Testing Simple Strategies MACD Works and Futures are Rewarding Traders Log

Post on: 10 Июнь, 2015 No Comment

Posted By: TradersLog

Traders are fascinated by indicators. But just because something is interesting, logical or mystical does not mean it works in the market. Testing is needed to be sure the indicator adds value, and we will define value as improving profits. If an indicator beats a simple trend following strategy, it adds value.

Over the years, probably thousands of indicators have been developed as traders spend time looking for ways to beat the markets. Some like the relative strength index (RSI) or stochastics are very well known and widely followed. Others, like Chaikin Money Flow or the Chande Momentum Oscillator, are much less studied. All indicators are developed with the objective of providing traders an edge in the market. An edge should be quantifiable and to determine whether or not an edge exists, we can look at whether or not the indicator increases profits compared to a baseline trading strategy. This week we will look at two standard and widely followed indicators, saving the less followed ones for a different article.

For testing, we will look at a diversified basket of futures contracts that could be traded with an account balance of about $25,000. Smaller accounts could adapt the strategy to use only a few of the contracts but that increases risk. The futures contracts used in the tests will include crude oil, cotton, the US dollar index, feeder cattle, five-year Treasuries, copper and sugar. Commissions and slippage of $45 per round turn will deducted from each trade to duplicate the reality of trading costs. The test will cover the twelve years ending December 31, 2011.

For the smallest accounts, five-year Treasuries test very well and can be traded with about $1,000 in margin. Of course it is best to have more than the minimum margin available in a trading account. Small traders can also use day trading strategies in futures markets since many brokers allow day trading with even lower margins.

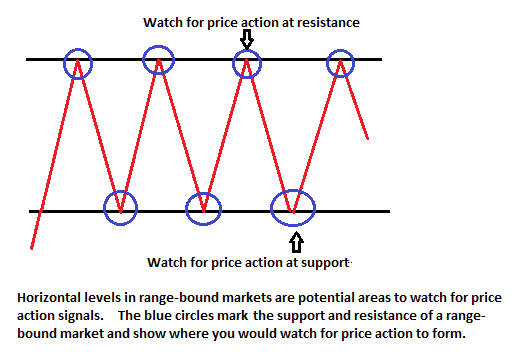

The baseline system will use only prices to determine whether to buy or sell. It will always be in the market, taking a long position when prices move to a new 20-day high and reversing to a short position when price falls to a new 20-day low. Closing prices are used in this study.

The indicators we will test will be MACD and RSI, using the standard default values in each case. MACD is a trend following indicator and RSI is an overbought/oversold indicator. Default values used to calculate the indicators are 12 days and 26 days for MACD and 14 days will be used for RSI. Optimization can be done on these or any indicator but that is a dangerous path for traders to follow. With optimization you are actually decreasing the odds of future success by fine tuning the rules to precisely fit the past which will be different from the future. The value of optimizing parameters is to find out if the indicator is stable. For example, RSI is usually considered oversold when it falls below 30. We could optimize and find that it delivers great results at a value of 28, loses money when it is set to buy at 29, and breaks even at 30. This would show that the past performance is actually due to luck rather than adding any value to trading. If the results with the default values show that the indicator is tradable, an optimization test should be completed to make sure a small change in the parameters has only a small impact on the results. Otherwise, profits in the future are unlikely to be similar to the back tested results.

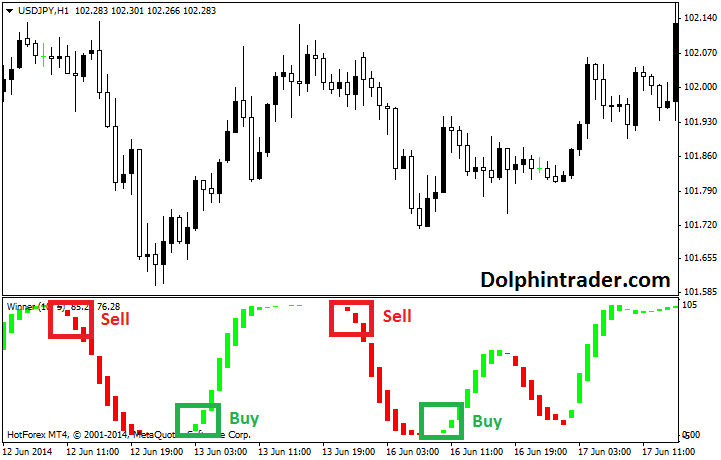

For MACD, we will be taking long positions when the histogram crosses above zero and going short when the MACD histogram is negative. The RSI strategy will be long when the indicator crosses above 30 after reaching an oversold extreme and short when it falls below 70 after becoming overbought. The results of the three systems tests are summarized in the table below. The initial evaluation of a trading strategy should simply look at the potential rewards and the risks. Returns are presented as the average annual returns because that is the most common way investors look at rewards. Risk is the ratio of the largest drawdown to the account value, a measure of how big the worst loss would be. This is really the way many investors think of risk. As a standard to measure performance against, a buy-and-hold stock market strategy would have a risk of about 60% over the test period and the S&P 500 showed a loss over that time. Buy-and-hold investors in a stock market index fund would have enjoyed a small gain when dividends are considered. Futures do not pay any dividends and all of the returns come from price action.

Looking solely at returns, the results are impressive and a $25,000 account would grow to more than $230,000 over twelve years with the 20-day rule. The default settings for MACD applied as a trading strategy would result in an account worth more than $330,000. A buy-and-hold stock market investor using a low cost ETF to track the S&P 500 would have seen $25,000 grow to about $27,500 over that time after accounting for dividends. Either futures trading system has less risk than the S&P 500 in addition to providing significantly better returns.

These results show that trend following strategies like the 20-day rule or MACD applied to the futures markets work well over time. RSI is an oscillator that tries to capture profits when the trend is changing. Using an indicator to buy oversold markets and short overbought markets doesn’t result in profits because trend reversals tend to be sharp moves. By the time the signal is given, a significant part of the move has already taken place. Trend followers are not trying to pick tops or bottoms, they are simply trying to get in once a trend has been identified.

These incredible results were obtained in the futures markets. Trend following strategies do not work as well in the stock market. Testing over the same time period using the S&P 500 gives the exact opposite results – losses are realized with the 20-day rule and MACD while RSI delivers a small gain. RSI actually provides results that are in line with a buy-and-hold strategy and does not offer any benefit when compared to that approach. When tested on a basket of stocks, the results are the same. Trend following strategies lose money and RSI is no better than a buy-and-hold approach.

Given these types of results, the obvious question is why do most individual traders focus on the stock market? Almost all individual traders limit themselves to the stock market with individual stocks or ETFs that track the broad market indexes. This is probably due in part to the perception that futures are risky. I have met individuals who believe that if they do something wrong they will have a truckload of corn, or whatever they are trading, delivered to their front door. Many also believe they could lose their house to a margin call. Fortunately your broker will sell you out of your position before either of those things happen. But the numbers actually show that a diversified basket of futures has less risk than the stock market.

Futures are risky and the leverage does mean that you can lose more than you invested. However with proper risk management, they can be a very rewarding investment. Those MACD test results show that profits are possible and the risk can actually be less than that seen in stocks.

Individual traders, even small traders, should consider futures. Futures and foreign exchange markets can both be more profitable than the stock market. Making big profits and successfully trading for a living requires you to do things differently than the average investor who is not successful and not making a living from the markets. Trade in the markets where you can actually meet your goals.

By Michael J. Carr, CMT