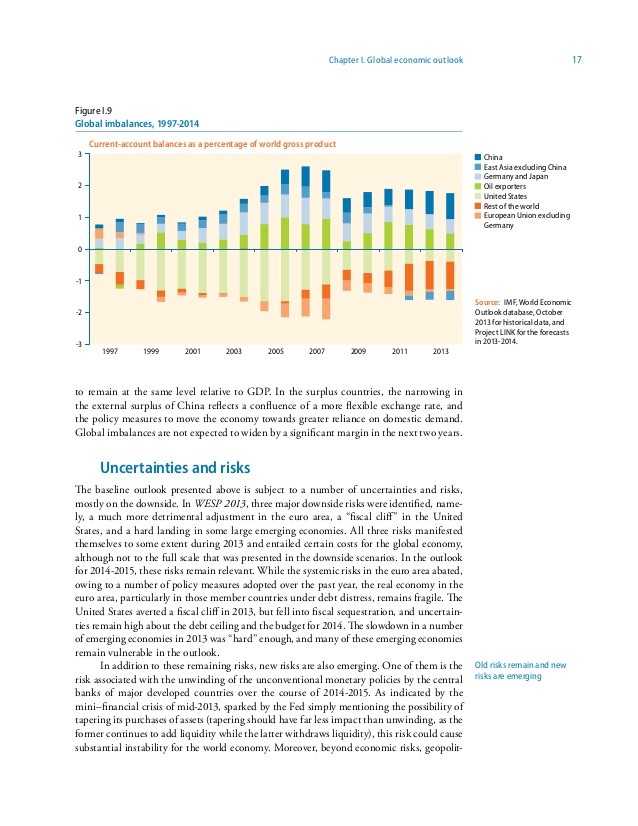

Among the array of traditional economic indicators is a cryptic indicator that often goes unnoticed by some investors, the Baltic Dry Index. This number provides investors with an indication of global supply and demand of major raw materials used at the beginning of production, and thus has provided a gauge of the world’s economic growth and production.

However, the index’s reception among analysts is mild. Some consider it a good indicator, especially when looking for hints of economic recovery, while others think investors shouldn’t rely on it, suggesting that it’s a long shot to count on this investment tool as a crystal ball to foresee the direction of stock markets or the global economy.

The Baltic Dry Index

The Baltic Dry Index is a barometer for shipping costs of dry bulk commodities including iron ore, coal and grain.

Global shipping brokers are asked every workday about their pricing by the Baltic Exchange. The Baltic Exchange consists of more than 600 members as of October 2010, including professionals in the international dry shipping industry and maritime lawyers and arbitrators. The exchange calculates the Baltic Dry Index by estimating the average timecharter rate of four indexes that represent the vessel types. Each of these vessels makes up 25% of the Baltic Dry Index:

Vessel type Deadweight (tons) Capesize172,000Panamax74,000Supramax52,454Handysize28,000Source: The Baltic Exchange

The Baltic Dry Index dates back more than 250 years to the first use of the name at the Virginia and Baltick Coffee House in Threadneedle Street in London, according to the Baltic Exchange. Merchants and ships’ captains who frequented the shop negotiated terms for the shipment of cargo.

It wasn’t until 1985 that the Baltic Exchange established the Baltic Dry Index. The Baltic Dry Index was calculated using voyage rates along more than two dozen routes until July 2009. This was based on a move to boost derivative trading. (To understand more about hedging, see Hedging In Layman’s Terms .)

The Index Highs and Lows

It’s often assumed that when the Baltic Dry Index rises, the increase is indicative of a stronger demand for commodities, as producers are buying more materials, meaning that companies are growing. When the shipments increase, economies tend to do well. A Baltic Dry Index that trends downward leads to the thought that producers don’t believe consumer demand is high and the companies are slowing down their production.

Debating the Pros and Cons

In addition to these predictive qualities of the Baltic Dry Index, analysts in favor of it also think it’s reliable because it provides real-time updates. The information is current compared to traditional economic indicators. It doesn’t have speculative content. Actions are limited to those involved with the contract: the people with the cargo and those who have the ship for the cargo. Thus, the index can’t be manipulated as the amount of ships has been fixed.

Analysts who aren’t too convinced by its predictability consider the Baltic Dry Index an indicator, but not necessarily the best. First, the Baltic Dry Index can be very volatile, at times simulating a roller coaster ride on the charts. The recession that began in 2007 illustrated these swings — hitting extreme highs and severe lows.

Between January, 2006 and October, 2007, the Baltic Dry Index increased more than 400%, largely due to the significant growth in the global economy for manufactured products, according to a report entitled Recent Movements in the Baltic Index. released by the Federal Reserve Bank of St. Louis in March, 2009. By late January, 2008, it dropped 6,052 points, only to reach its all-time high of 11,440 points in June 2008. But as of November 31, 2008, the index was at its lowest level since January of 1987 — 715 points, added the report. The doubters also think little or no relationship exists with the stock market, for instance the S&P 500 and the Baltic Dry Index had a negative correlation during 2009; while one rose, the other declined. As of September 2011 it was hovering around 1880.

Conclusion

The Baltic Dry Index provides a glimpse of global trade via the transport and production of major raw materials — it involves the assessment of shipping rates worldwide. The concept has been around since the 1800s and is still evolving. It has intrigued many analysts with its predictability and other perks, such as its real-time data and inability to be manipulated. Others think it’s too volatile for it to be considered reliable, and shouldn’t be compared with the stock market. Regardless, the Baltic Dry Index is an indicator worth examining, but make sure to gather some context by not using it as the only means to reach a conclusion.