Swing Trading Or Day Trading Which Is Better

Post on: 2 Июнь, 2015 No Comment

Estimated Reading Time: 5 minutes.

Should you swing trade or day trade?

Before I answer this question, let’s define these two terms:

- Day Trading means opening and closing a position within the same day. When day trading, you often enter and exit a trade within minutes. So you never carry a position overnight.

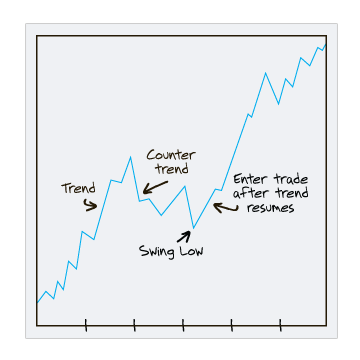

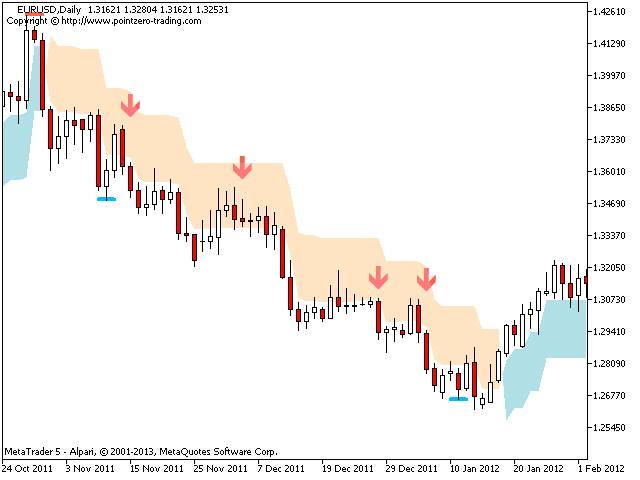

- Swing Trading means that you are trying to take advantage of larger price swings in the markets. Typically you will hold a position for a few days, or even a weeks. When swing trading, you normally carry a position overnight.

So which trading approach is better? — Swing trading or day trading?

I personally prefer day trading and here’s why:

As a day trader, I like to control my risk. I will never be able to eliminate all risk from trading, but by holding a position only for a few minutes — or maybe even hours — I can control the risk much better than holding a position overnight.

Let me give you an example:

Let’s say you are driving down the highway at 70mph. There’s no traffic, the sun is shining and you are just cruising. Now you decide to let go of the steering wheel for a quick second. What will happen? Nothing! You’re still in control of the car, aren’t you?

Now let’s assume you let go of the steering wheel for 5 seconds. What will happen? Well, maybe your car drifts a little bit into the other lane, but you can quickly correct it and since there’s no traffic, probably nothing will happen. It might have been scary for a second, but you are still in control.

But what would happen if you decide to let go of the steering wheel, unbuckle, climb on the back seat and try to take a nap? The car will drive off the road and you’ll get into a major accident, right?

And that’s how I feel about holding a position overnight — you’re simply no longer in control.

If you are trading a market that’s open 24 hours a day (e.g. Forex or Futures), you could place a stop loss, but often the markets have some wild swings overnight. So, you might get stopped out with a loss, even though when you wake up the next morning, the market is trading more or less at the closing price of the previous day.

If you trade stocks or ETFs. then risk control becomes even more difficult. For example, you could place a stop loss, but if the market opens BELOW your stop loss the next morning, you will be out of your position with a much larger loss than planned. To be clear, let’s say you bought a stock at $100, and you place a stop loss at $98. The stock gaps down and opens at $96 the next morning. In this case your stop loss order will get filled at $96, and instead of losing only $2 per share as planned, you will lose $4!

And especially these days the markets are crazy. News from Europe or Asia can cause huge opening gaps, which make risk control extremely challenging.

Some traders might say that when day trading, the profit potential is much smaller. That’s true, but especially when trading futures, your day trading margin requirement is much smaller than your overnight margin requirement. As a result, you will have significant leverage. But, keep in mind that leverage is a double-edged sword and can work in your favor as well as against you.

But let me give you another example:

Let’s say you are swing trading the e-mini S&P and you’re holding a position overnight. As I write this post, the overnight margin requirement is $5,000 for the e-mini S&P, while many futures brokers will offer you $500 day trading margin. Therefore, you will get 10 times more leverage when day trading the e-mini S&P, than if you trade that same position overnight.

Now, let’s assume your profit target is 20 points (=$1,000) when swing trading the e-mini S&P. It might take you a few days until you realize this profit. But if you are day trading, you could trade 10 contracts instead of just one, and you only need a move of 2 points in your favor to realize the same profit. A gain of 2 points would give you $100 in profits per contract traded. and since you are trading 10 contracts the total profit would be $1,000.

It would probably take the e-mini S&P only minutes to move 2 points, and I have no problem monitoring my trade for this short period of time. To me this is like taking your hands of the steering wheel for a few seconds. Chances are very low that you will wreck your car in this short timeframe.

I like to control my risk as much as I can, and therefore I prefer day trading. I haven’t held an overnight position since 2002. Especially these days the markets are crazy, and I don’t like to worry about my position in the evenings or on the weekends. And I know I would if I had an open position. I would check the markets in the evenings before I go to bed, during the night when I wake up and first thing in the morning. That doesn’t sound like fun to me!

What about YOU?

Do you prefer swing trading or day trading. What’s your trading style and why?

Leave a comment!