Synthetic Floating Crude Oil Storage and Optimal Statistical Arbitrage A Model Specification

Post on: 25 Июль, 2015 No Comment

Page 1

ssrn.com/abstract=1932432

Synthetic Floating Crude Oil Storage

and Optimal Statistical Arbitrage:

A Model Speci?cation Analysis

Andrea Bucca∗

Mark Cummins†

May 22, 2011

Abstract

The informational ?ow between oil and spot freight markets is examined in a novel

way via the time charter equivalent (TCE) to identify statistical arbitrage trading

opportunities. Using Brent and TD3 data, synthetic ?oating storage positions are con-

structed, which are shown to be cointegrated with Brent futures prices of common ma-

turity. A comprehensive model speci?cation analysis of the optimal statistical arbitrage

trading model of Bertram (2010) is performed on this data. Model mis-speci?cation in

the underlying Gaussian Ornstein-Uhlenbeck (OU) process is identi?ed. Evidence of

ssrn.com/abstract=1932432

1Introduction

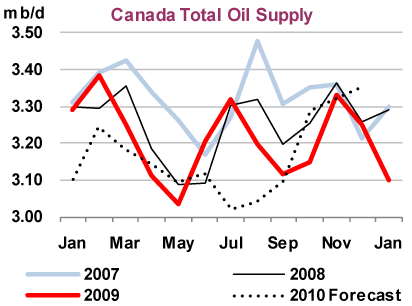

With the recent global economic crisis, crude oil markets experienced a severe collapse in

prices from record-breaking heights. Over the second half of 2008, the futures markets were

seen to move to a prolonged period of strong contango. The contango over this period was

coupled with a signi?cant collapse in freight prices due to the expectation of lower global

energy and commodity demands. During this period, signi?cant increases in buy-and-hold

activity had been observed in the markets, with freight vessels being held o?shore and used

as ?oating storage facilities for crude. Such static strategies had been made viable by the

collapse in freight and ?nancing costs, netting out to signi?cant returns on the contango

play. As expected, the major global oil companies, who have considerable freight capacity

available, were to the forefront of this activity. However, many investment banks were also

reported to have got involved in such physical buy-and-hold activity given the relatively

cheap cost of chartering vessels.

Motivated by this interaction between oil and freight markets, this study investigates the

potential for trading synthetic (i.e. purely paper-based) ?oating storage positions, speci?cally

exploiting the informational ?ow from spot freight markets via the time charter equivalent

(TCE). With the TCE e?ectively representing storage costs inferred from the spot market,

it is possible to set up purely paper-based synthetic ?oating storage positions. The bene?t

of this is that dynamic paper-based trading strategies are possible and ?storage? may be

sold short as required. This would be of particular interest to trading companies and, in

particular, hedge funds with exposure to the energy and commodity markets. In contrast,

the physical buy-and-hold strategy is static and applicable only when prevailing oil and

freight markets allow (i.e. su?ciently strong oil price contango and low freight prices), and

of course, it is a long physical storage strategy.

This study contributes in a number of key ways. Firstly, the informational ?ow between

oil and spot freight markets is examined in a novel way via the TCE to identify statisti-

cal arbitrage trading opportunities. Adland and Cullinane (2006) analyse the TCE spot

freight rate directly for a range of freight sectors, where the focus is on the application of

non-parametric estimation techniques to model the TCE dynamics. Much of the current

literature has investigated either oil markets separately (Crowder and Hamed (1993), Silva-

pulle and Moosa (1999), Ewing and Harter (2000), Milonas and Henker (2001), and Kinnear

Page 3

given period are replaced by storage costs based purely on the spot TCE. In so doing, ine?-

ciencies are introduced by construction that o?er trading opportunities, with predictability

being established in the cointegration spread between synthetic storage and Brent futures

prices of common maturity.

This predictability opens up statistical arbitrage trading opportunities and therefore

a number of statistical arbitrage based studies are possible.

contribution to this study, a comprehensive model speci?cation analysis (both in-sample

and out-of-sample) is performed on the novel optimal statistical arbitrage trading model of

Bertram (2010). The study investigates model mis-speci?cation in the underlying Gaussian

Ornstein-Uhlenbeck (OU) process. A number of alternative studies in the area of statistical

arbitrage trading have been conducted to date. Many of the papers focus on the design of

statistical arbitrage trading rules and the resulting performance when applied to empirical

data. These include Burgess (1999, 2000), Trapletti, Geyer and Leisch (2002), Vidyamurthy

(2004), Whistler (2004), Elliott,Van Der Hoek and Malcolm (2005), Gatev, Goetzmann and

Rouwenhorst (2006), and Do, Fa? and Hamza (2006). Andrade, di Petro and Seasholes

(2005), Papadakis and Wysocki (2007) and Do and Fa? (2009) contribute to the literature

by means of providing independent veri?cation of the trading rule proposed by Gatev et al.

(2006) and examining the sustainability of pro?ts. Aldridge (2009), Bowen, Hutchinson and

OSullivan (2010) and Dunis, Giorgini, Laws and Rudy (2010) consider the application of

statistical arbitrage trading on high-frequency data. Kanamura, Rachev and Fabozzi (2010)

use the approximate ?rst-time hitting density formulation of Linetsky (2004) to develop a

total pro?t model for pairs trading. Other papers of interest include Shleifer and Vishny

(1997), Hogan, Jarrow, Teo and Warachka (2004) and Lin, McRae and Gulati (2006).

However, few of these papers deal directly with the issue of optimal entry and exit

trading levels in the presence of stochastic trade cycle times. Vidyamurthy (2004) proposes

an optimal entry level given by the maximum point on a pro?tability pro?le constructed

as the product of probability estimates — obtained from counting the number of times each

candidate entry level is exceeded — and the associated absolute pro?t levels. Vidyamurthy

(2004) further proposes an exit level that lies through the long-run equilibrium level and of

equal distance away as the entry level; this is to account for any potential trade slippage.

Elliott et al (2005) use ?rst-passage time theory on the standard Ornstein-Uhlenbeck (OU)

process to develop a framework for calculating the expected trade cycle time of a statistical

arbitrage strategy, along with symmetric entry and exit boundaries. Do et al (2006) similarly

theory to inform the underlying statistical applications.

In contrast to these papers, Bertram (2010) presents a novel approach. Modelling a given

spread series as an OU process, analytic solutions are derived that allow for the optimal entry

and exit levels to be determined through maximising either (i) the expected return per unit

time or (ii) the associated per unit time Sharpe ratio. Extending the current literature in this

area, a comprehensive model speci?cation analysis of the Bertram trading model is performed

However, as a second key

Page 4

on the set of synthetic storage and Brent futures price pairings. Empirical counterparts to the

following key measures underlying the Bertram trading model are calculated: expected trade

cycle time; variance of trade cycle time; expected return per unit time; variance of return per

unit time; and, where applicable, the per unit time Sharpe ratio. Model mis-speci?cation

error is both identi?ed and quanti?ed.

As a third key contribution of this study, a formal investigation is conducted to iden-

tify potential sources of the model mis-speci?cation evidenced. To begin, a pairs trading

style strategy is implemented whereby the entry and exit signals of the Bertram trading

model (determined in-sample) are applied out-of-sample. The results of this implementation

provide evidence of potential structural changes or regime shifts in the long-term statisti-

cal relationships, in addition to asymmetric adjustment of the cointegration spread series

to the respective long-run mean levels. Based on these observations, formal threshold and

structural change cointegration tests are performed. The former tests allow one to identify

asymmetric correction of short-term deviations from the long-run equilibrium level and the

latter allow one to identify fundamental structural changes or regime shifts in the long-term

statistical relationship. Evidence is provided to support the existence of threshold e?ects in

the cointegrating relationship between synthetic storage and Brent futures prices of medium-

to long-term maturities, i.e. greater than ?ve months. Also, statistical evidence is provided

to support the possibility of structural change cointegration e?ects across all maturities.

The remainder of the paper is organised as follows. Section 2 presents the economic frame-

work linking voyage freight and time charter rates, which will form the basis of constructing

the synthetic ?oating storage positions. It is discussed how this construction introduces in-

e?ciencies that may o?er statistical arbitrage trading opportunities. The data used in the

Page 5

of time or entering into a sequence of spot voyage charters over the same period of time.

Similarly, Strandenes (1984) appeals to the e?cient market hypothesis to explain that the