Supply and Demand Not Speculators to Blame for High Food Prices

Post on: 9 Июнь, 2015 No Comment

A Magazine Published by CME Group

- Equities

- FX

- Fed

- CME Group

- China

- Energy

Supply and Demand, Not Speculators, to Blame for High Food Prices

I arrived in Paris yesterday to speak at an OECD -sponsored workshop. Before I left, I read this timely Wall Street Journal article discussing who may be to blame for high global food prices, and what the Group of 20 nations can do to help fix matters.

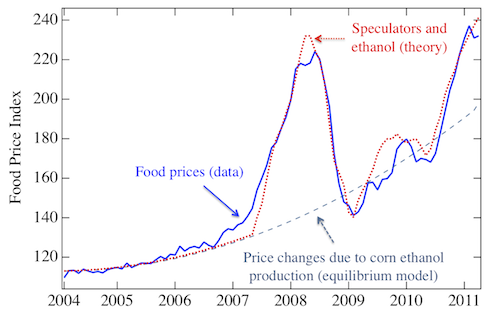

Speculators have been blamed far and wide for the spike in agricultural commodity prices. But as author Andrew Peaple notes, “there is little conclusive evidence that speculators have pushed up prices.”

Speculation and markets are not the issue. Rather, a food supply shortage is to blame. Setting arbitrary margins and limits simply does not make good policy – this would constitute a reaction, but definitely not a solution. The core fundamentals of supply and demand continue to drive the market, along with environmental factors such as droughts, floods and diseased crops, as well as the value of the U.S. dollar.

In addition, more corn crops are being diverted to ethanol and, because corn is becoming more valuable, more farmland is being dedicated to corn with less going to other crops such as soybeans and wheat. My colleague, Tim Andriesen, has written about the “food vs. fuel” debate concerning biofuels made from food crops. At the same time, we’ve seen an unprecedented increase in demand from China and India, which can now afford more food than ever, and they also want more meat (which requires more corn for feed).

The bottom line? We need more food.

And to have more food, we need free markets that promote price discovery and transfer risk so farmers can plant more crops. In this respect, it’s important to point out that our markets work. Futures markets, which take into account present and future availability of goods, are a vital part of a smooth-functioning economy. Our derivatives marketplace is centralized, transparent and well-regulated, and it facilitates price discovery and free-market principles. In addition, futures markets provide much needed signals to producers. Right now, all those signals show that the demand for food is on the rise and supplies are low.

Current prices, viewed through an inflation-adjusted lens, are relatively low. That said, they will likely remain volatile in the next several months. Here are charts for corn. soybean and wheat prices that illustrate these points.

Speculation is legal, transparent trading activity aimed at taking on the risk exposure while benefitting from natural price changes. Limiting the role of speculators could actually do more harm, since this would limit the risk exposure and the market signals that commercial producers need. Moreover, speculators participate on both sides of the market, acting as key cogs in efficient, liquid markets.

The percentage of open positions held by speculators has actually remained constant throughout the price ups and downs. Exhibit A: the price of wheat has gone down 40 percent since hitting its high in March 2009, yet speculators still hold the same amount of positions. Exhibit B: rice is at record high prices, but there is very low speculative participation in the market.

Everyone can be considered a speculator at some point. A farmer who has already hedged his entire crop may still participate in the market and benefit further from higher prices. In other words, hurting, or “punishing,” speculators hurts everyone in the markets.

David Lehman is the managing director of commodity research & product development at CME Group.