Swing Trading

Post on: 17 Май, 2015 No Comment

Swing stock trading is commonly defined as a stock, index, or commodities trading practice whereby a traded instrument is bought at or near opposite cycle swings caused by daily or weekly price volatility. You will often hear swing trading defined as “momentum trading”. A swing trade is open longer than a day, but shorter than trend following trades or buy and hold investment strategies. Swing trading also differs from the buy-and-hold approach to investing. Long-term investors may hold a security through periods of weakness that may last several months or years. Swing traders dont care for such poor performance in the near term. If a securitys price is performing poorly, swing traders exit first and ask questions later. Swing traders are nimble and judicious in choosing potential opportunities and market timing is critical to swing trading stocks. Using technical analysis swing trader’s prospect changes in stock price caused by, or occurring with oscillations between its prices bid up by optimism and alternatively down by pessimism over a period of a few days, weeks, or months depending on a stock’s trading personality.

Swing Trading Strategies

A stocks technical analysis is the #1 criteria for market timing, but should also be confirmed with a securities fundamentals. A professional swing trader analyzes daily technicals to forecast futures based on a stocks trading history and trading personality. Learning the ins and outs of technical stock analysis can be laborious and time intensive. Predictive market trading algorithm is defined as a calculable set of trade rules which results in entry, exit and stop loss trade points. Investment in researching trading algorithms has skyrocketed, particularly by investment banking firms like Goldman Sachs which spends tens of millions on trading algorithm research, and which staffs its trading algorithm team more heavily than even its trading desk. Trading algorithms do work and some algorithms are better than others.

Trading algorithms can be as esoteric as extrapolated biology theories like neural networks applied to derivatives trading. The Stocknod neural network embodies these indicators.

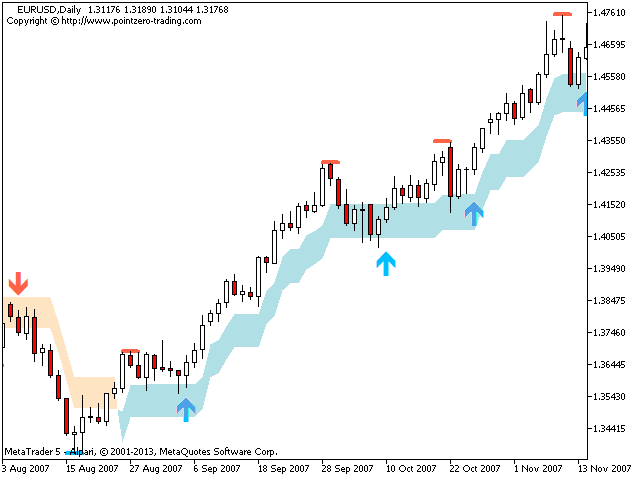

Simply stated the Stocknod strategy is measuring the behavior of a stock above and below a baseline where a moving average identifies the typical baseline on a stock chart. The stock is to be invested long at the baseline when the stock is heading up, and short at the baseline when the stock is headed down.

Trading algorithms may lose their profit potential when their trading strategies obtain enough of a mass following to curtail their effectiveness. Trading software is now an arms race. Everyone is building more sophisticated algorithms, and the more competition exists, the smaller the profits. But competition also drives the market and we wouldnt still be around if Stocknod Alerts didnt beat the pants off of most stock brokers.

Swing traders do not need perfect timing to buy at the bottom, and sell at the top. Small consistent earnings will compound returns significantly. Most important is to have or develop a trading algorithm that is mathematical certain and successfully tested on historical prices of the time dimension a swing trader is trading, be it by the minute, hour, day, week, or month.

Neural Network Swing Trading Software

Automated Swing Trading Software by Stocknod.com. Stocknod swing trading alerts is a revolutionary way for investors to get the critical information they need to stay ahead of the trading curve and maximize gains. Buy & Hold is an outdated trading strategy that provides minimal gains. Swing traders have been successful for years and now with Stocknod Stock Alerts you can be too. Swing trading stocks relies heavily on technical analysis: the art and science of trading securities based on chart patterns and technical indicators. But its easy to get lost in the world of technical analysis given how many different chart patterns and indicators exist. When should you use one one indicator over the other one? How does one indicator correlate to other indicators? Technical stock analysis and swing trading software takes years to learn and the learning curve is long and arduous. With the innovation of Stocknod.com now swing traders can get superior technicals and the best part is it is all automated.

Stocknod swing trader alerts is an automated trading algorithm that provides all the necessary research for our members to maximize profits and stay in front of the swing trading moves. With Stocknod alerts, learning how to swing trade has never been easier or more profitable. Stock alerts provide the critical homework to investors- automatically. The Stocknod Neural Network is a custom trading algorithm with over twenty trend indicators that tracks your stocks daily performance and alerts you automatically via email (or sms) when to buy and sell your stocks. Learning how to swing trade requires superior timing and the Stocknod software is the only online stock service that provides this critical data in an easy to use automated format. Team up with Stocknod for safer investments and higher returns. Visit HOW TO SWING TRADE for further explanation and tips on how to swing trade stocks .