SwingTradeOnline More About Swing Trading

Post on: 29 Июнь, 2015 No Comment

Swing trading is a form of short-term trading which seeks to maximize trading profits and minimize risk by entering and exiting strategic trades that are held from 3 to 30 trading days. It is called swing trading because it seeks to enter already established trends (for the most part) and ride them as they swing up or down to new highs or lows. But before we further define what swing trading is, let’s first separate the idea from what it is not.

What Swing Trading is Not

Swing trading is not buy and hold investing .

Buy and hold investing involves the fundamental or economic analysis of market cycles, business sectors and individual companies with the intent of buying solid companies, or funds of such companies, when valuations are attractive or when growth prospects are strong. The aim of this strategy is to realize long-term capital gains with a minimum of portfolio turnover. Buy and hold investors are not traders. They normally pay little attention to even the basics of technical analysis. The holding time of a buy and hold position is usually six months, and in many cases it can be much longer.

Swing trading is not position trading.

Position traders are indeed traders inasmuch as they normally rely on the technical analysis of chart trends rather than the fundamental analysis of companies. But their aim is to get in on the beginning of more sizeable moves, which may last several weeks to several months. The primary chart of the position trader is the weekly chart, with the daily chart being used to time entries and exits. Position traders like to buy bottoms and sell tops, but if they enter the position too soon, they are forced to sit through sometimes lengthy drawdowns.

Swing trading is not overnight trading.

The overnight trader is someone who relies on technical analysis and tape reading skills, along with (sometimes) intraday news breaks, to take a two day position in a stock. The overnight trader normally enters the position in the afternoon of the first day, and sells before the close of the second day. The overnight trader’s aim is to capture three phases of movement: the afternoon run, the overnight gap, and the morning continuation. This is a very profitable form of trading for someone with sound trading strategies, but it can be very time-consuming, and trading the exit requires as much focused attention as daytrading.

Swing trading is not day trading.

The day trader is someone who, like the overnight trader, relies on technical analysis and tape reading skills, but uses these to pinpoint only intraday moves in stocks. The day trader’s aim is to capture intraday breakout or reversal moves, and to do this repeatedly throughout the day. Day traders never hold positions overnight and losses are usually cut short very quickly. Sometimes a day trader will trade in and out of the same stock, or market derivative (like an index futures contract), over and over again throughout the day.

What Swing Trading Is

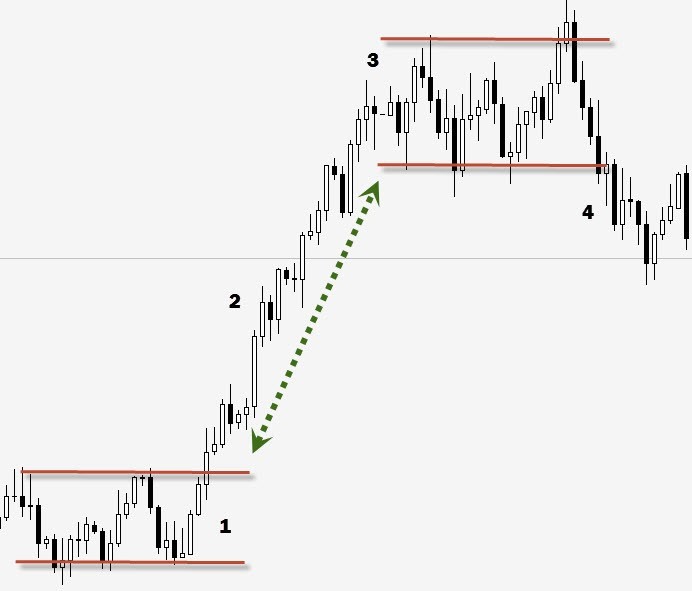

Swing trading occupies the niche between the position trader and the overnight trader. The primary aim of the swing trader is to capture the bulk of major moves in trending stocks, entering after the trend has begun and often exiting before the trend concludes. Swing traders rely mostly on daily charts, but will make reference to both weekly and hourly charts to better time their entries and exits. The typical holding time for a swing trade is from 3 to 15 trading days. Profit expectations from a swing trade depend on the kind of stock that is traded (less volatile stocks pose less risk but also less potential profit), but are normally in the 5% to 15% range per trade. Portfolio turnover for the swing trader is much less than that of the daytrader, but is greater than that for the position trader. Typically a swing trader will close 3 to 5 trades per week.

Further clarification of the different types of trading styles can be found below: