The Art Of Charting

Post on: 16 Март, 2015 No Comment

The very existence of millions of traders in the world necessarily implies millions of trading preferences, methods, and styles. Traders from different countries, different religions, different times, and different mentalities make the financial world a richly diversified ecosystem. Everybody has a different way of surviving in this tumultuous world, each dealing with upheavals, crises and victories in their own individual manner, and yet altogether as a whole.

One aspect of trade that unites all traders is the use of information surrounding their operations. Every trader needs to perform technical analysis in order to plan their next moves, but the same information from one trader to the next can be interpreted in diametrically opposed ways, because interpretation necessarily implies human emotion, which eventually dictates everything we do.

Speaking of technical analysis What a cold-blooded name for such a delicate practice! Technical analysis is more like an art than a science, given that each individual trader translates what they see in their own personal way, just as anyone would do while gazing at a painting. In fact, traders differ from one another the same way painters do. One painter will choose oil paint while another will prefer aquarelle, the same way some traders are loyal bar-chart users while others will religiously stand by their candlestick display.

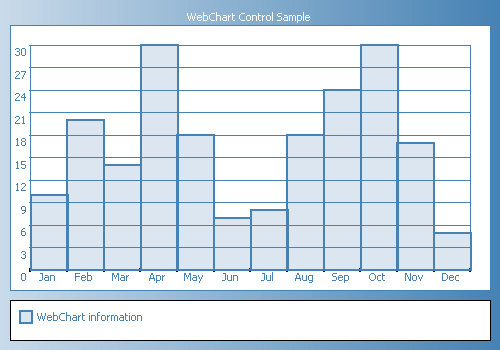

Candlesticks: Bar Charts:

With the advent of advanced technology in the world of finances, the physical presence of traders on the trade floor in New York or in Tokyo is no longer necessary. The development of home-based trading platforms has revolutionized financial markets, as participants have been multiplying ever since. All the information necessary for efficient trading is available in one single downloadable package, and what better example of online trading software than MetaTrader 4.

You would think MetaTrader 4 is a complicated program to use, considering its countless features and configuration possibilities, right? Think again. The beauty of this platform is that not only is it genuinely a fully-equipped package, but using it is a breeze. You don’t even need to be a computer genius: everything is gracefully displayed and easy to find Every trader’s dream come true. MetaTrader 4 has it all, as was conceived to satisfy the needs and requirements of EVERY trader.

Though entire books have been written and many more could be written on MetaTrader, let’s focus on its available technical analysis tools. Traders can choose and customize every little detail of their charts as they wish, all the way down to display colors. While you may adore a yellow background, it may give your fellow traders a splitting headache:

The beauty of it all is that what the charts should look like is entirely up to you, whether it be lines and trendlines, bars, candlesticks, along with different types of analysis, using the Gann analysis, Fibonacci analysis, oscillators, and more.

Technical analyses as listed above are what mainly help the trader define as accurate forecasts as possible, using either one type of technical analysis or combining several, in search for a secret pattern, a hidden key, a door to open behind which are the answers the trader wants to find

The Gann analysis, created by William Delbert Gann, is an analysis method that includes tools such as the Gann Fan, Gann Trend and Gann Grid. Such analyses describe only the relationship between time and price. While pinions on the relevance of Gann’s work for forecasting are sharply divided today, it still remains a very popular analysis method. MetaTrader offers all types of Gann lines for traders to choose from:

Gann Line Gann Fan